Xerox 2002 Annual Report Download - page 68

Download and view the complete annual report

Please find page 68 of the 2002 Xerox annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

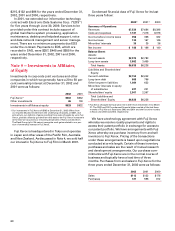

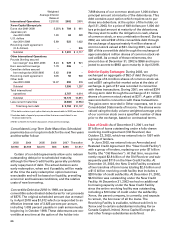

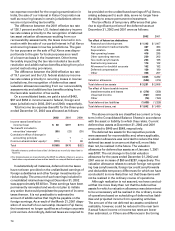

66

Weighted

Average Interest

Rates at

International Operations 12/31/02 2002 2001

Xerox Capital (Europe) plc:

Euros due 2001-2008 5.25% $ 784 $ 661

Japanese yen

due 2001-2005 1.30 84 229

U.S. dollars

due 2001-2008 5.89 523 1,022

Revolving credit agreement

(U.S. dollars) – – 805

Subtotal $ 1,391 $ 2,717

Other International Operations:

Pounds Sterling secured

borrowings(3) due 2001-2003 6.24 $ 529 $ 521

Euro secured borrowings 7.78 206 –

Canadian dollars secured

borrowings due 2003-2005 5.63 319 –

Revolving credit agreement 6.45 50 500

Other debt

due 2001-2008 10.07 292 276

Subtotal 1,396 1,297

Total international

operations 2,787 4,014

Subtotal 13,774 16,691

Less current maturities (3,980) (6,584)

Total long-term debt $ 9,794 $10,107

1 This debt contains a put option that may be exercisable in 2003 (see below).

2 Includes debt of special purpose entities that are consolidated in our

financial statements.

3 Refer to Note 5 for further discussion of secured borrowings.

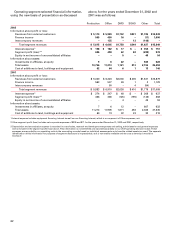

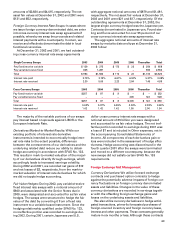

Consolidated Long-Term Debt Maturities: Scheduled

payments due on long-term debt for the next five years

and thereafter follow:

2003 2004 2005 2006 2007 Thereafter

$3,980 $3,909 $4,016 $56 $296 $1,517

Certain of our debt agreements allow us to redeem

outstanding debt prior to scheduled maturity,

although the New Credit Facility generally prohibits

early repayment of debt. The actual decision as to

early redemption, when and if possible, will be made

at the time the early redemption option becomes

exercisable and will be based on liquidity, prevailing

economic and business conditions, and the relative

costs of new borrowing.

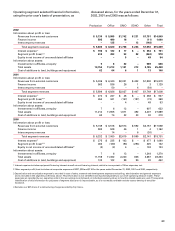

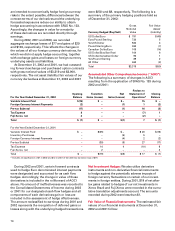

Convertible Debt due 2018: In 1998, we issued

convertible subordinated debentures for net proceeds

of $575. The original scheduled amount due at maturi-

ty in April 2018 was $1,012 which corresponded to an

effective interest rate of 3.625 percent per annum,

including 1.003 percent payable in cash semiannually

beginning in October 1998. These debentures are con-

vertible at any time at the option of the holder into

7.808 shares of our common stock per 1,000 dollars

principal amount at maturity of the debentures. This

debt contains a put option which requires us to pur-

chase any debenture, at the option of the holder, on

April 21, 2003, for a price of 649 dollars per 1,000 dol-

lars principal amount at maturity of the debentures.

We may elect to settle the obligation in cash, shares

of common stock, or any combination thereof. During

2002, we retired $32 of this convertible debt through

the exchange of approximately 4 million shares of

common stock valued at $31. During 2001, we retired

$58 of this convertible debt through the exchange of

approximately 6 million shares of common stock val-

ued at $49. As a result of these retirements, the

amount due at December 31, 2002 is $556 and is pro-

jected to accrete to $863 upon maturity in April 2018.

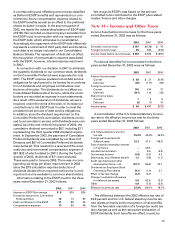

Debt-for-Equity Exchanges: During 2002, we

exchanged an aggregate of $52 of debt through the

exchange of 6.4 million shares of common stock val-

ued at $51 using the fair market value at the date of

exchange. A gain of $1 was recorded in connection

with these transactions. During 2001, we retired $374

of long-term debt through the exchange of 41 million

shares of common stock valued at $311. A gain of $63

was recorded in connection with these transactions.

The gains were recorded in Other expenses, net in our

Consolidated Statements of Income. The shares were

valued using the daily volume-weighted average price

of our common stock over a specified number of days

prior to the exchange, based on contractual terms.

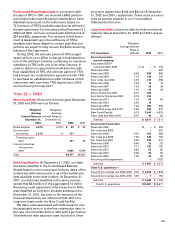

Lines of Credit: As of December 31, 2001, we had

$7 billion of loans outstanding under a fully-drawn

revolving credit agreement (Old Revolver) due

October 22, 2002, which we entered into in 1997 with

a group of lenders.

In June 2002, we entered into an Amended and

Restated Credit Agreement (the “New Credit Facility”)

with a group of lenders, replacing our prior $7 billion

facility (the “Old Revolver”). At that time, we perma-

nently repaid $2.8 billion of the Old Revolver and sub-

sequently paid $710 on the New Credit Facility. At

December 31, 2002, the New Credit Facility consisted

of two tranches of term loans totaling $2.0 billion and

a $1.5 billion revolving credit facility that includes a

$200 letter of credit subfacility. At December 31, 2002,

$3.5 billion was outstanding under the New Credit

Facility. At December 31, 2002 we had no additional

borrowing capacity under the New Credit Facility

since the entire revolving facility was outstanding,

including a $10 letter of credit under the subfacility.

Xerox, the parent company, is currently, and expects

to remain, the borrower of all the loans. The

Revolving Facility is available, without sub-limit, to

Xerox and to certain subsidiaries including Xerox

Canada Capital Limited, Xerox Capital Europe plc,

and other foreign subsidiaries as defined.