Volvo 2004 Annual Report Download - page 83

Download and view the complete annual report

Please find page 83 of the 2004 Volvo annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

81

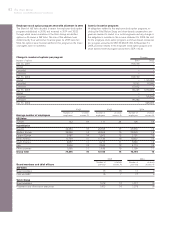

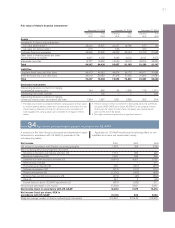

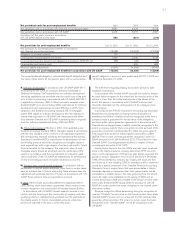

Pensions

Previous pension agreements for certain senior executives stipulated

that early retirement can be obtained from the age of 60. The

defined pension benefits are vested and earned gradually over the

years up to the employee’s retirement age and are fully earned at

age 60. During the period between ages of 60 and 65 the employee

receives a pension equal to 70% of the pensionable salary.

Agreements of retirement at an age of 60 are no longer signed,

and are instead replaced by a defined contribution plan without a

definite time for retirement. The premium constitutes 10% of the

pensionable salary.

The previous agreement, which entitled the employee 50% of the

pensionable salary after normal retirement age, has also been

replaced by a defined contribution plan. The premium constitutes of

30,000 SEK plus 20% of the pensionable salary over 30 income

base amounts.

Renegotiation, on a voluntary basis, is in progress with those

executives currently covered by the defined-benefit pension plan.

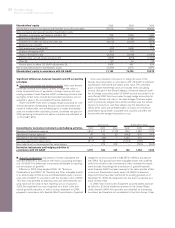

Incentive programs

Volvo currently has two different types of option programs for certain

senior executives outstanding, one call option program (expires dur-

ing 2005) and one program for employee stock options (expires

2006/2008). The employee stock options may only be exercised if

the holder is employed by Volvo at the end of the vesting period.

However, if the holder’s employment with Volvo is terminated for any

reason other than dismissal or the holder’s resignation, the options

may be exercised in part, in relation to how large part of the vesting

period the holder has been employed. If the holder retires during the

vesting period, he or she may exercise the full number of options.

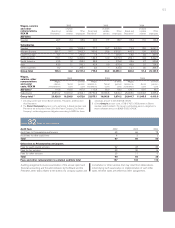

Stock-based incentive program

In 2004 the Annual General Meeting approved a stock based incen-

tive program for certain senior executives within the Volvo Group.

Allotment in the program will be executed in April 2005, and is

based on the fulfilment of certain financial goals for 2004. The

Annual General Meeting decided that Volvo's own shares may be

used for allotment in the stock-based incentive program.

The Board of directors has proposed to the Annual General

Meeting to approve a new stock-based incentive programme similar

to the program approved in 2004. Under the new program, a total of

maximum 185,000 (110,000; –) Volvo shares can be allotted to

approximately 165 (165; –) senior executives. The number of shares

to be allotted is proposed to depend upon the fulfilment of certain

financial goals for 2005. Assuming that the financial goals are ful-

filled in full and that the Volvo share price is SEK 300 at grant date,

Volvo’s cost for the program including social fees will be approxi-

mately SEK 70 M. The Board has furthermore proposed to the

Annual General Meeting that Volvo’s own shares may be used for

allotment in the stock-based incentive program.

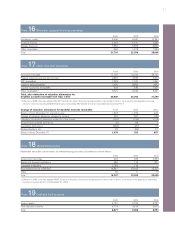

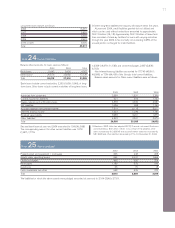

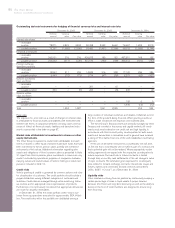

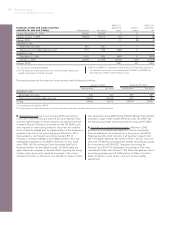

Programs from prior years

2003/2008

2000/2005, employee

call options stock options

Financial instruments number number

Board Chairman ––

CEO 8,821 50,000

GEC and other senior executives 93,009 895,000

Total 101,830 945,000

Total number of

outstanding options

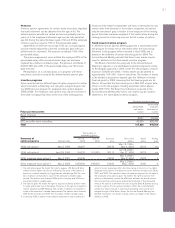

Summary of Dec 31, Dec 31, Excercise Term of the Value/ Vesting,

option programs Allotment date 2003 2004 price options option years

May 18, 1999–

1998, call options 1May 5, 1999 46,097 – 290.70 May 4, 2004 68.70 n/a

Apr 28, 2000–

1998, call options 2April 28, 2000 116,929 101,830 302.12 Apr 27, 2005 55.75 n/a

May 4, 2003–

2000, employee stock options 3May 4, 2001 96,245 – 159.00 May 3, 2004 22.00 2

May 2, 2006–

2002, employee stock options 3May 2, 2003 1,050,000 945,000 163.00 May1, 2008 32.00 3

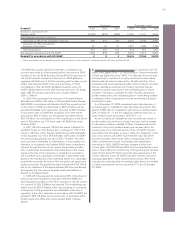

1The call options gave the holder the right to acquire 1.03 Series B Volvo

shares for each option held from a third party. The price of the options is

based on a market valuation by Trygg-Hansa Livförsäkrings AB. The num-

ber of options corresponds to a part of the executive’s variable salary

earned. The options were financed 50% by the Company and 50% from

the option-holder’s variable salary.

2The options gives the holder the right to acquire one Series B Volvo share

for each option held from a third party. The price of the options is based on

market valuation by UBS Warburg. The number of options corresponds to

apart of the executive’s variable salary earned. The options were financed

50% by the Company and 50% from the option holder’s variable salary.

3In January 2000, a decision was made to implement a new incentive pro-

gram for senior executives within the Volvo Group in the form of so-called

employee stock options. The decision covers allotment of options for 2000,

2001 and 2002. The executives have not made any payment for the options.

The employee stock options gives the holders the right to exercise their

options or alternatively receive the difference between the actual price at

that time and the exercise price determined at allotment. The theoretical

value of the options at allotment was set using the Black & Scholes pricing

model for options. For the options allotted in 2001, the committements

related to a future increase in share price (including social costs) were

hedged through a Total Return Swap. The Annual General Meeting has

decided that Volvo’s own shares may be used as a hedge for the options

allotted in 2003.