Xerox 2002 Annual Report Download - page 65

Download and view the complete annual report

Please find page 65 of the 2002 Xerox annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

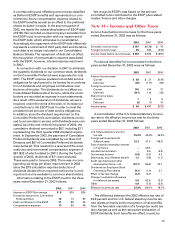

63

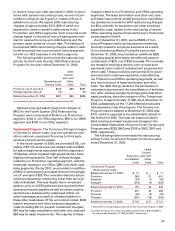

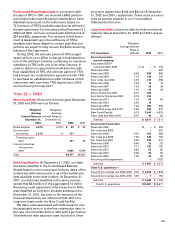

Production Office DMO SOHO Other Total

2002

Information about profit or loss:

Revenues from external customers $ 5,130 $ 5,995 $1,742 $ 231 $1,751 $14,849

Finance income 505 490 16 – (11) 1,000

Intercompany revenues – 135 – 13 (148) –

Total segment revenues $ 5,635 $ 6,620 $1,758 $ 244 $1,592 $15,849

Interest expense(1) $ 198 $ 182 $ 17 $ – $ 354 $ 751

Segment profit (loss)(2)(3) 613 493 53 82 (263) 978

Equity in net income of unconsolidated affiliates – – 5 – 49 54

Information about assets:

Investments in affiliates, at equity 9 8 22 – 589 628

Total assets 10,756 11,213 1,121 213 2,155 25,458

Cost of additions to land, buildings and equipment 62 64 6 1 13 146

2001

Information about profit or loss:

Revenues from external customers $ 5,336 $ 6,340 $2,001 $ 402 $1,800 $15,879

Finance income 563 536 26 1 3 1,129

Intercompany revenues – 50 – 4 (54) –

Total segment revenues $ 5,899 $ 6,926 $2,027 $ 407 $1,749 $17,008

Interest expense(1) $ 274 $ 247 $ 48 $ – $ 368 $ 937

Segment profit (loss)(2)(3) 454 341 (157) (197) (73) 368

Equity in net income of unconsolidated affiliates – – 4 – 49 53

Information about assets:

Investments in affiliates, at equity 7 6 12 – 607 632

Total assets 11,214 11,905 1,671 492 2,407 27,689

Cost of additions to land, buildings and equipment 60 74 32 23 30 219

2000

Information about profit or loss:

Revenues from external customers $ 5,749 $ 6,518 $2,573 $ 592 $2,157 $17,589

Finance income 583 528 46 1 4 1,162

Intercompany revenues – 14 – 6 (20) –

Total segment revenues $ 6,332 $ 7,060 $2,619 $ 599 $2,141 $18,751

Interest expense(1) $ 275 $ 235 $ 103 $ – $ 477 $ 1,090

Segment profit (loss)(2)(3) 463 (180) (93) (293) 225 122

Equity in net income of unconsolidated affiliates(4) (2) (2) 4 – 103 103

Information about assets:

Investments in affiliates, at equity 7 6 13 – 1,244 1,270

Total assets 11,158 11,362 2,240 806 2,687 28,253

Cost of additions to land, buildings and equipment 132 122 88 90 20 452

1 Interest expense includes equipment financing interest as well as non-financing interest, which is a component of Other expenses, net.

2 Other segment profit (loss) includes net corporate expenses of $227, $35 and $116 for the years ended December 31, 2002, 2001 and 2000, respectively.

3 Depreciation and amortization expense is recorded in cost of sales, research and development expenses and selling, administrative and general expenses

and is included in the segment profit (loss) above. This information is not identified and reported separately to our chief operating decision-maker. These

expenses are recorded by our operating units in the accounting records based on individual assessments as to how the related assets are used. The separate

identification of this information for purposes of segment disclosure is impracticable, as it is not readily available and the cost to develop it would be

excessive.

4 Excludes our $37 share of a restructuring charge recorded by Fuji Xerox.

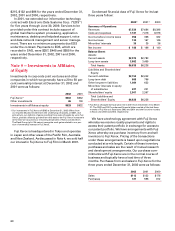

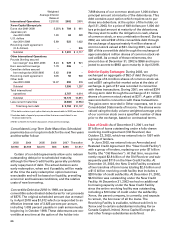

Operating segment selected financial information,

using the prior year’s basis of presentation, as

discussed above, for the years ended December 31,

2002, 2001 and 2000 was as follows: