Xerox 2002 Annual Report Download - page 17

Download and view the complete annual report

Please find page 17 of the 2002 Xerox annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

15

Several statistical and other factors that attempt to

anticipate future events are used in calculating the

expense, liability and asset values related to our pen-

sion and post-retirement benefit plans. These factors

include assumptions we make about the discount rate,

expected return on plan assets, rate of increase in

healthcare costs, the rate of future compensation

increases, and mortality, among others. Actual returns

on plan assets are not immediately recognized in our

income statement, due to the aforementioned delayed

recognition feature that we follow in accounting for

pensions. In calculating the expected return on the plan

asset component of our net periodic pension cost, we

apply our estimate of the long-term rate of return to the

plan assets that support our pension obligations,

after deducting assets that are specifically allocated to

Transitional Retirement Accounts (which are accounted

for based on specific plan terms).

For purposes of determining the expected return on

plan assets, we utilize a calculated value approach in

determining the value of the pension plan assets, as

opposed to a fair market value approach. The primary

difference between the two methods relates to a sys-

tematic recognition of changes in fair value over time

(generally two years) versus immediate recognition of

changes in fair value. Our expected rate of return on

plan assets is then applied to the calculated asset value

to determine the amount of the expected return on

plan assets to be used in the determination of the net

periodic pension cost. The calculated value approach

reduces the volatility in net periodic pension cost that

results from using the fair market value approach.

The difference between the actual return on plan

assets and the expected return on plan assets is

added to, or subtracted from, any cumulative differ-

ences that arose in prior years. This amount is a com-

ponent of the unrecognized net actuarial (gain) loss

and is subject to amortization to net periodic pension

cost over the remaining service lives of the employ-

ees participating in the pension plan.

As a result of actual asset returns being lower than

expected asset returns over the previous two years,

2003 net periodic pension cost will increase. The total

unrecognized actuarial loss as of December 31, 2002

is $1.8 billion. This amount will be amortized in the

future, subject to offsetting gains or losses that will

change the future amortization amount.

We have historically utilized a weighted average

expected rate of return on plan assets of approximate-

ly 8.8 percent, on a worldwide basis, in determining

our net periodic pension cost. In estimating this rate,

we considered the historical returns earned by the

plan assets, the rates of return expected in the future,

and our investment strategy and asset mix with

respect to the plans’ funds. In response to market con-

ditions during the prior three years, a re-evaluation of

our domestic asset investment strategy with our

external asset managers, and our overall expectation

of lower long-term rates of return, we have reduced

our weighted average expected rate of return for our

major worldwide pension plans. The weighted aver-

age rate we will utilize to calculate our 2003 expense

will be approximately 8.3 percent.

An additional significant assumption affecting our

pension and post-retirement benefit obligations and

the net periodic pension and other post-retirement

benefit cost is the rate that we use to discount our

future anticipated benefit obligations. In estimating

this rate, we consider rates of return on high quality

fixed-income investments currently available, and

expected to be available, during the period to maturi-

ty of the pension benefits. The weighted average rate

we will utilize to calculate our 2003 expense will be

approximately 6.2 percent, which is a decrease from

6.8 percent in 2002. On a consolidated basis, we recog-

nized net periodic pension cost of $168 million, $99 mil-

lion and $44 million for the years ended December 31,

2002, 2001 and 2000, respectively. Pension cost is

included as a component of cost of sales, cost of serv-

ice, outsourcing and rentals, research and develop-

ment expenses and selling, administrative and general

expenses in our Consolidated Statements of Income.

Pension cost is allocated to these income statement

components based on the related employee costs.

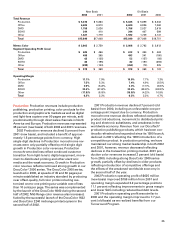

The weighted average assumptions used in the

computation of our projected net periodic pension

cost for 2003, and our actual net periodic pension cost

for 2002, 2001 and 2000, were as follows:

2003

Projected 2002 2001 2000

Discount rate 6.2% 6.8% 7.0% 7.4%

Expected rate of

return on plan assets 8.3% 8.8% 8.9% 8.9%

Rate of future

compensation

increases 4.0% 3.9% 3.8% 4.2%

As a result of the reduction in the expected rate of

return on plan assets, the reduction in the discount

rate, the slight increase in the rate of future compensa-

tion increases, the lower actual return on plan assets

during the prior three years and certain other factors,

our 2003 net periodic pension cost is expected to be

$150 million higher than 2002.

The estimated impacts on net periodic pension cost

of changes in the expected rate of return on plan

assets assumption are as follows ($ in millions):

Assuming a Increase/(Decrease)

Discount Rate of in 2003 Projected Net

6.2 percent Periodic Pension Cost

0.25% increase in expected rate of

return on plan assets $(11)

0.25% decrease in expected rate of

return on plan assets 11