Xerox 2002 Annual Report Download - page 35

Download and view the complete annual report

Please find page 35 of the 2002 Xerox annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

33

the term of the New Credit Facility, we can pay cash

dividends on our preferred stock, provided there is

then no event of default. In addition to other defaults

customary for facilities of this type, defaults on other

debt, or bankruptcy, of Xerox Corporation, or certain

of our subsidiaries, would constitute defaults under

the New Credit Facility.

At December 31, 2002, we are in compliance with

all aspects of the New Credit Facility including finan-

cial covenants and expect to be in compliance for at

least the next twelve months. Failure to be in compli-

ance with any material provision or covenant of the

New Credit Facility could have a material adverse

effect on our liquidity and operations.

As previously mentioned, in October 2002, we

completed an eight-year agreement in the U.S. (the

“New U.S. Vendor Financing Agreement”), under

which GE Vendor Financial Services, a subsidiary of

GE, became our primary equipment financing

provider in the U.S., through monthly securitizations

of our new lease originations. In addition to the

$2.5 billion already funded by GE prior to this agree-

ment, which is secured by portions of our current U.S.

lease receivables, the New U.S. Vendor Financing

Agreement calls for GE to provide funding in the

U.S. on new lease originations, of up to an additional

$5 billion outstanding at anytime, during the eight

year term, subject to normal customer acceptance

criteria. The $5 billion limit may be increased to

$8 billion subject to agreement between the parties.

The new agreement contains mutually agreed renew-

al options for successive two-year periods.

Under this agreement, we expect GE to fund

approximately 70 percent of new U.S. lease origina-

tions at over-collateralization rates, which vary over

time, but are expected to be approximately 10 percent

of the net receivables balance. The securitizations will

be subject to interest rates calculated at each monthly

loan occurrence at yield rates consistent with average

rates for similar market based transactions. Consistent

with the loans already received from GE, the funding

received under this new agreement will be recorded

as secured borrowings and the associated receivables

will be included in our Consolidated Balance Sheet.

GE’s commitment to fund under this new agreement

is not subject to our credit ratings. There are no credit

rating defaults that could impair future funding under

this agreement. This agreement contains cross

default provisions related to certain financial

covenants contained in the New Credit Facility and

other significant debt facilities. Any default would

impair our ability to receive subsequent funding until

the default was cured or a waiver was received. As of

December 31, 2002, we were in compliance with all

covenants and expect to be in compliance for at least

the next twelve months.

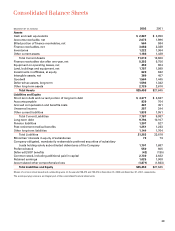

In 2002 and 2001, we received financing totaling

$1,845 million and $1,175 million, respectively, from

GE, secured by lease receivables in the U.S. Net fees

of $16 million were capitalized as debt issue costs.

In connection with these transactions, $150 million

was required to be held in escrow, as security for our

continuing obligations under transferred contracts.

At December 31, 2002, the remaining balance of

$2,323 million was included as debt in our

Consolidated Balance Sheet.

In May 2002, we launched the Xerox Capital

Services (“XCS”) venture with GE, under which XCS

now manages our customer administration and leas-

ing activities in the U.S., including various financing

programs, credit approval, order processing, billing

and collections. We account for XCS as a consolidated

entity since we are responsible to fund all of its opera-

tions, and, further, all events of termination result in

GE receiving their entire equity investment, with total

ownership reverting to us.

Summary – Financial Flexibility and Liquidity: With

$2.9 billion of cash and cash equivalents on hand at

December 31, 2002, we believe our liquidity (including

operating and other cash flows we expect to gener-

ate) will be sufficient to meet operating cash flow

requirements as they occur and to satisfy all sched-

uled debt maturities for at least the next twelve

months. Our ability to maintain sufficient liquidity

going forward is highly dependent on achieving

expected operating results, including capturing the

benefits from restructuring activities, and completing

announced finance receivable securitization and other

initiatives. There is no assurance that these initiatives

will be successful. Failure to successfully complete

these initiatives could have a material adverse effect

on our liquidity, operations and financial position, and

could require us to consider further measures, includ-

ing deferring planned capital expenditures, reducing

discretionary spending, selling additional assets and,

if necessary, restructuring existing debt.

Our access to the public debt markets is expected

to be limited to the non-investment grade segment

until our debt ratings have been restored to invest-

ment grade. Specifically, until our credit ratings

improve, we will be unable to access the commercial

paper markets or obtain unsecured bank lines of cred-

it. Improvements in our credit ratings depend on (1)

our ability to demonstrate sustained profitability

growth and operating cash generation and (2) contin-

ued progress on our finance receivable securitization

initiatives. However, there is no assurance on the tim-

ing of when our ratings may be restored to invest-

ment grade by the rating agencies.