Xerox 2002 Annual Report Download - page 24

Download and view the complete annual report

Please find page 24 of the 2002 Xerox annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

22

and Resende, Brazil to Flextronics for $167 million. In

addition, Flextronics purchased the related inventory,

property and equipment. We expect these sales, to a

company that specializes in manufacturing as their

core competency, will help us reduce manufacturing

costs and help effectively manage our inventory lev-

els. In total, approximately 4,100 employees in these

operations transferred to Flextronics. For further dis-

cussion, refer to Note 4 to our Consolidated Financial

Statements.

We also exited certain non-core businesses in

2001 and 2002. These sales included the sale of Katun

Corporation in 2002, a supplier of after market copi-

er/printer parts and supplies, for net proceeds of

$67 million and the sale of Delphax in 2001, a manu-

facturer of high-speed electron beam imaging digital

printing systems and related parts, supplies and

services, for net proceeds of $16 million. These sales

were essentially break-even. The sale of these busi-

nesses did not have a material effect on our financial

position, results of operations or cash flows.

At this time, we have substantially completed our

restructuring initiatives, although we expect 2003

restructuring charges of approximately $115 million

as further described in Note 2 to our Consolidated

Financial Statements.

Worldwide employment declined by approximately

11,100 in 2002, to approximately 67,800, largely as a

result of our restructuring programs, and the transfer

of employees to Flextronics, as part of our office man-

ufacturing outsourcing. Worldwide employment was

approximately 78,900 and 91,500 at December 31,

2001 and 2000, respectively.

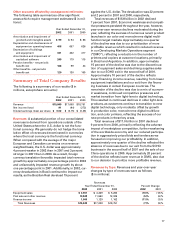

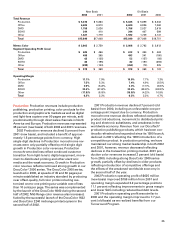

Other Expenses, Net: Other expenses, net for the

three years ended December 31, 2002 consisted of

the following ($ in millions):

Year Ended December 31,

2002 2001 2000

Non-financing interest expense $350 $ 480 $ 592

Currency losses (gains), net 77 (29) (103)

Legal and regulatory matters 37 — —

Amortization of goodwill

(2001 and 2000) and intangibles 36 94 86

Interest income (77) (101) (77)

Gain on early extinguishment

of debt (1) (63) —

Business divestiture and asset sale

(gains) losses (1) 10 (67)

Purchased in-process research

and development —— 27

All other, net 24 53 93

$445 $ 444 $ 551

2002 non-financing interest expense was $130

million lower than 2001 reflecting lower debt levels

throughout 2002 and lower borrowing costs in the

first half of the year, partially offset by higher interest

rates and borrowing costs in the second half of the

year associated with the terms of the New Credit

Facility. Lower borrowing costs reflect the continued

decline in interest rates throughout 2002, coupled

with our higher proportion of variable rate debt in

2002 as compared to 2001. Our current credit ratings

are below investment grade and effectively constrain

our ability to fully use derivative contracts to manage

interest rate risk. Accordingly, although we benefited

from lower interest rates in 2002, we have greater

exposure to volatility in our results of operations. 2002

non-financing interest expense included net gains of

$12 million from the mark-to-market valuation of our

interest rate swaps. Differences between the contract

terms of our interest rate swaps and the underlying

related debt restricts hedge accounting treatment in

accordance with Statement of Financial Accounting

Standards No. 133 “Accounting for Derivative and

Hedging Activities” (“SFAS No. 133”), which required

us to record the mark-to-market valuation of these

derivatives directly to earnings. 2001 non-financing

interest expense was $112 million lower than 2000,

reflecting lower interest rates and lower debt levels.

Non-financing interest expense in 2001 included net

losses of $2 million from the mark-to-market of our

interest rate swaps. Due to the inherent volatility in

the interest rate markets, we are unable to predict the

amount of the above noted mark-to-market gains or

losses in future periods. Such gains or losses could be

material to the financial statements in any future

reporting period.

Net currency losses (gains) result from the

re-measurement of unhedged foreign currency-

denominated assets and liabilities, the spot/forward

premiums on foreign exchange forward contracts in

those markets where we have been able to restore

economic hedging capability and economic hedges of

anticipated transactions for which we do not qualify

for cash flow hedge accounting treatment under

SFAS No. 133. In the first half of 2002, we incurred

$57 million of exchange losses, primarily in Brazil and

Argentina due to the devaluation of the underlying

currencies. In the latter half of 2002, we have been

able to restore hedging capability in the majority of

our key markets. Therefore, the $20 million of curren-

cy losses in the second half of 2002 primarily repre-

sents the spot/forward premiums on foreign

exchange forward contracts and unfavorable currency

movements on economic hedges of anticipated trans-

actions not qualifying for hedge accounting treat-

ment. In 2001, exchange gains on yen debt of

$107 million more than offset losses on Euro loans of