Xerox 2002 Annual Report Download - page 12

Download and view the complete annual report

Please find page 12 of the 2002 Xerox annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

10

Throughout this document, references to “we,” “our”

or “us” refer to Xerox Corporation and its subsidiaries.

Introduction:

This Management’s Discussion and Analysis of

Results of Operations and Financial Condition

(“MD&A”) describes the matters that we consider to

be important to understanding the results of our

operations for each of the three years in the period

ended December 31, 2002 and our capital resources

and liquidity as of December 31, 2002 and 2001. Our

discussion begins with an overview of our financial

performance for the last three years and is followed

by a review of the critical accounting judgments and

estimates that we have made which we believe are

most important to an understanding of our MD&A

and our consolidated financial statements. These are

the critical accounting policies that affect the recogni-

tion and measurement of our transactions and the

balances in our consolidated financial statements. We

then analyze the results of our operations for the last

three years, including the trends in the overall busi-

ness and our operating segments, followed by brief

reference to where you can find more information on

recent accounting pronouncements which we adopt-

ed during the year, as well as those not yet adopted

that are expected to have an impact on our financial

accounting practices. We conclude our MD&A with a

discussion of our cash flows and liquidity, capital mar-

kets events and transactions, credit ratings, our new

credit facility, derivatives, contractual commitments

and related issues and important forward-looking

cautionary statements.

Financial Overview:

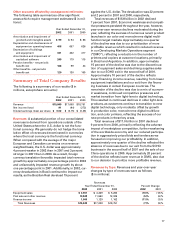

In 2002, we returned to profitability, significantly

strengthened our balance sheet and launched 17 new

products, making the year one of our strongest ever

for new products. Our results demonstrate effective

execution to date of our Turnaround Program, which

we announced in October 2000. Our Turnaround

Program has focused on improving liquidity, stabiliz-

ing our operations and significantly reducing our cost

base in order to improve our competitiveness. By the

end of 2002, we had sold assets totaling approximate-

ly $2.7 billion, implemented actions to reduce our

annualized costs by approximately $1.7 billion and

returned each of our core business segments to prof-

itability. During this period we also transitioned a por-

tion of our equipment financing to third parties in

Management’s Discussion and Analysis of

Results of Operations and Financial Condition

some geographies and implemented a strategy to

securitize our finance receivables.

Throughout 2002, the worldwide economic envi-

ronment and information technology spending

remained weak, however, our equipment sales and

revenue declines moderated, reflecting the success of

our new products launched during the year. Improved

gross margins and reduced selling, administrative

and general expenses, reflect benefits from our cost

base reductions, our focus on more profitable rev-

enue and our exit from certain businesses. While we

reduced our overall cost base, we continued to invest

in research and development, prioritizing our invest-

ments in the faster growing areas of our market. We

strengthened our balance sheet and liquidity by gen-

erating operating cash flows of $1.9 billion, repaying

debt of $3.2 billion, negotiating a new credit facility

and securitizing almost half our finance receivables

by the end of 2002.

Net income for 2002 of $91 million, or 2 cents per

diluted share, included after-tax asset impairment and

restructuring charges of $471 million ($670 million

pre-tax), primarily associated with our Fourth Quarter

2002 Restructuring Program, a pre-tax and after-tax

charge of $63 million for impaired goodwill and an

after-tax charge of $72 million ($106 million pre-tax)

for permanently impaired internal-use capitalized

software, partially offset by $105 million of tax bene-

fits arising from the favorable resolution of a foreign

tax audit and tax law changes, as well as a favorable

adjustment to compensation expense of $31 million

($33 million pre-tax), that was previously accrued in

2001, associated with the reinstatement of dividends

for our Employee Stock Ownership Plan (“ESOP”).

The 2001 net loss of $94 million, or 15 cents per

diluted share, included $507 million of after-tax

charges ($715 million pre-tax) for restructuring and

asset impairments associated with our Turnaround

Program including our disengagement from our

worldwide Small Office/Home Office (“SOHO”) busi-

ness. 2001 results also included a $304 million after-tax

gain ($773 million pre-tax) from the sale of half of our

interest in Fuji Xerox, a $38 million after-tax gain

($63 million pre-tax) related to the early retirement of

debt, $21 million of after-tax gains ($29 million pre-tax)

associated with unhedged foreign currency, partially

offset by $31 million ($33 million pre-tax) of increased

compensation expense associated with the suspen-

sion of dividends for our ESOP and after-tax goodwill

amortization of $59 million ($63 million pre-tax).