Xerox 2002 Annual Report Download - page 33

Download and view the complete annual report

Please find page 33 of the 2002 Xerox annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

31

• In June 2001, we announced several Framework

Agreements with GE under which they became our

primary equipment-financing provider in the U.S.,

Canada, Germany and France. In October 2002 we

finalized an eight-year U.S. arrangement and fund-

ing commenced in the fourth quarter of 2002. We

are currently negotiating other GE arrangements

under the respective Framework Agreements.

• In April 2001, we sold our leasing businesses in

four Nordic countries to a company now owned by

GE and retained interests in certain finance receiv-

ables. These sales are part of an agreement under

which that company will provide ongoing, exclu-

sive equipment financing to our customers in those

countries.

• In December 2001, we formed a joint venture with

De Lage Landen International BV (“DLL”) which

manages equipment financing, billing and collec-

tions for our customers’ equipment orders in the

Netherlands. This joint venture began funding in

the first quarter of 2002. DLL owns 51 percent of

the venture and provides the funding to support

new customer leases. We own the remaining 49

percent of this unconsolidated venture.

• In March 2002, we signed agreements with third

parties in Brazil and Mexico under which those

third parties became our primary equipment

financing providers in those countries. Funding

under both of these arrangements commenced in

the second quarter of 2002.

• In April 2002, we sold our leasing business in Italy

to a company recently acquired by GE, as part of an

agreement under which GE will provide on-going,

exclusive equipment financing to our customers in

Italy.

• In December 2002, we securitized existing state and

local government finance receivables in the U.S.

with GE.

• In December 2002, we securitized existing finance

receivables in France with a 364-day financing with

Merrill Lynch (“ML”). ML intends to replace this

financing with a long-term public secured offering

during 2003.

• In December 2002, we received a series of financ-

ings from our unconsolidated joint venture with

DLL, secured by our lease receivables in Holland.

• In December 2002, we received loans from GE

secured by finance receivables in Germany.

New Credit Facility: In June 2002, we entered into an

Amended and Restated Credit Agreement (the “New

Credit Facility”) with a group of lenders, replacing

our prior $7 billion facility (the “Old Revolver”). At that

time, we permanently repaid $2.8 billion of the Old

Revolver and subsequently paid $710 million on the

New Credit Facility. At December 31, 2002, the New

Credit Facility consisted of two tranches of term loans

totaling $2.0 billion and a $1.5 billion revolving credit

facility that includes a $200 million letter of credit sub-

facility. At December 31, 2002, $3.5 billion was out-

standing under the New Credit Facility. At December

31, 2002 we had no additional borrowing capacity

under the New Credit Facility since the entire revolving

facility was outstanding, including a $10 million letter

of credit under the subfacility. Xerox Corporation is the

only borrower of the term loans. The revolving loans

are available, without sub-limit, to Xerox Corporation

and to Xerox Canada Capital Limited (“XCCL”), Xerox

Capital Europe plc (“XCE”), and other foreign sub-

sidiaries as defined. Xerox Corporation is the borrower

of all but $50 million of the revolver at December 31,

2002. The size and contractual maturities of the loans

are as follows ($ in millions):

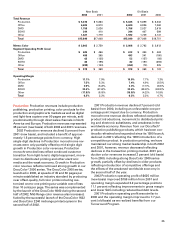

2003 2004 2005 Total

Tranche A Term Loan $400 $600 $ 500 $1,500

Tranche B Term Loan 5 5 490 500

Revolving Facility – – 1,490 1,490

Total $405 $605 $2,480 $3,490

We are required to repay portions of the loans earli-

er than their scheduled maturities with specified per-

centages of any proceeds we receive from capital

market debt issuances, equity issuances or asset sales

during the term of the New Credit Facility, except that

the revolving facility cannot be reduced below $1 bil-

lion, as a result of such prepayments. Additionally, all

loans under the New Credit Facility become due and

payable upon the occurrence of a change in control.

Subject to certain limits described in the following

paragraph, all obligations under the New Credit

Facility are secured by liens on substantially all of the

domestic assets of Xerox Corporation and by liens on

the assets of substantially all of our U.S. subsidiaries

(excluding Xerox Credit Corporation (“XCC”)), and

are guaranteed by substantially all of our U.S. sub-

sidiaries. In addition, a revolving loan outstanding to

XCCL ($50 million at December 31, 2002) is secured

by all of its assets, and is guaranteed by certain

defined material foreign subsidiaries.

Under the terms of certain of our outstanding pub-

lic bond indentures, the amount of obligations under

the New Credit Facility that can be (1) secured by

assets (the “Restricted Assets”) of (a) Xerox

Corporation and (b) our non-financing subsidiaries

that have a consolidated net worth of at least

$100 million, without (2) triggering a requirement to

also secure those indentures, is limited to the excess

of (1) 20 percent of our consolidated net worth (as

defined in the public bond indentures) over (2) the

outstanding amount of certain other debt that is

secured by the Restricted Assets. Accordingly, the

amount of New Credit Facility debt secured by the