Xerox 2002 Annual Report Download - page 52

Download and view the complete annual report

Please find page 52 of the 2002 Xerox annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

50

evaluations of our receivables and evaluations of the

risks of repayment. Allowances for doubtful accounts

on accounts receivable balances were $282 and $306,

as of December 31, 2002 and 2001, respectively.

Allowances for doubtful accounts on finance receiv-

ables were $324 and $368 at December 31, 2002 and

2001, respectively.

Inventories: Inventories are carried at the lower of

average cost or realizable values.

Land, Buildings and Equipment and Equipment on

Operating Leases: Land, buildings and equipment are

recorded at cost. Buildings and equipment are depre-

ciated over their estimated useful lives. Leasehold

improvements are depreciated over the shorter of the

lease term or the estimated useful life. Equipment on

operating leases is depreciated to its estimated resid-

ual value over the term of the lease. Depreciation is

computed using principally the straight-line method.

Significant improvements are capitalized and mainte-

nance and repairs are expensed. Refer to Notes 6 and

7 for further discussion.

Internal-Use Software: We capitalize direct costs

incurred during the application development stage

and the implementation stage for developing,

purchasing or otherwise acquiring software for inter-

nal use. These costs are amortized over the estimated

useful lives of the software, generally three to five

years. All costs incurred during the preliminary proj-

ect stage, including project scoping, identification

and testing of alternatives, are expensed as incurred.

During 2002 we wrote off $106 of permanently

impaired internal-use capitalized software. Refer to

Note 7 for further discussion.

Impairment of Long-Lived Assets: We review the

recoverability of our long-lived assets, including build-

ings, equipment, internal-use software and other intan-

gible assets, when events or changes in circumstances

occur that indicate that the carrying value of the asset

may not be recoverable. The assessment of possible

impairment is based on our ability to recover the carry-

ing value of the asset from the expected future pre-tax

cash flows (undiscounted and without interest charges)

of the related operations. If these cash flows are less

than the carrying value of such asset, an impairment

loss is recognized for the difference between estimated

fair value and carrying value. The measurement of

impairment requires management to make estimates

of these cash flows related to long-lived assets, as well

as other fair value determinations.

Research and Development Expenses: Research and

development costs are expensed as incurred.

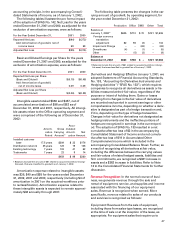

As of December 31, 2002 2001

Escrow and cash collections related to

the secured borrowings with GE –

U.S. and Canada $349 $199

Escrow related to distribution payments

for the 2001 trust preferred securities 155 229

Collateral related to swaps and letters

of credit 77 111

Escrow and cash collections related to our

asset-backed security transactions and

other restricted cash 97 47

Total $678 $586

Of these amounts, $263 and $235 were included in

Other current assets and $415 and $351 were includ-

ed in Other long-term assets, as of December 31, 2002

and 2001, respectively. The current amounts are

expected to be available for our use within one year.

The total increase in restricted cash during 2002 of

$92 is included in the Consolidated Statement of

Cash Flows as a use of cash of $104 in other, net of

Operating Activities and a source of cash of $12 in

investing activities (of the total $41).

Securitizations and Transfers of Receivables: From

time to time, in the normal course of business, we

may securitize or sell finance and accounts receivable

with or without recourse and/or discounts. The receiv-

ables are removed from the Consolidated Balance

Sheet at the time they are sold and the risk of loss has

transferred to the purchaser. However, we maintain risk

of loss on our retained interest in such receivables.

Sales and transfers that do not meet the criteria for sur-

render of control or were sold to a consolidated special

purpose entity (non-qualified special purpose entity)

are accounted for as secured borrowings. When we

sell receivables in securitizations of finance receivables

or accounts receivable, we retain servicing rights,

beneficial interests, and, in some cases, a cash reserve

account, all of which are retained interests in the securi-

tized receivables. The value assigned to the retained

interests in securitized trade receivables is based on the

relative fair values of the interest retained and sold in

the securitization. We estimate fair value based on the

present value of future expected cash flows using man-

agement’s best estimates of the key assumptions,

consisting of receivable amounts, anticipated credit

losses and discount rates commensurate with the risks

involved. Gains or losses on the sale of the receivables

depend in part on the previous carrying amount of the

financial assets involved in the transfer, allocated

between the assets sold and the retained interests

based on their relative fair value at the date of transfer.

Provisions for Losses on Uncollectible Receivables:

The provisions for losses on uncollectible trade and

finance receivables are determined principally on the

basis of past collection experience applied to ongoing