Volvo 2004 Annual Report Download - page 95

Download and view the complete annual report

Please find page 95 of the 2004 Volvo annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

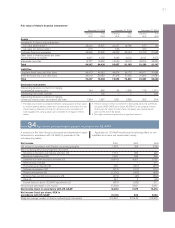

Parent Company AB Volvo 93

Board of Directors’ report in 2004

Corporate registration number 556012-5790.

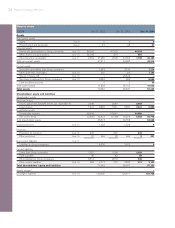

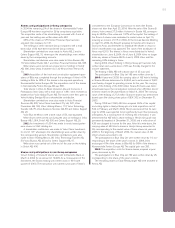

Volvo’s holding of Scania B shares was sold to Deutsche Bank on

March 4, 2004 for an amount of SEK 14.9 billion. As a consequence

of the divestment, the Scania holding was written down in the fourth

quarter of 2003. At the Annual General Meeting on April 16, the

Board’s proposal to transfer all A shares in Scania to Ainax and

thereafter to distribute 99% of the shares in Ainax to Volvos’ share-

holders was approved. The value of the distribution of Ainax was

SEK 6.3 bn. Further information regarding the holding in Scania is

provided in Note 10.

The Annual General Meeting also authorized the Board of

Directors to decide on the acquisition of own shares. During the year

145,000 Series A and 9,170,000 Series B shares have been repur-

chased with a total purchase value of SEK 2,532 M or 2% of the

registered shares. Continued repurchases may be carried out during

the period until the Annual General Meeting in 2005.

AB Volvo and Renault SA signed a settlement agreement regard-

ing the disagreement the companies have had since 2001 pertaining

to Volvo’s acquisition of Renault V.I. and Mack. According to this set-

tlement, Renault SA has transferred EUR 108 M to AB Volvo. The

amount has then been transferred to Volvo Holding France SA as

the owner of the shares in Renault V.I. and Mack.

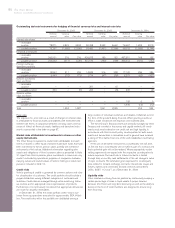

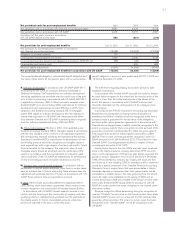

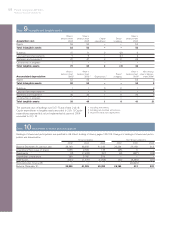

Income from investments in Group companies includes dividends

in the amount of 101 (4,368; 770), write-down of shares of 1,364

(1,579; 531) and group contributions and transfer pricing adjust-

ments received totaling a net amount of 5,673 (delivered 406; deliv-

ered 3,835). Income from other shares and participations includes a

revaluation of shares in Scania AB of 915 and a write-down of

shares in Henlys Group plc amounting to 95.

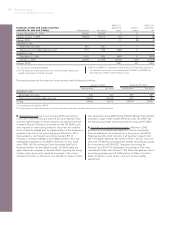

The carrying value of shares and participations in Group compa-

nies amounted to 40,393 (41,329; 38,950), of which 39,878

(40,060; 38,537) pertained to shares in wholly owned subsidiaries.

The corresponding shareholders’ equity in the subsidiaries (including

equity in untaxed reserves but excluding minority interests) amount-

ed to 55,831 (51,395; 49,657).

Shares and participations in non-Group companies included 0 (1;

628) in associated companies that are reported in accordance with

the equity method in the consolidated accounts. The portion of

shareholders’ equity in associated companies accruing to AB Volvo

totaled 90 (98; 861). Shares and participations in non-Group com-

panies included listed shares in Deutz AG with a carrying value of

670. The market value of this holding amounted to 169 at year-end.

No write-down has been made of the holding in Deutz since the fair

value of the investment is considered to be higher than the quoted

market price of this investment.

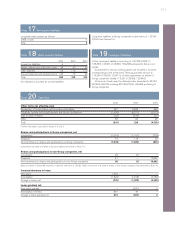

Financial net assets amounted to 5,149 (debt 3,606; assets

3,281).

AB Volvo’s risk capital (shareholders’ equity plus untaxed

reserves) amounted to 53,673 corresponding to 94% of total assets.

The comparable figure at year-end 2003 was 89%.

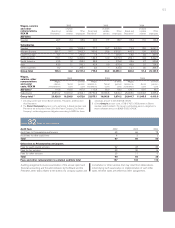

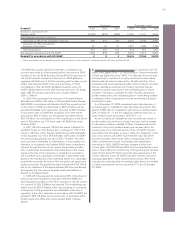

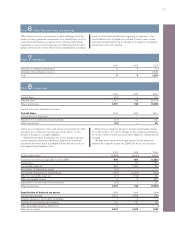

Income statements

SEK M 2002 2003 2004

Net sales 441 458 531

Cost of sales (441) (458) (531)

Gross income ———

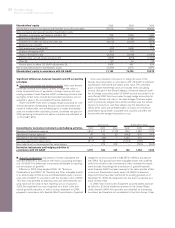

Administrative expenses Note 1 (560) (498) (471)

Other operating income and expenses 16 52 5

Income from investments in Group companies Note 2 (3,599) 1,812 4,409

Income from investments in associated companies Note 3 54 283 (1)

Income from other investments Note 4 326 (3,822) 851

Operating income (loss) (3,763) (2,173) 4,793

Interest income and similar credits Note 5 503 139 294

Interest expenses and similar charges Note 5 (261) (196) (238)

Other financial income and expenses Note 6 (34) (117) 45

Income (loss) after financial items (3,555) (2,347) 4,894

Allocations Note 7 —01,524

Income taxes Note 8 1,070 158 (1,320)

Net income (loss) (2,485) (2,189) 5,098

Parent Company AB Volvo