Volvo 2004 Annual Report Download - page 103

Download and view the complete annual report

Please find page 103 of the 2004 Volvo annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

101

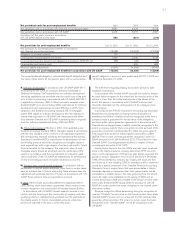

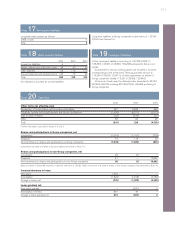

Note 19Contingent liabilities

Of the contingent liabilities amounting to 120,738 (128,411;

133,330), 120,591 (128,399; 133,298) pertained to Group com-

panies.

Guarantees for various credit programs are included in amounts

corresponding to the credit limits. These guarantees amount to

115,266 (123,503; 129,471), of which guarantees on behalf of

Group companies totaled 115,261 (123,498; 129,446).

At the end of each year, the utilized portion amounted to 53,142

(67,603; 69,672) including 53,130 (67,591; 69,640) pertaining to

Group companies.

Note 18 Other current liabilities

2002 2003 2004

Income tax liabilities 6 – –

Wages, salaries and withholding taxes 38 39 53

Other liabilities 93 110 170

Accrued expenses and prepaid income 146 70 90

Total 283 219 313

No collateral is provided for current liabilities.

Note 17 Non-current liabilities

Long-term debt matures as follows:

2008 or later 6

Total 6

Long-term liabilities to Group companies include loans of – (3,180;

3,204) from Renault V.I.

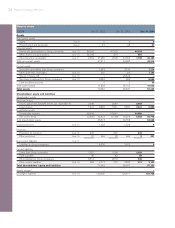

Note 20 Cash flow

2002 2003 2004

Other items not affecting cash

Revaluation of shareholdings and long-term receivables 557 6,555 545

Dividends, transfer pricing adjustments and Group contributions (1,408) (6,017) (5,273)

Gain on sale of shares (32) (310) (27)

Other 68 60 29

Total (815) 288 (4,726)

Further information is provided in Notes 2, 3 and 4.

Shares and participations in Group companies, net

Investments (1,616) (1,151) (703)

Disposals 72 118 33

Net investments in shares and participations in Group companies (1,544) (1,033) (670)

Investments and sales of shares in Group companies are shown in Note 10.

Shares and participations in non-Group companies, net

Investments 25 (1) –

Disposals 41 – 15,082

Net investments in shares and participations in non-Group companies 66 (1) 15,082

Sales of shares in Scania AB resulted in a positive cash flow of 15,029. Other investments and sales of shares in non-Group companies are presented in Note 10.

Increase/decrease in loans

New loans 1,054 – –

Amortization (1,829) (1,078) (3,180)

Change in loans, net (775) (1,078) (3,180)

Loans granted, net

New loans granted – (631) 0

Amortization received 891 40 –

Change in loans granted, net 891 (591) 0