Volvo 2004 Annual Report Download - page 13

Download and view the complete annual report

Please find page 13 of the 2004 Volvo annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

11

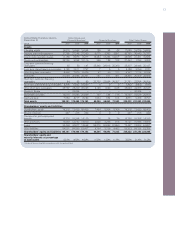

Consolidated income statements1

SEKM 2002 2003 2004

Net sales 177,080 174,768 201,496

Cost of sales (145,453) (141,256) (158,231)

Gross income 31,627 33,512 43,265

Research and development expenses (5,869) (6,829) (7,233)

Selling expenses (15,393) (15,891) (18,048)

Administrative expenses (5,464) (5,259) (5,321)

Other operating income and expenses (2,989) (540) (658)

Income from Financial Services 490 926 1,365

Income from investments in

associated companies 126 166 2

Income from other investments 309 (3,581) 828

Operating income 2,837 2,504 14,200

Interest income and similar credits 1,246 1,193 993

Interest expenses and similar charges (1,870) (1,984) (1,404)

Other financial income and expenses2(200) (56) (1,210)

Income after financial items 2,013 1,657 12,579

Income taxes (590) (1,334) (3,184)

Minority interests in net income (30) (25) (40)

Net income 1,393 298 9,355

Income per share, SEK 3.32 0.71 22.35

1 Financial Services reported in accordance with the equity method.

2 2004 includes a write-down relating to the holding in Henlys Group Plc of SEK 1,196 M.

Operating margin

%2002 2003 2004

Trucks 1.0 3.4 6.6

Buses (0.7) (3.0) 1.5

Construction Equipment 1.9 3.9 5.5

Volvo Penta 8.4 9.1 10.3

Volvo Aero 0.1 (0.5) 5.4

Volvo Group11.4 3.5 6.6

Volvo Group 1.6 1.4 7.0

1Excluding revaluation of shares in Scania AB and

Henlys Group Plc and dividend received from

Scania AB.

Change in operating income

SEK bn

Operating income 2003 2,5

Higher volumes and improvement

of gross margins 10,8

Higher income from Financial Services 0,4

Changes in currency exchange rates (1,8)

Higher capitalization of development costs 0,4

Higher research and development

expenditures (1,0)

Higher selling and administrative expenses (1,7)

Dividend from Scania 2003 (0,5)

Revaluation of shares in Scania

and Henlys Group 4,9

Other 0,2

Operating income 2004 14,2

reported operating income of SEK 1,572 M

compared with SEK 908 M in 2003. The

improved earnings were primarily related

to increased volumes due to recently

launched products, further improved market

shares and strengthened distribution, how-

ever strongly offset by negative currency

effects and increased raw material costs.

Operating income in 2004 for Volvo

Penta amounted to SEK 937 M (695).

The strong financial performance of Volvo

Penta mainly related to higher sales and

improved gross margins. In Volvo Aero,

operating income increased to SEK 377

M (loss:44). The improved earnings were

mainly a result of cost reduction and more

efficient use of production facilities.

Operating income within Financial

Services amounted to SEK 1,365 M

(926). Financial Services’ favorable trend

of progressively increasing earnings pri-

marily pertained to a continued improved

performance of the credit portfolio.

Operating margin for the Volvo Group

during 2004 was 7.0%, compared with

1.4% in 2003.

Impact of exchange rates on

operating income

The effect of changes in currency rates

on operating income in 2004 compared

with 2003 was negative by approximate-

ly SEK 1,800 M.

The Swedish krona strengthened dur-

ing 2004 against the US dollar, with nega-

tive effects on operating income.

Net interest expense

Net interest expense for the year amount-

ed to SEK 411 M (791). The improvement

of the net interest expense can be

explained by higher financial assets and

lower financial liabilities. This development

is explained by the sale of the Scania B

shares and the strong operating cash flow

during 2004.

Income taxes

During 2004, an income tax expense of

SEK 3,184 M was reported, compared

with SEK 1,334 M for the year-earlier

period. The income tax expense was

related to current and deferred tax

expenses.