Volvo 2004 Annual Report Download - page 108

Download and view the complete annual report

Please find page 108 of the 2004 Volvo annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

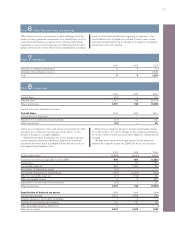

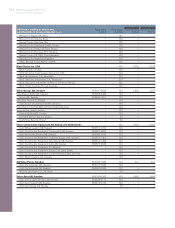

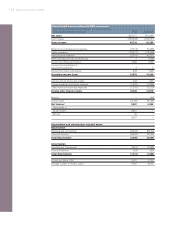

106 Proposed disposition of unappropriated earnings

Proposed disposition of

unappropriated earnings

Group

As shown in the consolidated balance sheet at December 31, 2004, unrestricted equity

amounted to SEK 56,034 M (57,002). Of this amount, SEK 0 M is estimated to be appropri-

ated to restricted equity.

AB Volvo SEK M

Retained earnings 38,680

Net income 2004 5,098

Total 43,778

The Board of Directors and the President propose that the above sum be disposed of as

follows:

SEK M

To the shareholders, a dividend of SEK 12.50 per share 15,126

To be carried forward 138,652

Total 43,778

1 As per February 9, 2005, the amount of outstanding shares amounted to 410,129,842. If further repur-

chase of own shares is carried out before the Annual General Meeting held April 12, 2005, the total divi-

dend according to the proposal of the Board of Directors will be reduced with an amount corresponding

to SEK 12.50 multiplied with the amount additional repurchased shares. Correspondingly the amount to

be carried forward will be increased with the equivalent amount.

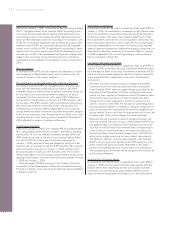

Göteborg, February 9, 2005

Finn Johnsson

Per-Olof Eriksson Patrick Faure

Haruko Fukuda Tom Hedelius Leif Johansson

Louis Schweitzer Ken Whipple

Martin Linder Olle Ludvigsson Johnny Rönnkvist

Our audit report was issued on February 9, 2005

PricewaterhouseCoopers AB

Olof Herolf Olov Karlsson

Authorized Public Accountant Authorized Public Accountant

Lead Partner Partner