Xerox 2002 Annual Report Download - page 57

Download and view the complete annual report

Please find page 57 of the 2002 Xerox annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

55

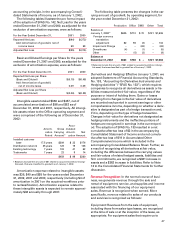

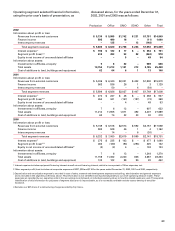

2002 2001 2000

Charges to reserve, all programs $(474) $(555) $(423)

Non-cash items:

Special termination benefits and

pension curtailment 59 21 –

Effects of foreign currency and

other non-cash charges 23 50 36

Cash payments for restructurings $(392) $(484) $(387)

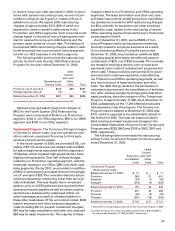

Note 3 — Acquisitions

CPID Division of Tektronix, Inc.: In January 2000, we

and Fuji Xerox completed the acquisition of the Color

Printing and Imaging Division of Tektronix, Inc.

(“CPID”). CPID manufactures and sells color printers,

ink and related products, and supplies. The original

aggregate consideration paid of $925 in cash, includ-

ing $73 paid directly by Fuji Xerox, was subject to pur-

chase price adjustments pending the finalization of

net asset values. During 2001, we were reimbursed

$18 in cash upon finalization of these values which

was recorded as a reduction to Goodwill in the

accompanying Consolidated Balance Sheets. The

acquisition was accounted for in accordance with the

purchase method of accounting.

The excess of cash paid over the fair value of net

assets acquired was allocated to identifiable intangi-

ble assets and goodwill using a discounted cash flow

approach. The value of the identifiable intangible

assets included $27 for purchased in-process research

and development that was expensed in 2000. The

charge represented the fair-value of certain acquired

research and development projects that were deter-

mined not to have reached technological feasibility as

of the date of the acquisition, and was determined

based on a methodology that utilized the projected

after-tax cash flows of the products expected to result

from in-process research and development activities

and the stage of completion of the individual projects.

Other identifiable intangible assets acquired were

exclusive of intangible assets acquired by Fuji Xerox,

and included the installed customer base, the distribu-

tion network, the existing technology, the workforce

(which was transferred to goodwill upon adopting

SFAS No. 142) and trademarks. These identifiable

assets are included in Intangible assets, net in the

accompanying Consolidated Balance Sheets.

The other identifiable intangible assets acquired are

being amortized on a straight-line basis over the esti-

mated useful lives which range from 7 to 25 years.

During 2001, certain intangible asset useful lives were

revised. As a result of these revisions, we recorded an

additional $9 in amortization expense during 2001. The

goodwill recorded in connection with this transaction

was being amortized on a straight-line basis (over 25

years) through December 31, 2001. On January 1, 2002,

we adopted the provisions of SFAS No. 142 and the

amortization of goodwill was discontinued. Refer to

Note 1 for further discussion of the adoption of SFAS

No. 142.

In connection with this acquisition, we recorded

approximately $45 for anticipated costs associated

with exiting certain activities of the acquired opera-

tions. These activities included: (i) the consolidation

of duplicate distribution facilities; (ii) the rationaliza-

tion of the service organization and (iii) the exiting of

certain lines of the CPID business. The costs associat-

ed with these activities included inventory write-offs,

severance charges, contract cancellation costs and

fixed asset impairment charges. During 2001, we

revised our originally planned initiatives related to

the acquired European service organization and our

estimate of the costs to complete the exit from our

distribution facilities in Europe. These changes, along

with certain other changes, resulted in the reversal of

$9 of the originally recorded reserves, with a

corresponding reduction in goodwill.

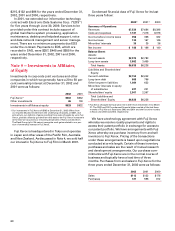

Note 4 — Divestitures and Other Sales

Nigeria: In December 2002, we sold our remaining

investment in Nigeria for a nominal amount and

recognized a loss of $35, primarily representing

cumulative translation adjustment losses which were

previously unrealized.

Licensing Agreement: In September 2002, we signed

a license agreement with a third-party, related to a

nonexclusive license for the use of certain of our

existing patents. In October 2002, we received

proceeds of $50 and granted the license. We have no

continuing obligation or other commitments to the

third-party and recorded the income associated with

this transaction as revenue in Service, outsourcing

and rentals in the accompanying Consolidated

Statement of Income.

Katun Corporation: In July 2002, we sold our 22 per-

cent investment in Katun Corporation, a supplier of

aftermarket copier/printer parts and supplies, for net

proceeds of $67. This sale resulted in a pre-tax gain of

$12, which is included in Other expenses, net, in the

accompanying Consolidated Statement of Income.

After-tax, the sale was essentially break-even, as the

taxable basis of Katun was lower than our carrying

value on the sale date resulting in a high rate of

income tax.

Italy Leasing Business: In April 2002, we sold our

leasing business in Italy to a company now owned by

GE for $200 in cash plus the assumption of $20 of debt.

This sale is part of an agreement under which GE, as

successor, will provide ongoing, exclusive equipment

financing to our customers in Italy. The total pre-tax

loss on this transaction, which is included in Other

expenses, net, in the accompanying Consolidated