Xerox 2002 Annual Report Download - page 87

Download and view the complete annual report

Please find page 87 of the 2002 Xerox annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

respectively. No monetary consideration is paid by

employees who receive restricted shares. Compen-

sation expense for restricted grants is based upon the

grant date market price and is recorded over the vest-

ing period which on average ranges from one to three

years. Compensation expense recorded for restricted

grants was $17, $15 and $18 in 2002, 2001 and 2000,

respectively.

Stock options and rights are settled with newly

issued or, if available, treasury shares of our common

stock. Stock options generally vest in three years and

expire between eight and ten years from the date of

grant. The exercise price of the options is equal to the

market value of our common stock on the effective

date of grant.

At December 31, 2002 and 2001, 43.2 million and

39.7 million shares, respectively, were available for

grant of options or rights. The following table provides

information relating to the status of, and changes in,

options granted:

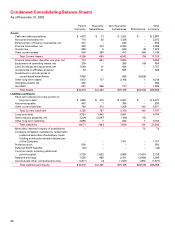

Options Outstanding Options Exercisable

Weighted

Range of Number Average Remaining Weighted Average Number Weighted Average

Exercise Prices Outstanding Contractual Life Exercise Price Exercisable Exercise Price

$ 4.75 to $ 6.98 12,730 8.16 $ 4.85 3,983 $ 4.76

7.13 to 10.69 14,554 8.97 10.12 252 7.78

10.72 to 15.27 468 7.59 12.87 164 14.68

16.91 to 23.25 18,982 5.37 21.51 15,025 21.44

25.81 to 36.70 11,668 4.13 31.29 8,861 32.94

41.72 to 60.95 18,447 4.34 52.99 16,965 53.47

$ 4.75 to $60.95 76,849 6.09 $25.58 45,250 $34.13

Options outstanding and exercisable at December 31, 2002 were as follows:

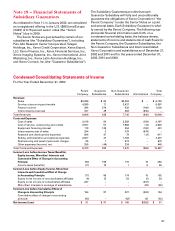

2002 2001 2000

Average Average Average

Stock Option Stock Option Stock Option

Employee Stock Options Options Price Options Price Options Price

Outstanding at January 1 68,829 $29 58,233 $35 43,388 $42

Granted 14,286 10 15,085 5 19,338 22

Cancelled (5,668) 34 (4,479) 28 (4,423) 38

Exercised (598) 5 (10) 5 (70) 22

Outstanding at December 31 76,849 26 68,829 29 58,233 35

Exercisable at end of year 45,250 36,388 23,346

Note 18 — Earnings Per Share

Basic earnings per share is computed by dividing

income available to common shareholders (the numer-

ator) by the weighted-average number of common

shares outstanding (the denominator) for the period.

Diluted earnings per share assumes that any dilutive

convertible preferred shares, convertible subordinated

debentures, and convertible securities outstanding

were converted, with related preferred stock dividend

requirements and outstanding common shares adjust-

ed accordingly. It also assumes that outstanding com-

mon shares were increased by shares issuable upon

exercise of those stock options for which market price

exceeds the exercise price, less shares which could

have been purchased by us with the related proceeds.

In periods of losses, diluted loss per share is computed

on the same basis as basic loss per share as the inclu-

sion of any other potential shares outstanding would

be anti-dilutive.

When computing diluted EPS, we are required to

assume conversion of the ESOP preferred shares into

common stock if we are profitable. The conversion

guarantees that each ESOP preferred share be convert-

ed into shares worth a minimum value of $78.25. As

long as our common stock price is above $13.04 per

share, the conversion ratio is 6 to 1. As our share price

falls below this amount, the conversion ratio increases.

85