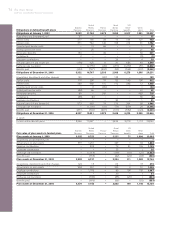

Volvo 2004 Annual Report Download - page 73

Download and view the complete annual report

Please find page 73 of the 2004 Volvo annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

71

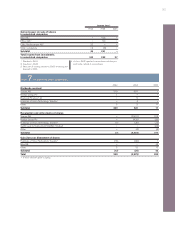

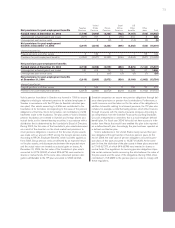

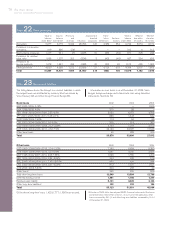

Note 19 Cash and bank accounts

2002 2003 2004

Cash in banks 4,157 5,782 5,787

Time deposits in banks 4,714 3,424 3,004

Total 8,871 9,206 8,791

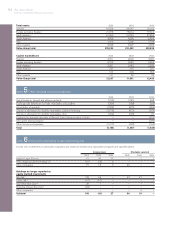

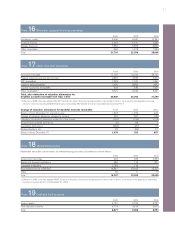

Note 18 Marketable securities

2002 2003 2004

Government securities 203 203 6,354

Banks and financial institutions 484 116 371

Corporate institutions 1,140 176 –

Real estate financial institutions 14,841 19,023 19,220

Other 39 11 10

Total 116,707 19,529 25,955

1 Effective in 2003, Volvo has adopted RR27, Financial instruments; Disclosure and presentation. See further in Note 1. As a result of the application, marketable

securities increased by 66 (–) at December 31, 2004.

Marketable securities consist mainly of interest-bearing securities, distributed as shown below:

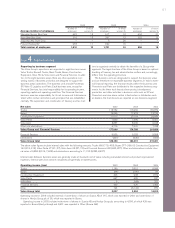

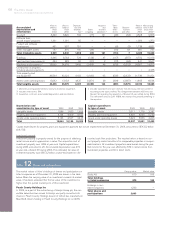

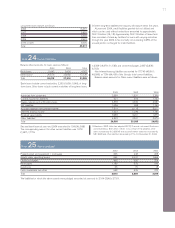

Note 16 Short-term customer-financing receivables

2002 2003 2004

Installment credits 8,306 8,947 10,382

Financial leasing 5,269 5,737 5,488

Retailer financing 7,356 6,555 8,850

Other receivables 860 1,315 1,286

Total 21,791 22,554 26,006

Note 17 Other short-term receivables

2002 2003 2004

Accounts receivable 17,155 16,924 20,137

Prepaid expenses and accrued income 12,846 3,036 3,203

VAT receivables 1,333 1,181 1,561

Loans to external parties 11,300 3,863 1,642

Current income tax receivables 634 530 1,426

Other receivables 13,727 3,232 3,321

Total, after deduction of valuation allowances for

doubtful accounts receivable 837 (932; 1,079) 26,995 28,766 31,290

1 Effective in 2003, Volvo has adopted RR 27, Financial instrument; Disclosure and presentation. See further in Note 1. As a result of the application, accrued

interest income increased by 818 (600) and loans increased by 292 (3,000) and other receivables decreased by 77 (–).

Change of valuation allowances for doubtful accounts receivable 2002 2003 2004

Balance sheet, December 31, preceding year 1,393 1,079 932

Change of valuation allowance charged to income 224 201 (30)

Utilization of valuation allowance related to actual losses (290) (239) (174)

Acquired and divested operations (5) 68 1

Translation differences (266) (81) 17

Reclassifications, etc. 23 (96) 91

Balance sheet, December 31 1,079 932 837