Xerox 2002 Annual Report Download - page 85

Download and view the complete annual report

Please find page 85 of the 2002 Xerox annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

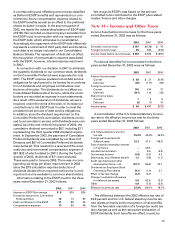

Outstanding preferred stock related to our ESOP

at December 31, 2002 and 2001 follows (shares in

thousands):

2002 2001

Shares Amount Shares Amount

Convertible

Preferred Stock 7,023 $550 7,730 $605

Preferred Stock Purchase Rights: We have a share-

holder rights plan designed to deter coercive or unfair

takeover tactics and to prevent a person or persons

from gaining control of us without offering a fair price to

all shareholders. Under the terms of the plan, one-half

of one preferred stock purchase right (“Right”) accom-

panies each share of outstanding common stock. Each

full Right entitles the holder to purchase from us one

three-hundredth of a new series of preferred stock at

an exercise price of 250 dollars. Within the time limits

and under the circumstances specified in the plan, the

Rights entitle the holder to acquire either our common

stock, the stock of the surviving company in a business

combination, or the stock of the purchaser of our assets,

having a value of two times the exercise price. The

Rights, which expire in April 2007, may be redeemed

prior to becoming exercisable by action of the Board of

Directors at a redemption price of $.01 per Right. The

Rights are non-voting and, until they become exercis-

able, have no dilutive effect on the earnings per share

or book value per share of our common stock.

Company-obligated, Mandatorily Redeemable

Preferred Securities of Subsidiary Trusts Holding

Solely Subordinated Debentures of the Company:

The components of Company-obligated, mandatorily

redeemable preferred securities of subsidiary trusts

holding solely subordinated debentures of the

Company at December 31, 2002 and 2001 follow:

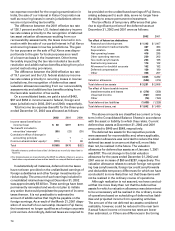

2002 2001

Trust II $1,016 $1,005

Trust I 640 639

Deferred Preferred Stock 45 43

Total $1,701 $1,687

Trust II: In 2001, Xerox Capital Trust II (“Capital II”), a

trust sponsored and wholly-owned by us, issued 20.7

million 7.5 percent convertible trust preferred securities

(the “Trust Preferred Securities”) to investors for an

aggregate liquidation amount of $1,035 and 0.6 million

shares of common securities to us for an aggregate

liquidation amount of $32. With the proceeds from

these securities, Capital II purchased $1,067 aggregate

principal amount of 7.5 percent convertible junior sub-

ordinated debentures due 2021 of Xerox Funding LLC II

(“Funding”), a wholly-owned subsidiary of ours. With

the proceeds from these securities, Funding purchased

$1,067 aggregate principal amount of 7.5 percent con-

vertible junior subordinated debentures due 2021 of

the Company. Capital II’s assets consist principally of

Funding’s debentures, and Funding’s assets consist

principally of our debentures. On a consolidated basis,

we received net proceeds of $1,004, which was net of

$31 of fees and expenses. The initial carrying value is

being accreted to liquidation value through Minorities’

interests in earnings of subsidiaries over three years to

the earliest redemption date. As of December 31, 2002,

the carrying value had accreted to $1,016. We used the

net proceeds from the issuance of our debentures for

general corporate purposes, including the payment of

our indebtedness. Our debentures, along with those

of Funding, and related income statement effects are

eliminated in our consolidated financial statements.

Distributions on the Trust Preferred Securities are

charged, net of tax, to Minorities’ interests in earnings

of subsidiaries and, together with the accretion noted

above, amounted to $54 after-tax ($89 pre-tax) and $2

after-tax ($4 pre-tax) in 2002 and 2001, respectively. We

have effectively guaranteed, fully and unconditionally,

on a subordinated basis, the payment and delivery by

Funding, of all amounts due on the Funding debentures

and the payment and delivery by Capital II of all amounts

due on the Trust Preferred Securities, in each case to

the extent required under the terms of the securities.

The Trust Preferred Securities accrue and pay cash

distributions quarterly at a rate of 7.5 percent per

annum of the stated liquidation amount of fifty dollars

per trust preferred security. Concurrently, with the initial

issuance of the Trust Preferred Securities, Funding

issued 0.2 million common securities to us, for an

aggregate liquidation amount of $229. Funding used

the proceeds to purchase, and deposit with a pledge,

trustee U.S. treasuries in order to secure Funding’s

obligations under its debentures through the distribu-

tion payment date (November 27, 2004). As of

December 31, 2002 and 2001, the balance of these

securities was $151 and $229, respectively, and is

included in both Other current assets and Other long-

term assets in the Consolidated Balance Sheets. The

Trust Preferred Securities are convertible at any time,

at the option of the investors, into 5.4795 shares of

our common stock per Trust Preferred Security, sub-

ject to adjustment. The Trust Preferred Securities are

mandatorily redeemable upon the maturity of the

debentures on November 27, 2021 at fifty dollars per

Trust Preferred Security plus accrued and unpaid distri-

butions. Investors may require us to cause Capital II

to purchase all or a portion of the Trust Preferred

Securities on December 4, 2004, and November 27,

2006, 2008, 2011 and 2016 at a price of fifty dollars per

Trust Preferred Security, plus accrued and unpaid distri-

butions. In addition, if we undergo a change in control

on or before December 4, 2004, investors may require

us to cause Capital II to purchase all or a portion of the

Trust Preferred Securities. In either case, the purchase

83