Xerox 2002 Annual Report Download - page 36

Download and view the complete annual report

Please find page 36 of the 2002 Xerox annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

34

We intend to access the non-investment grade pub-

lic debt markets until our credit ratings are restored to

investment grade. This, together with possible oppor-

tunistic access to the equity or equity-linked markets,

can provide significant sources of additional funds

until full access to the public debt markets is restored.

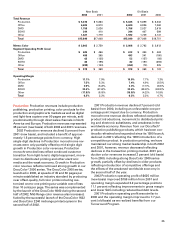

Contractual Cash Obligations and Other Commercial

Commitments and Contingencies: At December 31,

2002, we had the following contractual cash obliga-

tions and other commercial commitments and contin-

gencies:

Contractual Cash Obligations including Cumulative

Preferred Securities ($ in millions):

There-

2003 2004 2005 2006 2007 after

Long-term

debt $3,980 $3,909 $4,016 $ 56 $296 $1,517

Short-term

debt 397 – – – – –

Minimum

operating

lease

commit-

ments 238 202 157 124 71 346

Total

contractual

cash

obligations

$4,615 $4,111 $4,173 $180 $367 $1,863

Cumulative Preferred Securities: As of December 31,

2002, we have four series of outstanding preferred

securities as summarized below. The redemption

requirements and the annual cumulative dividend

requirements on our outstanding preferred stock are

as follows:

•Series B Convertible Preferred Stock (“ESOP

Shares”): The balance at December 31, 2002 was

$508 million, net of deferred ESOP benefits, and is

redeemable in shares of common stock or cash, at

our option, as employees with vested shares leave

the Company. Annual cumulative dividend require-

ments are $6.25 per share. Dividends declared but

not yet paid amounted to $11 million at December

31, 2002. At December 31, 2002, we had 7,023,437

shares issued and outstanding.

•7.5 percent Convertible Trust Preferred Securities:

The balance at December 31, 2002 was $1,016 mil-

lion, and is putable in 2004 in cash or in shares of

common stock at a redemption value of $1,035 mil-

lion at the holders’ option. Annual cumulative

distribution requirements of approximately

$78 million are $3.75 per Preferred Security on

20.7 million securities. The first three years’

dividend requirements were funded at issuance

and are invested in U.S. Treasury securities held

by a separate trust. As of December 31, 2002,

$151 million of the original $229 million remained

in the trust.

•8 percent Convertible Trust Preferred Securities:

The balance at December 31, 2002 was $640 mil-

lion, and is redeemable in 2027 at a redemption

value of $650 million. Annual cumulative dividend

requirements are $80 per security on 650,000 secu-

rities or $52 million per year.

•Canadian Deferred Preferred Stock: The balance at

December 31, 2002 was $45 million, and is

redeemable in 2006. Annual cumulative non-cash

dividend requirements will increase this amount

to its 2006 redemption value of approximately

$56 million.

Other Commercial Commitments and Contingencies:

Flextronics: As previously discussed, in 2001 we

outsourced certain manufacturing activities to

Flextronics under a five-year agreement. During 2002,

we purchased approximately $1 billion of inventory

from Flextronics. We anticipate that we will purchase

approximately $900 million of inventory from

Flextronics during 2003 and expect to increase this

level commensurate with our sales in the future.

Fuji Xerox: We had product purchases from Fuji

Xerox totaling $727 million, $598 million, and

$812 million in 2002, 2001 and 2000, respectively. Our

purchase commitments with Fuji Xerox are in the

normal course of business and typically have a lead

time of three months. We anticipate that we will

purchase approximately $700 million of products

from Fuji Xerox in 2003.

Other Purchase Commitments: We enter into other

purchase commitments with vendors in the ordinary

course of business. Our policy with respect to all

purchase commitments is to record losses, if any,

when they are probable and reasonably estimable.

We currently do not have, nor do we anticipate,

material loss contracts.

EDS Contract: We have an information management

contract with Electronic Data Systems Corp. (“EDS”)

to provide services to us for global mainframe system

processing, application maintenance and enhance-

ments, desktop services and help desk support, voice

and data network management, and server manage-

ment. In 2001, we extended the original ten-year con-

tract through June 30, 2009. Although there are no

minimum payments required under the contract, we

anticipate making the following payments to EDS