Volvo 2004 Annual Report Download - page 70

Download and view the complete annual report

Please find page 70 of the 2004 Volvo annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

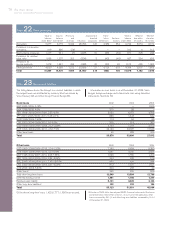

68 The Volvo Group

Notes to consolidated financial statements

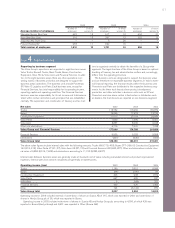

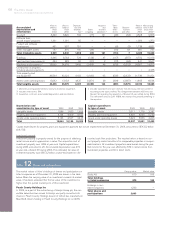

Note 12 Shares and participations

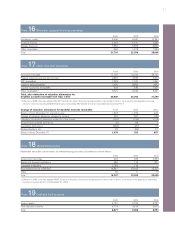

1 Machinery and equipment pertains mainly to production equipment.

2 Includes write-downs, 244.

3 Acquisition costs less accumulated depreciation and amortization.

4 Includes subsidiaries and joint ventures that previously were accounted for

according to the equity method. The disagreement between AB Volvo and

Renault SA regarding the acquisition of Renault V.I was settled during 2004.

The settlement amount, EUR 108 M, has reduced the goodwill pertaining to

the aquisition.

Capital expenditures for property, plant and equipment approved but not yet implemented at December 31, 2004, amounted to SEK 8.2 billion

(6.4; 5.5).

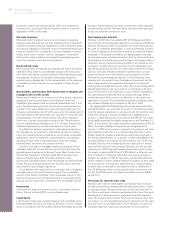

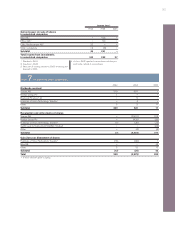

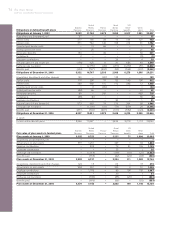

Value in Value in Deprecia- Acquired Trans- Value in Net carrying

Accumulated balance balance tion and and lation Reclassi- balance value in bal-

depreciation and sheet sheet amortiza- Sales/ divested differ- fications sheet ance sheet

amortization 2002 2003 tion 2scrapping operations 4ences and other 2004 2004 3

Goodwill 3,490 3,826 702 (17) 161 (90) (54) 4,528 9,656

Entrance fees,

aircraft engine programs 1,201 1,291 95 ––––1,386 1,372

Product and software

development 491 997 751 – – (8) (2) 1,738 4,831

Other intangible assets 747 816 150 (26) – (16) 63 987 747

Total intangible assets 5,929 6,930 1,698 (43) 161 (114) 7 8,639 16,606

Buildings 6,445 6,763 724 (128) 47 (117) (557) 6,732 10,196

Land and land improvements 454 483 50 (21) 2 (10) (63) 441 3,547

Machinery and equipment 123,695 24,976 3,408 (1,493) 46 (378) (2,002) 24,557 14,973

Construction in progress,

including advance payments ––––––––2,435

Total property, plant

and equipment 30,594 32,222 4,182 (1,642) 95 (505) (2,622) 31,730 31,151

Assets under operating leases 15,842 13,153 4,425 (1,851) 29 (334) (3,957) 11,465 19,534

Total tangible assets 46,436 45,375 8,607 (3,493) 124 (839) (6,579) 43,195 50,685

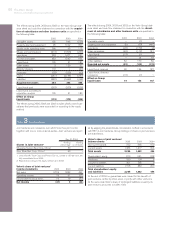

Depreciation and

amortization by type of asset 2002 2003 2004

Intangible assets 1,586 1,633 1,698

Property, plant and equipment 4,134 4,009 4,182

Assets under operating leases 5,124 4,527 4,425

Total 10,844 10,169 10,305

Capital expenditures

by type of asset 2002 2003 2004

Intangible assets 2,011 1,176 2,287

Property, plant and equipment 4,802 4,939 5,790

Assets under operating leases 5,424 5,566 4,406

Total 12,237 11,681 12,483

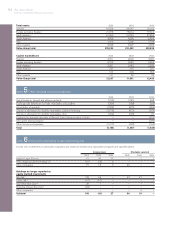

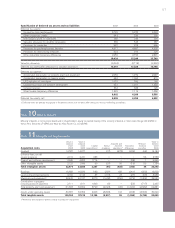

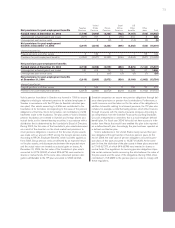

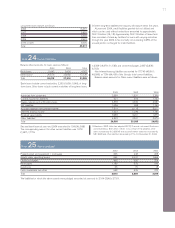

Investment property

Investment property is property owned for the purpose of obtaining

rental income and/or appreciation in value. The acquisition cost of

investment property was 1,859 at year-end. Capital expenditures

during 2004 amounted to 20. Accumulated depreciation was 472

at year-end, whereof 68 during 2004. The estimated fair value of

investment property was SEK 2.2 billion at year-end, based on dis-

counted cash flow projections. The required return is based on cur-

rent property market conditions for comparable properties in compar-

able locations. All investment properties were leased during the year.

Net income for the year was affected by 332 in rental income from

investment properties and 66 in direct costs.

The market values of Volvo’s holdings of shares and participations in

listed companies as of December 31, 2004 are shown in the table

below. When the carrying value of an investment exceeds its market

value, it has been assessed that the fair value of the investment is

higher than the quoted market price of this investment.

Peach County Holdings Inc

In 2004, as a part of the restructuring of Henlys Group plc, the con-

vertible debenture loan issued to Henlys was partly converted into

shares in Peach County Holdings (owner of school bus manufacturer

Blue Bird). Volvo’s holding in Peach County Holdings Inc is 42,5%.

Carrying value Market value

Deutz AG 670 169

Total holdings

in listed companies 670 169

Holdings in non-

listed companies 1,333 –

Total shares and

participations 2,003