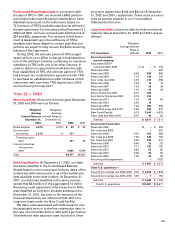

Xerox 2002 Annual Report Download - page 72

Download and view the complete annual report

Please find page 72 of the 2002 Xerox annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

70

are intended to economically hedge foreign currency

risks to the extent possible, differences between the

contract terms of our derivatives and the underlying

forecasted exposures reduce our ability to obtain

hedge accounting in accordance with SFAS No. 133.

Accordingly, the changes in value for a majority

of these derivatives are recorded directly through

earnings.

During 2002, 2001 and 2000, we recorded

aggregate exchange losses of $77 and gains of $29

and $103, respectively. This reflects the changes in

the values of all our foreign currency derivatives, for

which we did not apply hedge accounting, together

with exchange gains and losses on foreign currency

underlying assets and liabilities.

At December 31, 2002 and 2001, we had outstand-

ing forward exchange and purchased option contracts

with gross notional values of $3,319 and $3,900,

respectively. The net asset (liability) fair values of our

currency derivatives at December 31, 2002 and 2001

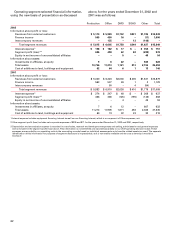

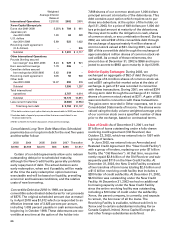

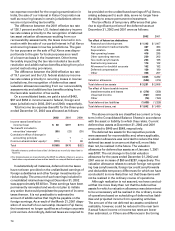

Reclass to

Opening Transition Net Statement of Closing

For the Year Ended December 31, 2002 Balance Gains (Losses) Gains (Losses) Operations* Balance

Variable Interest Paid $(15) $ – $ – 15 $ –

Foreign Currency Interest Payments (2) – (1) 1 (2)

Pre-tax Subtotal (17) – (1) 16 (2)

Tax Expense 8 – – (7) 1

Fuji Xerox, net 2 – – (2) –

Total $ (7) $ – $(1) 7 $ (1)

For the Year Ended December 31, 2001

Variable Interest Paid $ – $(35) $ – $ 20 $(15)

Inventory Purchases – – (5) 5 –

Foreign Currency Interest Payments – – (4) 2 (2)

Pre-tax Subtotal – (35) (9) 27 (17)

Tax Expense – 14 4 (10) 8

Fuji Xerox, net – 2 – – 2

Total $ – $(19) $(5) $ 17 $ (7)

* Includes reclassification of $7 in 2002 and $12 in 2001 of the after-tax transition loss of $19.

were $(50) and $8, respectively. The following is a

summary of the primary hedging positions held as

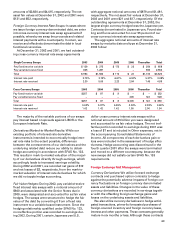

of December 31, 2002:

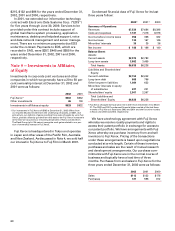

Gross Fair Value

Notional Asset/

Currency Hedged (Buy/Sell) Value (Liability)

US Dollar/Euro $ 791 $(45)

Euro/Pound Sterling 730 5

Yen/US Dollar 584 4

Pound Sterling/Euro 360 (7)

Canadian Dollar/Euro 109 (14)

US Dollar/Brazilian Real 104 6

US Dollar/Canadian Dollar 90 1

Yen/Pound Sterling 89 2

All Other 462 (2)

Total $3,319 $(50)

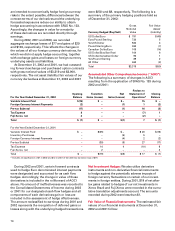

Accumulated Other Comprehensive Income (“AOCI”):

The following is a summary of changes in AOCI

resulting from the application of SFAS No. 133 during

2002 and 2001:

During 2002 and 2001, certain forward contracts

used to hedge Euro denominated interest payments

were designated and accounted for as cash flow

hedges. Accordingly, the change in value of these

derivatives is included in the rollforward of AOCI

above. No amount of ineffectiveness was recorded to

the Consolidated Statements of Income during 2002

or 2001 for our designated cash flow hedges and all

components of each derivatives gain or loss are

included in the assessment of hedge effectiveness.

The amount reclassified to earnings during 2001 and

2002 represents the recognition of deferred gains or

losses along with the underlying hedged transactions.

Net Investment Hedges: We also utilize derivative

instruments and non-derivative financial instruments

to hedge against the potentially adverse impacts of

foreign currency fluctuations on certain of our invest-

ments in foreign entities. During 2001, $18 of net after-

tax gains related to hedges of our net investments in

Xerox Brazil and Fuji Xerox were recorded in the cumu-

lative translation adjustments account. The amounts

recorded during 2002 were less than $1.

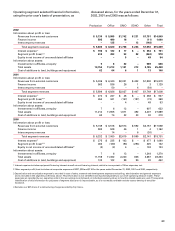

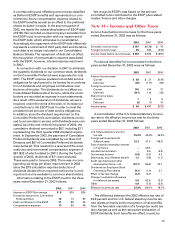

Fair Value of Financial Instruments: The estimated fair

values of our financial instruments at December 31,

2002 and 2001 follow: