Xerox 2002 Annual Report Download - page 18

Download and view the complete annual report

Please find page 18 of the 2002 Xerox annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

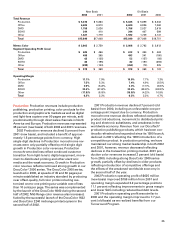

16

Our expected rate of return on plan assets has his-

torically had, and will likely continue to have, a mate-

rial impact on net periodic pension cost.

The estimated impacts on net periodic pension

cost of changes in the discount rate assumption are

as follows ($ in millions):

Assuming an Expected Rate Increase/(Decrease)

of Return on Plan Assets of in 2003 Projected Net

8.3 percent Periodic Pension Cost

0.25% increase in discount rate $(26)

0.25% decrease in discount rate 31

The market performance over the past two years has

decreased the value of the assets held by our world-

wide pension plans and has correspondingly

increased the amount by which our worldwide pen-

sion funds are under-funded. As a result of the reduc-

tion in the value of our pension plan assets and a

decline in interest rates, which increased the present

value of our benefit obligations for our major world-

wide pension plans, we recorded during the fourth

quarter of 2002 an incremental additional minimum

pension liability. This incremental liability was record-

ed through a non-cash charge to Shareholders’ Equity

as required by SFAS No. 87 “Employers’ Accounting

for Pensions.” The increase in the additional mini-

mum pension liability of $413 million resulted in an

incremental after-tax charge to Shareholders’ Equity

of $231 million. These amounts will increase or

decrease in the future based on the value of our pen-

sion obligations in relation to the value of the assets

held by our pension plans to settle such obligations.

Income Taxes and Tax Valuation Allowances: We

record the estimated future tax effects of temporary

differences between the tax bases of assets and

liabilities and amounts reported in our Consolidated

Balance Sheets, as well as operating loss and tax

credit carryforwards. We follow very specific and

detailed guidelines in each tax jurisdiction regarding

the recoverability of any tax assets recorded in our

Consolidated Balance Sheets and provide necessary

valuation allowances as required. We regularly review

our deferred tax assets for recoverability based on

projected future taxable income, the expected timing

of the reversals of existing temporary differences and

tax planning strategies. If we continue to operate at a

loss in certain jurisdictions or are unable to generate

sufficient future taxable income, or if there is a materi-

al change in the actual effective tax rates or time peri-

od within which the underlying temporary differences

become taxable or deductible, we could be required

to increase the valuation allowance against all or a

significant portion of our deferred tax assets resulting

in a substantial increase in our effective tax rate and

a material adverse impact on our operating results.

Conversely, if and when such jurisdictions were to

become sufficiently profitable to recover previously

reserved deferred tax assets, we would reduce all or a

portion of the applicable valuation allowance in the

period when such determination is made. This would

result in an increase to reported earnings in such

period. Increases to our valuation allowance, through

charges to expense, were $15 million, $247 million,

and $12 million for the years ended December 31,

2002, 2001 and 2000, respectively.

We are subject to ongoing tax examinations and

assessments in various jurisdictions. Accordingly, we

provide for additional tax expense based upon the

probable outcomes of such matters. In addition, when

applicable, we adjust the previously recorded tax

expense to reflect examination results. Our ongoing

assessments of the probable outcomes of the exami-

nations and related tax positions require judgment

and can materially increase or decrease our effective

tax rate as well as impact our operating results.

Legal Contingencies: We are a defendant in numerous

litigation and regulatory matters including those

involving securities law, patent law, environmental

law, employment law and ERISA, as discussed in

Note 15 to the Consolidated Financial Statements. As

required by Statement of Financial Accounting

Standards No. 5 “Accounting for Contingencies,” we

determine whether an estimated loss from a contin-

gency should be accrued by assessing whether a loss

is deemed probable and can be reasonably estimated.

We analyze our litigation and regulatory matters

based on available information to assess potential lia-

bility. We develop our views on estimated losses in

consultation with outside counsel handling our

defense in these matters, which involves an analysis

of potential results, assuming a combination of litiga-

tion and settlement strategies. Should our views on

estimated losses reflect the need to recognize a mate-

rial accrual, or should these matters result in an

adverse judgment or be settled for significant

amounts, they could have a material adverse effect on

our results of operations, cash flows and financial

position in the period or periods in which such

change in estimate, judgment or settlement occurs.

Other Accounting Policies: Other accounting policies,

not involving the same level of significance as those

discussed above, are nevertheless important to an

understanding of the financial statements. See Note 1

to the Consolidated Financial Statements, Summary

of Significant Accounting Policies, which discusses

other significant accounting policies.