Xerox 2002 Annual Report Download - page 73

Download and view the complete annual report

Please find page 73 of the 2002 Xerox annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

71

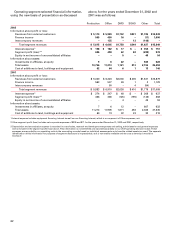

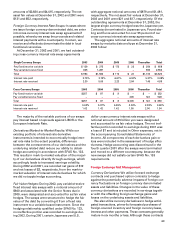

2002 2001

Carrying Fair Carrying Fair

Amount Value Amount Value

Cash and cash

equivalents $2,887 $2,887 $ 3,990 $3,990

Accounts receivable, net 2,072 2,072 1,896 1,896

Short-term debt 4,377 3,837 6,637 6,503

Long-term debt 9,794 9,268 10,107 9,261

The fair value amounts for Cash and cash equiva-

lents and Accounts receivable, net approximate

carrying amounts due to the short maturities of these

instruments.

The fair value of Short- and Long-term debt was

estimated based on quoted market prices for these or

similar issues or on the current rates offered to us for

debt of similar maturities. The difference between the

fair value and the carrying value represents the theo-

retical net premium or discount we would pay or

receive to retire all debt at such date. We have no

plans to retire significant portions of our debt prior

to scheduled maturity.

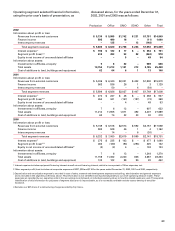

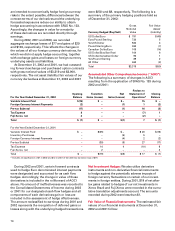

Note 13 — Employee Benefit Plans

We sponsor numerous pension and other post-retire-

ment benefit plans, primarily retiree health, in our U.S.

Pension Benefits Other Benefits

2002 2001 2002 2001

Change in Benefit Obligation

Benefit obligation, January 1 $ 7,606 $8,255 $ 1,481 $ 1,314

Service cost 180 174 26 28

Interest cost (210) (184) 96 99

Plan participants’ contributions 18 19 3–

Plan amendments (31) –(139) –

Actuarial loss 736 76 191 136

Currency exchange rate changes 327 (99) –(3)

Divestitures (1) –––

Curtailments 234 8(1)

Special termination benefits 39 –2–

Benefits paid/settlements (735) (669) (105) (92)

Benefit obligation, December 31 $ 7,931 $7,606 $ 1,563 $ 1,481

Change in Plan Assets

Fair value of plan assets, January 1 $ 7,040 $8,626 $ – $–

Actual return on plan assets (768) (843) ––

Employer contribution 138 42 102 92

Plan participants’ contributions 18 19 3–

Currency exchange rate changes 271 (135) ––

Divestitures (1) –––

Benefits paid (735) (669) (105) (92)

Fair value of plan assets, December 31 $ 5,963 $7,040 $–$ –

Funded status (including under-funded and non-funded plans) $(1,968) $ (566) $(1,563) $(1,481)

Unamortized transition assets –(1) ––

Unrecognized prior service cost (27) 8(134) (2)

Unrecognized net actuarial (gain) loss 1,843 434 445 250

Net amount recognized $ (152) $ (125) $(1,252) $(1,233)

Amounts recognized in the Consolidated Balance Sheets consist of:

Prepaid benefit cost $ 656 $ 597 $ – $ –

Accrued benefit liability (1,277) (785) (1,252) (1,233)

Intangible asset 77––

Accumulated other comprehensive income 462 56 ––

Net amount recognized $ (152) $ (125) $(1,252) $(1,233)

Under-funded or non-funded plans

Aggregate benefit obligation $ 7,865 $5,778 $ 1,563 $ 1,481

Aggregate fair value of plan assets $ 5,878 $5,039 $ – $–

Plans with under-funded or non-funded accumulated benefit obligations

Aggregate accumulated benefit obligation $ 5,188 $4,604

Aggregate fair value of plan assets $ 4,008 $4,157

and international operations. Information regarding

our benefit plans is presented below: