Xerox 2002 Annual Report Download - page 53

Download and view the complete annual report

Please find page 53 of the 2002 Xerox annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

51

cost over the remaining service lives of the employ-

ees participating in the pension plan.

An additional significant assumption affecting our

pension and post-retirement benefit obligations and

the net periodic pension and other post-retirement

benefit cost is the rate that we use to discount our

future anticipated benefit obligations. In estimating

this rate, we consider rates of return on high quality

fixed-income investments currently available, and

expected to be available, during the period to maturi-

ty of the pension benefits.

Foreign Currency Translation: The functional currency

for most foreign operations is the local currency. Net

assets are translated at current rates of exchange,

and income, expense and cash flow items are trans-

lated at the average exchange rate for the year. The

translation adjustments are recorded in Accumulated

Other Comprehensive Income. The U.S. dollar is

used as the functional currency for certain sub-

sidiaries that conduct their business in U.S. dollars or

operate in hyperinflationary economies. A combina-

tion of current and historical exchange rates is used in

remeasuring the local currency transactions of these

subsidiaries, and the resulting exchange adjustments

are included in income. Aggregate foreign currency

losses were $77 in 2002 and gains were $29 and

$103 in 2001 and 2000, respectively, and are included

in Other expenses, net in the accompanying Con-

solidated Statements of Income. Effective January 1,

2002, we changed the functional currency of our

Argentina operation from the U.S. dollar to the Peso

as a result of operational changes made subsequent

to the government’s new economic plan.

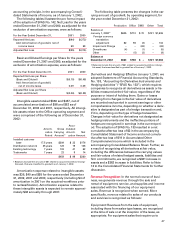

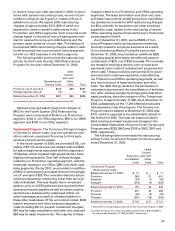

Note 2 — Restructuring Programs

Since early 2000, we have engaged in a series of

restructuring programs related to downsizing our

employee base, exiting certain businesses, outsourcing

certain internal functions and engaging in other

actions designed to reduce our cost structure. We

accomplished these objectives through the undertak-

ing of restructuring initiatives, two of which, the SOHO

Disengagement and the March 2000 Restructuring, are

now substantially completed. The execution of the

Turnaround Program and the Fourth Quarter 2002

Restructuring Program and related payments of obliga-

tions continued through December 31, 2002. As man-

agement continues to evaluate the business, there may

be supplemental charges for new plan initiatives as

well as changes in estimates to amounts previously

recorded, as payments are made or actions are com-

pleted. Asset impairment charges were incurred in con-

nection with these restructuring actions for those

assets made obsolete or redundant as a result of the

plans. The restructuring and asset impairment charges

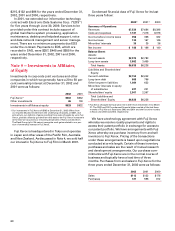

Pension and Post-Retirement Benefit Obligations: We

sponsor pension plans in various forms and in vari-

ous countries covering substantially all employees

who meet certain eligibility requirements. Post-retire-

ment benefit plans cover primarily U.S. employees for

retirement medical costs. As required by existing

accounting rules, we employ a delayed recognition

feature in measuring the costs and obligations of pen-

sion and post-retirement benefit plans. This allows for

changes in the benefit obligations and changes in the

value of assets set aside to meet those obligations to

be recognized, not as they occur, but systematically

and gradually over subsequent periods. All changes

are ultimately recognized, except to the extent they

may be offset by subsequent changes. At any point,

changes that have been identified and quantified

await subsequent accounting recognition as net cost

components and as liabilities or assets.

Several statistical and other factors that attempt to

anticipate future events are used in calculating the

expense, liability and asset values related to our

pension and post-retirement benefit plans. These

factors include assumptions we make about the dis-

count rate, expected return on plan assets, rate of

increase in healthcare costs, the rate of future com-

pensation increases, and mortality, among others.

Actual returns on plan assets are not immediately

recognized in our income statement, due to the afore-

mentioned delayed recognition feature that we follow

in accounting for pensions. In calculating the expect-

ed return on the plan asset component of our net

periodic pension cost, we apply our estimate of the

long-term rate of return to the plan assets that

support our pension obligations, after deducting

assets that are specifically allocated to Transitional

Retirement Accounts (which are accounted for based

on specific plan terms).

For purposes of determining the expected return

on plan assets, we utilize a calculated value approach

in determining the value of the pension plan assets,

as opposed to a fair market value approach. The pri-

mary difference between the two methods relates to

systematic recognition of changes in fair value over

time (generally two years) versus immediate recogni-

tion of changes in fair value. Our expected rate of

return on plan assets is then applied to the calculated

asset value to determine the amount of the expected

return on plan assets to be used in the determination

of the net periodic pension cost. The calculated value

approach reduces the volatility in net periodic pension

cost that results from using the fair market value

approach.

The difference between the actual return on plan

assets and the expected return on plan assets is

added to, or subtracted from, any cumulative differ-

ences that arose in prior years. This amount is a com-

ponent of the unrecognized net actuarial (gain) loss

and is subject to amortization of net periodic pension