Xerox 2002 Annual Report Download - page 78

Download and view the complete annual report

Please find page 78 of the 2002 Xerox annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

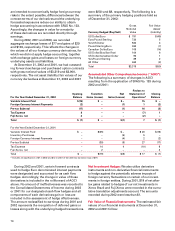

services to Xerox Corporation and our subsidiaries.

The by-laws provide no limit on the amount of

indemnification. As permitted under the State of New

York, we have purchased directors and officers insur-

ance coverage to cover claims made against the

directors and officers during the applicable policy

periods. The amounts and types of coverage have

varied from period to period as dictated by market

conditions. The current policy provides $105 of cover-

age and has no deductible. The litigation matters and

regulatory actions described below involve certain of

the Company’s current and former directors and offi-

cers, all of whom are covered by the aforementioned

indemnity and if applicable, the current and prior peri-

od insurance policies. However, certain indemnifica-

tion payments may not be covered under our

directors’ and officers’ insurance coverage.

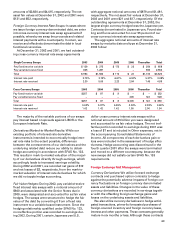

Product Warranty Liabilities: In connection with our

normal sales of equipment, including those under sales-

type lease, we generally do not issue product warranties.

Our arrangements typically involve a separate full

service maintenance agreement with the customer.

The agreements generally extend over a period equiva-

lent to the lease term or the expected useful life under a

cash sale. The service agreements involve the payment

of fees in return for our performance of repairs and

maintenance. As a consequence, we do not have any

significant product warranty obligations including any

obligations under customer satisfaction programs.

In few circumstances, particularly in certain cash

sales, we may issue a limited product warranty if

negotiated by the customer. We also issue warranties

for certain of our lower-end products in the Office seg-

ment, where full service maintenance agreements are

not available. In these instances, we record warranty

obligations at the time of the sale.

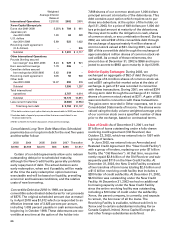

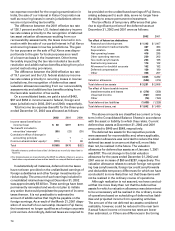

The following table summarizes product warranty

activity recorded for the year ended December 31, 2002:

Balance Provisions, Balance

December 31, Changes December 31,

2001 & Other Payments 2002

Product

warranty

liabilities $46 $51 $(72) $25

The decrease in product warranty liabilities at

December 31, 2002, as compared with December 31,

2001, is primarily due to our exit from the SOHO

business in 2001.

Legal Matters: As more fully discussed below, we are a

defendant in numerous litigation and regulatory matters

involving securities law, patent law, environmental law,

employment law and the Employee Retirement Income

Security Act (“ERISA”). Should these matters result in

a change in our determination as to an unfavorable

outcome, result in a final adverse judgment or be set-

tled for significant amounts, they could have a material

adverse effect on our results of operations, cash flows

and financial position in the period or periods in which

such determination, judgment or settlement occurs.

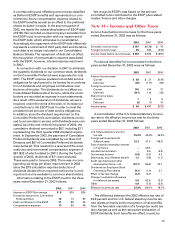

Litigation Against the Company:

In re Xerox Corporation Securities Litigation: A consoli-

dated securities law action (consisting of 17 cases) is

pending in the United States District Court for the

District of Connecticut. Defendants are the Company,

Barry Romeril, Paul Allaire and G. Richard Thoman.

The consolidated action purports to be a class action

on behalf of the named plaintiffs and all other

purchasers of common stock of the Company during

the period between October 22, 1998 through October

7, 1999 (“Class Period”). The amended consolidated

complaint in the action alleges that in violation of

Section 10(b) and/or 20(a) of the Securities Exchange

Act of 1934, as amended (“1934 Act”), and SEC Rule

10b-5 thereunder, each of the defendants is liable as a

participant in a fraudulent scheme and course of busi-

ness that operated as a fraud or deceit on purchasers of

the Company’s common stock during the Class Period

by disseminating materially false and misleading state-

ments and/or concealing material facts. The amended

complaint further alleges that the alleged scheme: (i)

deceived the investing public regarding the economic

capabilities, sales proficiencies, growth, operations and

the intrinsic value of the Company’s common stock; (ii)

allowed several corporate insiders, such as the named

individual defendants, to sell shares of privately held

common stock of the Company while in possession of

materially adverse, non-public information; and (iii)

caused the individual plaintiffs and the other members

of the purported class to purchase common stock of

the Company at inflated prices. The amended consoli-

dated complaint seeks unspecified compensatory dam-

ages in favor of the plaintiffs and the other members of

the purported class against all defendants, jointly and

severally, for all damages sustained as a result of

defendants’ alleged wrongdoing, including interest

thereon, together with reasonable costs and expenses

incurred in the action, including counsel fees and

expert fees. On September 28, 2001, the court denied

the defendants’ motion for dismissal of the complaint.

On November 5, 2001, the defendants answered the

complaint. On or about January 7, 2003, the plaintiffs

filed a motion for class certification. That motion is cur-

rently pending. The individual defendants and we deny

any wrongdoing and intend to vigorously defend the

action. Based on the stage of the litigation, it is not pos-

sible to estimate the amount of loss or range of possi-

ble loss that might result from an adverse judgment or

a settlement of this matter.

76