Volvo 2004 Annual Report Download - page 99

Download and view the complete annual report

Please find page 99 of the 2004 Volvo annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

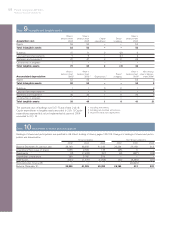

97

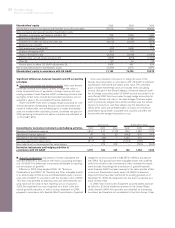

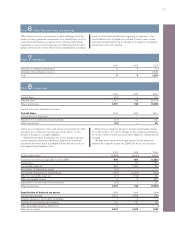

Claims as a consequence of tax audit carried out previously for which

provisions are not deemed necessary amount to 135 (–; –). The

amount is included in contingent liabilities.

Deferred taxes relate to estimated tax on the change in tax-loss

carryforwards and temporary differences. Deferred tax assets are

reported to the extent that it is probable that the amount can be uti-

lized against future taxable income.

Deferred taxes related to change in tax-loss carryforwards amount

to –1,427 (148; 1,111) and to changes in other temporary differences

to 15 (10; 10). No income taxes have been debited or credited directly

to equity.

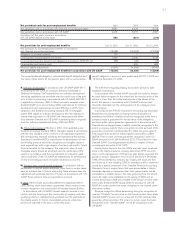

The table below shows the principal reasons for the difference

between the corporate income tax (28%) and the tax for the period.

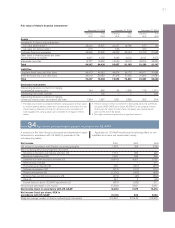

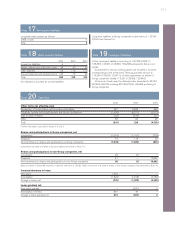

Note 8Income taxes

2002 2003 2004

Current taxes (51) — 92

Deferred taxes 1,121 158 (1,412)

Total income taxes 1,070 158 (1,320)

Current taxes were distributed as follows:

Current taxes 2002 2003 2004

Current taxes for the period – — –

Adjustment of current taxes for prior periods (51) — 92

Total income taxes (51) — 92

2002 2003 2004

Income before taxes (3,555) (2,347) 6,418

Income tax according to applicable tax rate (28%) 995 657 (1,797)

Capital gains 187184

Non-taxable dividends 350 1,362 46

Recognition of deferred tax assets (70) – –

Non-taxable revaluations of shareholdings (150) (1,831) (153)

Other non-deductible expenses (11) (120) 26

Other non-taxable income 6 3 282

Adjustment of current taxes for prior periods (51) – 92

Total income taxes 1,070 158 (1,320)

Specification of deferred tax assets 2002 2003 2004

Tax-loss carryforwards 2,221 2,369 942

Valuation allowance for doubtful receivables 1 2 1

Provision for post-employment benefits 125 137 154

Other deductible temporary differences 4 1 0

Deferred tax assets 2,351 2,509 1,097

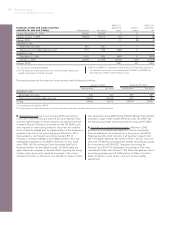

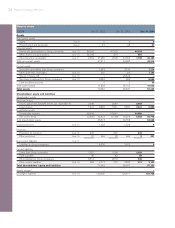

Note 7Allocations

2002 2003 2004

Allocation to additional depreciation 0 0 (1)

Utilization of tax allocation reserves – – 1,525

Total 001,524

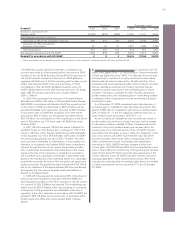

Note 6Other financial income and expenses

Other financial income and expenses include exchange rate differ-

ences on loans, guarantee commissions from subsidiaries, costs for

confirmed credit facilities as well as costs of having Volvo shares

registered on various stock exchanges. In 2004 expenses for distri-

bution of the shares in Ainax AB to Volvo's shareholders and repay-

ment of interest and residual taxes regarding a judgement in the

Administrative court of appeal are included. Previous years unreal-

ized gains (losses) pertaining to a hedge for a program of employee

stock options also are included.