Volvo 2004 Annual Report Download - page 61

Download and view the complete annual report

Please find page 61 of the 2004 Volvo annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

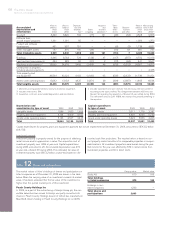

59

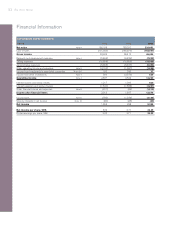

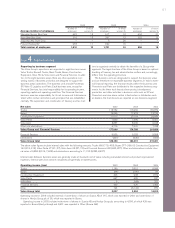

AB Volvo’s holding of shares in subsidiaries as of December 31,

2004 is shown on pages 103–105. Significant acquisitions, forma-

tions and divestments within the Group are listed below.

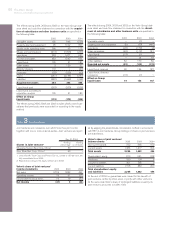

L.B. Smith (SABA Holding Inc.)

On May 2, 2003 Volvo Construction Equipment purchased the

assets amounting to USD 189 M associated with the Volvo distribu-

tion business of L.B. Smith Inc. in the US. No goodwill or real estate

was included in the deal. Because the intention was to spin off the

acquired operations, the L.B. Smith distribution business was not

consolidated in the Volvo Group’s financial statements during 2003.

The major part of the dealerships was divested during 2004. The

remaining part of the operation has been consolidated in the Volvo

Group’s financial statements during 2004.

Renault V.I. and Mack

During the fourth quarter 2004 AB Volvo and Renault signed a

settlement agreement regarding the disagreement the companies

have had since 2001 pertaining to Volvo’s acquisition of Renault

V.I./Mack and the value of certain of the acquired assets and certain

warranty claims. The settlement, EUR 108 M has reduced the

goodwill amount pertaining to the acquisition of Renault V.I.

Prévost Car Inc.

During the third quarter 2004 the North american bus manufacturer

Prévost Car Inc became a wholly owned subsidiary of Volvo Bus

Corporation. As part of the restructuring of the bus manufacturer

Henlys Group plc, Volvo Group reached an agreement to acquire the

remaining 50% of the shares. Prévost Car Inc. was a former 50/50

joint venture between Volvo and Henlys, reported in the Volvo Group

accounts in accordance with the proportionate consolidation method.

The purchase price was USD 83 M including two loans made avail-

Note 2Acquisitions and divestments of shares in subsidiaries

able to Prévost Car Inc. by Henlys. Prévost Car Inc. contain the

Prévost and Nova brands. Prévost manufactures coaches and bus

shells for luxury mobile homes. Nova Bus manufactures city buses

mainly for the Canadian market.

Axle manufacturing

During the third quarter 2004 Volvo and ArvinMeritor signed a

Strategic Alliance Agreement for the supply of axels. As a conse-

quence of the strategic alliance ArvinMeritor acquired the Volvo’s

axle plant and foundry in Lyon, France.

Bilia’s truck and construction equipment business

(“Kommersiella Fordon Europa AB”)

In the third quarter 2003, the acquisition of the truck and construc-

tion equipments operations of Bilia was completed. Volvo exchanged

41% of the shares in Bilia AB for 98% of the shares in Kommer-

siella Fordon Europa AB. Volvo has required compulsory acquisition

of the remaining shares. The acquired operations include dealers and

service suppliers for trucks and construction equipment in the Nordic

region and ten other european countries. The acquisition cost of the

shares was determined to SEK 0.9 billion. The goodwill arising from

this transaction amounted to SEK 0.6 billion.

Volvo Baumaschinen Deutschland GmbH

In February 2003 Volvo Construction Equipment sold the German

dealer Volvo Baumashinen Deutschland GmbH to the Swedish dealer

partner Swecon Anläggningsmaskiner AB.

Volvo Aero Services LP

During 2002 VNA Holding Inc acquired an additional 9% of the

shares in Volvo Aero Services LP (previously The AGES Group ALP).

Thereafter, Volvo owns 95% of Volvo Aero Services LP.

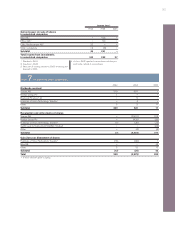

expected future price development, expected inventory turnover period

and expected variable and fixed selling expenses. If the residual value

risks are pertaining to products that are reported as tangible assets

in Volvo’s balance sheet, these risks are reflected by depreciation or

write-down of the carrying value of these assets. If the residual value

risks are pertaining to products which are not reported as assets in

Volvo’s balance sheet, these risks are reflected under the line item

provisions.

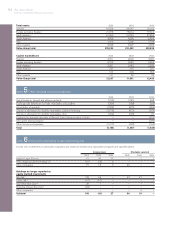

Deferred taxes, allocations and untaxed reserves

Tax legislation in Sweden and other countries sometimes contains

rules other than those identified with generally accepted accounting

principles, and which pertain to the timing of taxation and measure-

ment of certain commercial transactions. Deferred taxes are provided

for on differences which arise between the taxable value and report-

ed value of assets and liabilities (temporary differences) as well as on

tax-loss carryforwards. However, with regards to the valuation of

deferred tax assets, these items are recognized provided that it is

probable that the amounts can be utilized against future taxable

income.

Tax laws in Sweden and certain other countries allow companies

to defer payment of taxes through allocations to untaxed reserves.

These items are treated as temporary differences in the consolidated

balance sheet, that is, a split is made between deferred tax liability

and equity capital (restricted reserves). In the consolidated income

statement an allocation to, or withdrawal from, untaxed reserves is

divided between deferred taxes and net income for the year.