Volvo 2004 Annual Report Download - page 101

Download and view the complete annual report

Please find page 101 of the 2004 Volvo annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

99

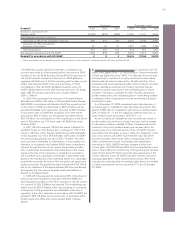

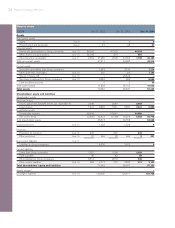

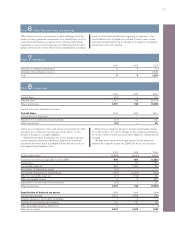

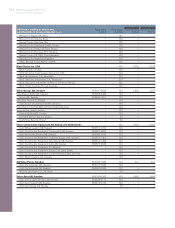

Shares and participations in Group companies

In 2004 the remaining 2% of the shares in Kommersiella Fordon

Europa AB has been acquired for 28 by compulsory acquisition.

The acquisition costs of the stockholding increased with 4 and at

year-end the holding was written-down with 643.

25% of the shares in VFS Servizi Financiari Spa has been

acquired inter-company for 101.

The holdings in seven dormant Group companies with a total

book value of 82 have been transferred Group internal.

Shareholder contributions were made to Alviva AB, 2 and to

Celero Support AB, 10, whereupon the shareholdings were written

down by the corresponding amounts.

Shareholder contributions were also made to Volvo Bussar AB,

18, Volvo Global Trucks AB, 1 and Volvo Financial Services AB, 345.

Write-downs were carried out at year-end on holdings in Sotrof

AB, 600, Volvo China Investment Co Ltd, 99 and Volvo Penta UK,

10.

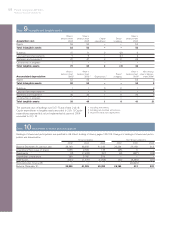

2003: Acquisition of the truck and construction equipment oper-

ations of Bilia was completed through the exchange of Volvo’s 41%

holding in Bilia for 98% of the shares in the acquired operations,

Kommersiella Fordon Europa AB. The acquisition cost of the shares

in Kommersiella Fordon Europa AB was 855.

Total shares in Volvo do Brasil Veiculos Ltda and Comercio é

Participacao Volvo Ltda, with a total value of 1,941 were received as

dividend from Volvo Global Trucks AB. The shares were then given to

Volvo Holding Sverige AB as a shareholder contribution.

Shareholder contributions were also made to Volvo Financial

Services AB, 400, Volvo China Investment Pty Ltd, 347, Volvo

Powertrain AB, 182, Volvo Holding Mexico, 110, Volvo Technology

Transfer AB, 75, Volvo Business Services AB, 85 and Celero Support

AB, 20.

Volvo Bus de Mexico with a book value of 50, was liquidated.

Write-downs were carried out during the year on holdings in Volvo

Bussar AB, 1,054, Sotrof AB, 500 and Celero Support AB, 20.

2002: An investment of 1,054 was made in newly issued prefer-

ence shares in VNA Holding Inc.

A shareholder contribution was made to Volvo China Investment

Co Ltd of 107, whereupon the shareholdings were written down by

the corresponding amount. Shareholder contributions were also

made to Volvo Holding Mexico, 89, Volvo Technology Transfer AB,

50, Volvo Bussar AB, 28 and to Celero Support AB, 15.

Write-down was carried out at the end of the year on the holding

in Sotrof AB, 400.

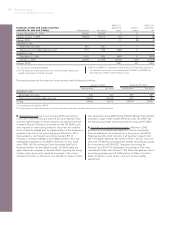

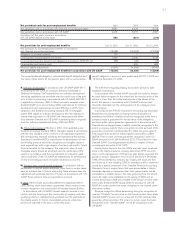

Shares and participations in non-Group companies

Volvo’s holding of Scania B shares was sold to Deutsche Bank on

March 4, 2004 for an amount of 14,905. As a consequence of the

divestment, the Scania holding was written down in the fourth

quarter of 2003. The transaction was carried out as part of Volvo’s

commitment to the European Commission to divest the Scania

shares not later than April 23, 2004. After the sale of the Scania B

shares, Volvo owned 27.3 million A shares in Scania AB, correspon-

ding to 24.8% of the votes and 13.7% of the capital. The holding of

the Scania A shares was revaluated to market value on April 15,

meaning an income of 915 in 2004. At the Annual General Meeting

on April 16, 2004, the Board’s proposal to transfer all A shares in

Scania to Ainax and thereafter to distribute the shares in Ainax to

Volvo’s shareholders was approved. The value of the distribution of

Ainax was 6,310. The shares in Ainax were distributed to Volvo's

shareholders on June 8, 2004. As of June 8, 2004 Volvo no longer

holds any shares in Scania AB. On June 9, 2004 Volvo sold the

remaining 0.9% holding in Ainax.

During 2004 Volvo’s holding in Henlys Group plc has been fully

written down and a write-down of 95 was thereby charged to the

income statement.

The holding in Bilia AB with a book value of 25 was sold.

The participations in Blue Chip Jet HB were written down by 1.

2003: At year-end 2003, the carrying value of AB Volvo’s holding

in Scania AB was determined to 20,424, and a write-down of 3,901

was thereby charged to operating income for the year. The carrying

value of the holding of the 63.8 million Scania B shares was deter-

mined based upon the consideration received when AB Volvo divest-

ed those shares to Deutsche Bank on March 4, 2004. The carrying

value of the holding of 27.3 million Scania A shares was determined

based upon the closing share price of SEK 202 on December 31,

2003.

During 1998 and 1999, AB Volvo acquired 9.9% of the capital

and voting rights in Henlys Group plc at a total acquisition cost of

524. In February and March 2004, Henlys announced that its earn-

ings for 2004 was expected to be significantly lower than previously

anticipated. As a consequence of receiving this information, it was

determined that AB Volvo’s share holding in Henlys Group plc was

permanently impaired at December 31, 2003, and a write-down of

429 was charged to income for the year. After this write-down, the

carrying value of AB Volvo’s shares in Henlys Group amounted to

95, corresponding to the market value of these shares at year-end

2003. In the beginning of March 2004, the market value of AB

Volvo’s shares amounted to 24.

The participations in Blue Chip Jet were written down by 14, cor-

responding to the share of the year’s income. In 2003, Volvo

exchanged 41% of the shares in Bilia AB for 98% of the shares in

Kommersiella Fordon Europa AB. The capital gain was 250.

2002: The acquisition costs for Scania shares, acquired in prior

years, decreased by 25.

The participations in Blue Chip Jet HB were written down by 25,

corresponding to the share of the year’s income.

The remaining shares in Eddo Restauranger AB were divested to

Amica AB.