Volvo 2004 Annual Report Download - page 86

Download and view the complete annual report

Please find page 86 of the 2004 Volvo annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

84 The Volvo Group

Notes to consolidated financial statements

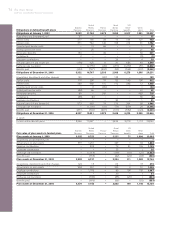

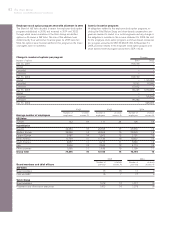

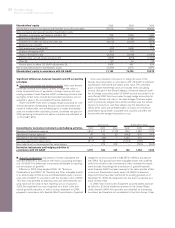

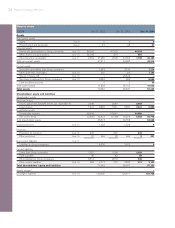

Currencies, average contract rates and maturities of outstanding forward contracts and option contracts as of

December 31, 2004 for hedging of commercial currency risks

Other Fair

Currencies currencies value 2

Net flow Net flow Net flow

Million USD GBP EUR Net SEK

Due date 2005 amount 1,058 168 441 4,005

rate17.42 13.44 9.15

Due date 2006 amount 131 – 75 (158)

rate17.86 – 9.23

Due date 2007 amount 78 – – (131)

rate17.39 – –

Total 1,267 168 516 3,716

of which, option contracts 267 – 187 (838)

Fair value of forward and

option contracts, SEK M 21,134 118 122 (3) 1,371

1Average forward contract rate.

2 Outstanding forward contracts valued at market rates.

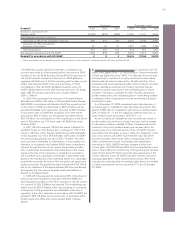

Net flows per currency 2004 Other

Currencies Currencies Total

Million USD GBP EUR Net SEK

Net flows 2004 amount 1,782 314 735

rate 37.3655 13.4515 9.1408

Net flows SEK M, 313,100 4,200 6,700 12,100 36,100

Hedged portion, % 459 54 60

3Average exchange rate during the financial year.

4Outstanding currency contracts, regarding commercial exposure due in 2005, percentage of net flows 2004.

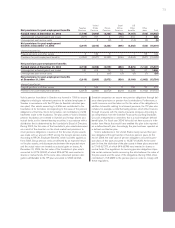

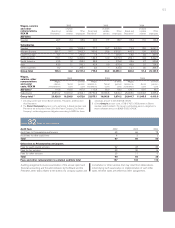

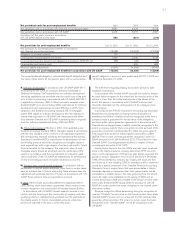

Note 33Financial risks and instruments

In its operations, the Volvo Group is exposed to various types of

financial risks. Groupwide policies, which are updated and decided

upon annually, form the basis of each Group company’s management

of these risks. The objectives of the Group’s policies for manage-

ment of financial risks are to optimize the Group’s capital costs by

utilizing economies of scale, to minimize negative effects on income

as result of changes in currency or interest rates, to optimize risk

exposure and to clarify areas of responsibilities within the Group’s

finance and treasury activities. Monitoring and control of that estab-

lished policies are adhered to is conducted continuously centrally

and at each group company. Most of the Volvo Group’s financial

transactions are carried out through Volvo’s inhouse bank, Volvo

Treasury, which conducts its operations within established risk man-

dates and limits. Credit risks are mainly managed by the different

business areas.

The nature of the various financial risks and objectives and policies

for the management of these risks are described in the sections

below. When applicable, information is also presented about the

carrying values and fair values of Volvo’s holdings of financial instru-

ments at the balance sheet date. Volvo’s accounting policies for

financial instruments are described in Note 1. In calculating the fair

values of financial instruments, Volvo has primarily used official rates

or prices quoted on the capital markets. In their absence, the valu-

ation has been made by discounting future cash flows at the market

interest rate for each maturity. In the case of instruments with matu-

rities shorter than three months, the carrying value has been

assumed to closely approximate the fair value. All reported fair

values are calculated values that will not necessarily be realized.

Currency risks

Currency risks in Volvo’s operations are related to changes in the

value of contracted and projected future flows of payments (com-

mercial currency risks), to changes in the value of loans and financial

investments (financial currency risks) and to changes in the value of

assets and liabilities in foreign subsidiaries (equity currency risks).

The objective of Volvo’s management of currency risks is to minimize

short-term negative impact on Volvo’s income and financial position

as a consequence of changes in currency exchange rates.

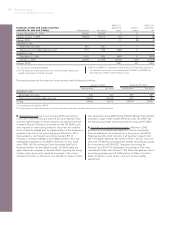

Commercial currency risks

Volvo uses forward contracts and currency options to hedge the

value of future payments in foreign currencies. According to the

Group’s currency policy, between 50% and 80% of the projected net

flow in each currency is hedged for the coming 6 months, 30% to

60% for months 7 through 12 and firm flows beyond 12 months

should normally be fully hedged. The notional amount of all forward

and option contracts outstanding as of December 31, 2004 was

SEK 19.9 billion (16.5; 20.9). The fair value of these contracts

amounted on the same date to 1,371. If assuming an instantaneous

10% strengthening of the SEK versus all other currencies, the fair

value would amount to 3,377. If assuming an instantaneous 10%

weakening of the SEK versus all other currencies the fair value

would be negative of 635. Actual foreign currency rates rarely move

instantaneously in the same direction and the actual impact of

exchange rate changes may thus differ from the above sensitivity

analyses. Further specifications of outstanding contracts are included

in the tables below.