Volvo 2004 Annual Report Download - page 78

Download and view the complete annual report

Please find page 78 of the 2004 Volvo annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

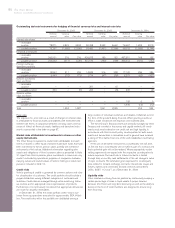

76 The Volvo Group

Notes to consolidated financial statements

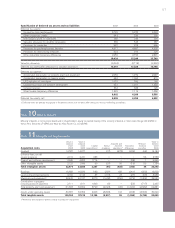

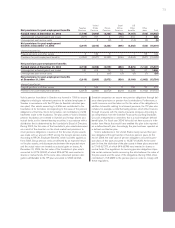

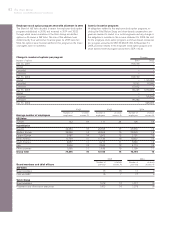

Note 22Other provisions

Value in Value in Provisions Acquired and Trans- Value in Whereof Whereof

balance balance and divested lation Reclassi- balance due within due after

sheet 2002 sheet 2003 reversals Utilization companies differences fications sheet 2004 12 months 12 months

Warranties 5,977 6,175 5,922 (5,659) 145 (195) 354 6,742 3,572 3,170

Provisions in insurance

operations 419 386 (74) ––––3120312

Restructuring measures 1,417 941 (7) (297) 19 (23) (62) 571 325 246

Provisions for residual

value risks 1,698 1,207 202 (336) 3 (43) (46) 987 354 633

Provisions for

service contracts 1,478 1,481 294 (288) 25 (20) 20 1,512 430 1,082

Other provisions 4,820 4,289 1,272 (1,580) 27 (172) 518 4,354 2,501 1,853

Total 15,809 14,479 7,609 (8,160) 219 (453) 784 14,478 7,182 7,296

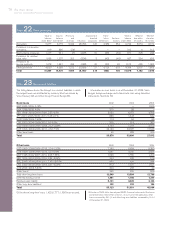

Other loans 2002 2003 2004

USD 1989–2004/2006–2015, 2.74–13.0% 7,280 5,634 5,360

EUR 1986–2004/2006–2013, 0.5–9.59% 1,841 3,245 2,596

GBP 1995-2004/2007–2010, 4.95-7.58% 1,028 1,786 1,269

SEK 1992–2004/2006–2016, 2.84–5.96% 224 349 519

BRL 2000–2004/2006–2011, 7.45–18.05% 435 626 944

CAD 2002–2004/2008–2010, 3.37–3.53% 972 1,527 1,557

AUD 2004–2008, 5.89% 400 208 49

Other loans1369 209 505

Total other long-term loans 12,549 13,584 12,799

Deferred leasing income 1,481 1,186 1,377

Residual value liability 5,121 3,249 3,122

Other long-term liabilities1102 192 154

Total 53,123 51,301 45,064

Of the above long-term loans, 1,422 (1,777; 1,358) was secured.

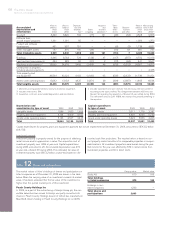

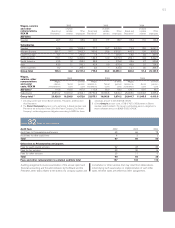

Note 23Non-current liabilities

Bond loans 2002 2003 2004

GBP 2004/2006, 5.18% — — 1,905

DKK 1998/2005, 4.0% 310 58 —

SEK 1998–2004/2006–2009, 2.35–6.0% 5,950 6,372 4,798

JPY 2001–2003/2006–2011, 0.45–2.1% 888 1,443 542

HKD 1999/2006, 7.99% 113 94 85

CZK 2001/2004–2006/2010, 2.6–6.5% 306 514 380

USD 1998–2004/2006–2008, 2.22–2.89% 2,154 1,274 2,150

EUR 1996–2004/2006–2011, 2.32–7.0% 24,120 23,047 17,546

Other bond loans 29 288 206

Total 33,870 33,090 27,612

The listing below shows the Group’s non-current liabilities in which

the largest loans are distributed by currency. Most are issued by

Volvo Treasury AB and Volvo Group Finance Europe BV.

Information on loan terms is as of December 31, 2004. Volvo

hedges foreign-exchange and interest-rate risks using derivative

instruments. See Note 33.

1 Effective in 2003, Volvo has adopted RR27, Financial instruments; Disclosure

and presentation. See further in Note 1. As a result of the application, other

loans increased by 241 (–) and other long-term liabilities increased by 15 (–)

at December 31, 2004.