Volvo 2004 Annual Report Download - page 93

Download and view the complete annual report

Please find page 93 of the 2004 Volvo annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

91

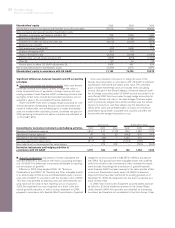

F. Software development. In accordance with US GAAP (SOP 98–1

“Accounting for the Costs of Computer Software Developed or

Obtained for Internal Use”) expenditures for software development

should be capitalized and amortized over the useful lives of the proj-

ects. In Volvo’s accounting in accordance with US GAAP, SOP 98–1

is applied as of January 1999. In Volvo’s accounts prepared under

Swedish GAAP up to and including 2000, expenditures for software

development were expensed as incurred. Effective in 2001, Volvo

adopted a new Swedish accounting standard, RR 15 Intangible

assets. With regard to software development, the new standard is

substantially equivalent to US GAAP and consequently the differ-

ence between Swedish and US GAAP is pertaining only to expendi-

tures for software development during 1999 and 2000.

G. Product development. Effective in 2001, Volvo adopted a new

Swedish accounting standard, RR15 Intangible assets. In accordance

with the new standard, which conforms in all significant respects to

the corresponding standard issued by the International Accounting

Standards Committee (IASC), expenditures for development of new

and existing products should be recognized as intangible assets if

such expenditures with a high degree of certainty will result in future

financial benefits for the company. The acquisition value of such

intangible assets should be amortized over the useful lives of the

assets. In accordance with the new standard, no retroactive appli-

cation is allowed. Under US GAAP, all expenditures for development

of new and existing products should be expensed as incurred.

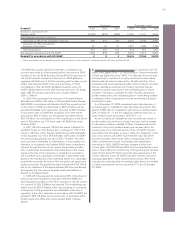

H. Entrance fees, aircraft engine programs. In connection with its

participation in aircraft engine programs, Volvo Aero in certain cases

pays an entrance fee. In Volvo’s accounting these entrance fees are

capitalized and amortized over 5 to 10 years. In accordance with US

GAAP, these entrance fees are expensed as incurred.

I. Other. Other include accounting differences regarding interest

costs, leasing, stock option plans, guarantees, Alecta surplus funds,

revenue recognition and consolidation of Variable Interest Entities.

In accordance with US GAAP, interest expense incurred in con-

nection with the financing of the construction of property and other

qualifying assets is capitalized and amortized over the useful life of

the related assets. In Volvo’s consolidated accounts, interest ex-

penses are reported in the year in which they arise.

The differences regarding leasing transactions pertain to sale-

leaseback transactions.

In accordance with Swedish GAAP, accruals are made for employ-

ee stock option programs to the extent that the exercise price of the

options is lower than the actual market price of the shares at the

end of the period. In accordance with US GAAP, such accruals

should be allocated over the vesting period of the employee stock

option program.

In accordance with FIN 45 “Guarantor’s Accounting and Disclosure

Requirement for Guarantees, Including indirect Guarantees of

indebtness for Others”, a liability should be recognized at the time a

company issues a guarantee for the fair value of the obligations

assumed under certain guarantee agreements. In accordance with

Swedish accounting principles, a liability should be recognized to the

extent a company expects that a loss will be incurred as result of the

guarantee commitment. At December 31, 2004, the gross value of

credit guarantees issued for external parties amounted to 2,869

(3,879). The fair value of these guarantees recognized under US

GAAP amounted to 92 (244), whereof 82 (217) provided for under

Swedish GAAP. Counterguarantees received in respect of these

commitments amounted to 56 (167).

Alecta surplus funds. In the mid-1990s and later years surpluses

arose in the Alecta insurance company (previously SPP) since the

return on the management of ITP pension plan assets exceeded the

growth in pension obligations. As a result of decisions in December

1998, Alecta distributed, company by company, the surpluses that

had arisen up to and including 1998. In accordance with a statement

issued by a special committee of the Swedish Financial Accounting

Standards Council, surplus funds that were accumulated in Alecta

should be reported in companies when their present value can be

calculated in a reliable manner. The rules governing how the refund

was to be made were established in the spring of 2000 and an

income amounting to 683 was included in the Group’s income state-

ment under Swedish GAAP during 2000. In accordance with US

GAAP, the surplus funds have been recognized in the income state-

ment when settled.

Revenue recognition. When determining timing for recognition of

revenue, US GAAP focuses more on the formal contract terms while

Swedish GAAP focuses more on actual risk that the residual value

guarantee will be exercised. This means in certain cases that sales

recognised under Swedish GAAP cannot be recognised under

US GAAP.

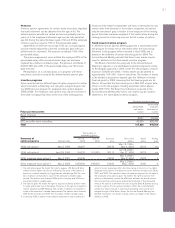

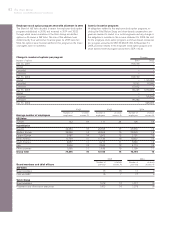

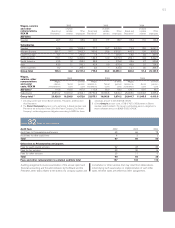

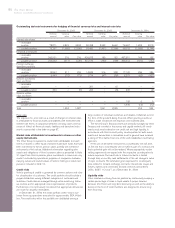

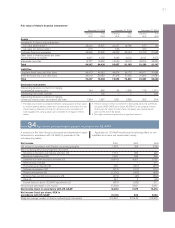

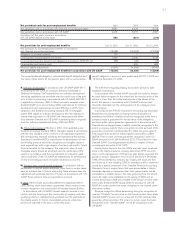

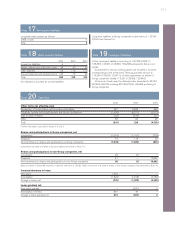

Net periodical costs for post-employment benefits 2002 2003 2004

Net periodical costs in accordance with Swedish accounting principles 5,087 4,424 4,414

Net periodical costs in accordance with US GAAP 4,418 5,075 4,687

Adjustment of this year’s income in accordance

with US GAAP, before income taxes 669 (651) (273)

Net provisions for post-employment benefits Dec 31, 2002 Dec 31, 2003 Dec 31, 2004

Net provisions for post-employment benefits in accordance

with Swedish accounting principles (15,528) (15,094) (13,784)

Difference in actuarial methods 170 – –

Unrecognized actuarial (gains) and losses 1,350 5,296 4,733

Unrecognized transition (assets) and obligations according to SFAS 87, net (33) (29) (15)

Unrecognized past service costs – 659 602

Minimum liability adjustments (1,507) (4,268) (4,542)

Net provisions for post-employment benefits in accordance with US GAAP (15,548) (13,436) (13,006)

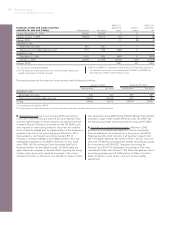

The projected benefit obligation, accumulated benefit obligation and

fair value of plan assets for the pension plans with an accumulated

benefit obligation in excess of plan assets were 20,157; 19,472 and

14,722 at December 31, 2004.