Xerox 2002 Annual Report Download - page 56

Download and view the complete annual report

Please find page 56 of the 2002 Xerox annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

54

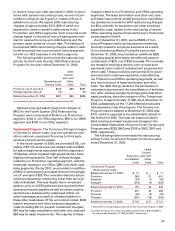

SOHO Disengagement: In 2001, we began a separate

restructuring program associated with the disengage-

ment from our worldwide small office/home office

(“SOHO”) business. In connection with exiting this

business in 2001, we recorded a provision of $239,

net of reversals of $26. Reversals were primarily relat-

ed to a higher than anticipated number of employees

re-deployed and better than expected experience in

certain contract terminations. The charge included

provisions for the elimination of approximately 1,200

positions worldwide by the end of 2001, the closing

of facilities and the write-down of certain assets to

net realizable value. The restructuring provision

associated with this action included $164 for asset

impairments, $49 for lease terminations, purchase

commitments and other exit costs, and $26 for sever-

ance and employee separation costs. An additional

provision of $34 related to excess inventory was

recorded as a charge to Cost of Sales in our Consoli-

dated Statements of Income.

During the fourth quarter 2001, we depleted our

inventory of personal inkjet and xerographic printers,

copiers, facsimile machines and multifunction devices

which were sold primarily through retail channels to

small offices, home offices and personal users (con-

sumers). We continue to provide service, support and

supplies, including the manufacturing of such

supplies, for customers who currently own these

products during a phase-down period to meet

customer needs.

During 2002, we recorded a charge of $10 primarily

for asset impairment charges for a change in the esti-

mated recoverability of the Ireland SOHO facility. The

total net costs included in Restructuring and asset

impairment charges in the Consolidated Statements

of Income for the SOHO disengagement were $10

and $239 in 2002 and 2001, respectively. Charges

against the reserve were $17 and $52 in 2002 and

2001, respectively. The SOHO Disengagement

program had been substantially completed as of

December 31, 2002, with $6 of reserves remaining for

severance and lease cancellation costs.

March 2000 Restructuring: In March 2000, we

announced details of a worldwide restructuring pro-

gram and recorded charges of $489 which included

severance and employee separation costs of $424

related to the elimination of 5,200 positions

worldwide, asset impairments of $30 and other exit

costs of $35. An additional provision of $84 related to

excess inventory primarily resulting from the planned

consolidation of certain warehousing operations was

recorded as a charge to Cost of sales. In late 2000, as

a result of weakening business conditions, poor oper-

ating results and a change in focus of our new senior

management team toward increasing liquidity, we re-

evaluated the remaining plan elements. As a result of

this re-evaluation, we reversed $120 of the original

charge. The amount reversed consisted of $97 related

to severance costs associated with approximately

1,000 positions and $23 related to other costs. The

most significant reversals related to an aggregated

$72 for the abandonment of our plans to outsource

warehouse facilities in North America, as well as the

outsourcing of a product manufacturing line. As 2000

progressed and the Turnaround Program was

announced, new senior management determined that

the costs required to complete the planned actions for

both of these initiatives and the estimated payback

periods were not in line with their objectives. Based

on the changes in facts and circumstances, we deter-

mined that the reserve should be reversed. The

remaining $48 of reversals related to attrition, as well

as management’s assessment of remaining employee

terminations, in light of the newly announced

Turnaround Program, which involved $71 of new sev-

erance charges in the fourth quarter of 2000. During

2001, we recorded additional provisions of $83 which

included $68 for severance and related costs, asset

impairments of $13 and other exit costs of $2 for

instances when the actual cost of certain initiatives

exceeded the amount estimated at the time of the

original charge. We also recorded reversals of $17

associated with the cancellation of certain service and

manufacturing initiatives. We provided an additional

$5 in 2002 to complete certain severance-related

actions. We recorded asset impairments of $13 and

$30 in 2001 and 2000, respectively. The total net costs

included in Restructuring and asset impairment

charges in the Consolidated Statements of Income for

the March 2000 Restructuring were $5, $66 and $369

in 2002, 2001 and 2000, respectively. Charges against

the reserve were $17, $204 and $176 in 2002, 2001 and

2000, respectively. As of December 31, 2002, the

March 2000 Restructuring Program had been

completed.

1998 Restructuring: During 2001, we recorded addi-

tional provisions for changes in estimates of $15 and

reversals of $8, primarily as a result of changes in

certain manufacturing initiatives. The total net costs

included in Restructuring and asset impairment

charges in the Consolidated Statements of Income for

the 1998 Restructuring was $7 and $1 in 2001 and

2000, respectively. Charges against the reserve were

$24, $76 and $247 in 2002, 2001 and 2000, respective-

ly. As of December 31, 2002, the 1998 Restructuring

Program had been completed.

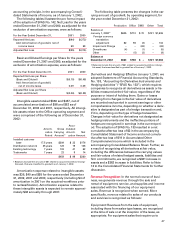

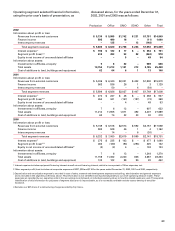

Reconciliation of Restructuring Charges to

Statements of Cash Flows: The following is a reconcil-

iation of charges to the restructuring reserves for all

restructuring actions to the amounts reported in the

Consolidated Statement of Cash Flows as Cash pay-

ments for restructurings: