Xerox 2002 Annual Report Download - page 77

Download and view the complete annual report

Please find page 77 of the 2002 Xerox annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

or amount of future reversals of existing taxable or

deductible temporary differences.

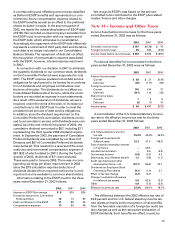

At December 31, 2002, we had tax credit carryforwards

of $204 available to offset future income taxes, of

which $159 is available to carryforward indefinitely

while the remaining $45 will begin to expire, if not uti-

lized, in 2004. We also had net operating loss carryfor-

wards for income tax purposes of $262 that will expire

in 2003 through 2012, if not utilized, and $1.9 billion

available to offset future taxable income indefinitely.

At December 31, 2002, our Brazilian operations had

assessments for indirect and other taxes which, inclu-

sive of interest, were approximately $260. These

assessments related principally to the internal transfer

of inventory. We do not agree with these assessments

and intend to vigorously defend our position. We, as

supported by the opinion of legal counsel, do not

believe that the ultimate resolution of these assessments

will materially impact our results of operations, finan-

cial position or cash flows.

We are subject to ongoing tax examinations and

assessments in various jurisdictions. Accordingly, we

provide for additional tax expense based upon the

probable outcomes of such matters. In addition, when

applicable, we adjust the previously recorded tax

expense to reflect examination results.

From 1995 through 1998, we incurred capital losses

from the disposition of our insurance group operations.

Such losses were disallowed under the tax law existing

at the time of the respective dispositions. As a result of

IRS regulations issued in 2002, some portion of the

losses may now be claimed subject to certain limitations.

We have filed amended tax returns for 1995 through

1998 reporting $1.2 billion of additional capital losses.

As of December 31, 2002, we have $425 of capital gains

available to be offset by the capital losses during the

relevant periods and anticipate a potential tax benefit

of approximately $150 to be recognized in a future

period. The additional losses claimed and related

tax benefits are subject to formal review by the U.S.

government which is currently in process. We have not

recognized any tax benefit of these losses pending the

completion of this review. Any resulting capital loss

carryforwards will expire, if not utilized, by 2003.

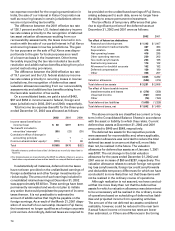

Note 15 — Litigation, Regulatory

Matters and Other Contingencies

Guarantees, Indemnifications and Warranty Liabilities:

As more fully discussed in Note 1, we apply the

disclosure provisions of FIN 45 to our agreements that

contain guarantee or indemnification clauses. These

disclosure provisions expand those required by SFAS

No. 5 “Accounting for Contingencies,” by requiring

that guarantors disclose certain types of guarantees,

even if the likelihood of requiring the guarantor’s per-

formance is remote. As of December 31, 2002, we have

accrued our estimate of liability incurred under these

indemnification arrangements and guarantees. The

following is a description of arrangements in which we

are a guarantor.

Indemnifications provided as part of sales and purchas-

es of businesses and real estate assets: We are a party

to a variety of agreements pursuant to which we may

be obligated to indemnify the other party with respect

to certain matters. Typically, these obligations arise in

the context of contracts that we entered into for the

sale or purchase of businesses or real estate assets,

under which we customarily agree to hold the other

party harmless against losses arising from a breach of

representations and covenants. These relate to such

matters as adequate title to assets sold, intellectual

property rights, specified environmental matters, and

certain income taxes. In each of these circumstances,

our payment is conditioned on the other party making

a claim pursuant to the procedures specified in the par-

ticular contract, which procedures typically allow us to

challenge the other party’s claims. Further, our obliga-

tions under these agreements may be limited in terms

of time and/or amount, and in some instances, we may

have recourse against third parties for certain

payments we made.

Patent indemnifications: In most sales transactions to

resellers of our products, we indemnify against possible

claims of patent infringement caused by our products

or solutions. These indemnifications usually do not

include limits on the claims, provided the claim is

made pursuant to the procedures required in the sales

contract.

For the indemnification agreements discussed

above, it is not possible to predict the maximum poten-

tial amount of future payments under these or similar

agreements due to the conditional nature of our obliga-

tions and the unique facts and circumstances involved

in each agreement. Historically, payments we have

made under these agreements did not have a material

effect on our business, financial condition or results

of operations.

Residual value guarantees: For certain vendor-financing

relationships, we have guaranteed the leasing company

for the residual value position they have taken subject

to the lease. The amount of these guarantees are

insignificant at December 31, 2002, but may be material

in future periods to the extent we offer additional

guarantees.

Indemnification of Officers and Directors: Our

corporate by-laws require that, except to the extent

expressly prohibited by law, we must indemnify our

officers and directors against judgments, fines, pen-

alties and amounts paid in settlement, including legal

fees and all appeals, incurred in connection with civil

or criminal action or proceedings, as it relates to their

75