Volvo 2004 Annual Report Download - page 58

Download and view the complete annual report

Please find page 58 of the 2004 Volvo annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

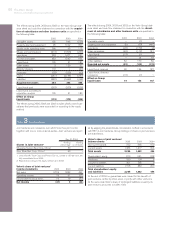

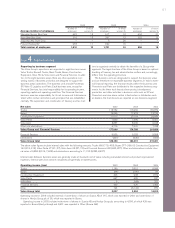

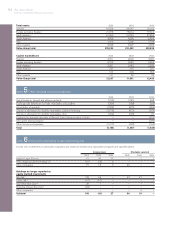

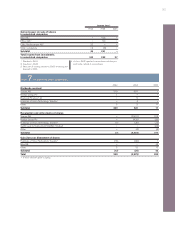

56 The Volvo Group

Notes to consolidated financial statements

The consolidated financial statement have been prepared in

accordance with the principles set forth in the Recommendation of

the Swedish Financial Accounting Standards Council, RR 1:00,

Consolidated Financial Statements and Business Combinations.

All business combinations are accounted for in accordance with

the purchase method.

Companies that have been divested are included in the consoli-

dated financial statements up to and including the date of divest-

ment. Companies acquired during the year are consolidated as of the

date of acquisition.

Joint ventures are preferably reported by use of the proportionate

method of consolidation. A few joint ventures are reported by use of

the equity method due to practical reasons.

Holdings in associated companies are reported in accordance

with the equity method. The Group’s share of reported income after

financial items in such companies, adjusted for minority interests, is

included in the consolidated income statement in Income from

investments in associated companies, reduced in appropriate cases

by amortization of goodwill. The Group’s share of reported taxes in

associated companies, is included in Group income tax expense.

For practical reasons, most of the associated companies are

included in the consolidated accounts with a certain time lag, nor-

mally one quarter. Dividends from associated companies are not

included in consolidated income. In the consolidated balance sheet,

the book value of shareholdings in associated companies is affected

by Volvo’s share of the company’s net income, reduced by the amor-

tization of goodwill and by the amount of dividends received.

Accounting for hedges

Loans and other financial instruments used to hedge an underlying

position are reported as hedges. In order to apply hedge accounting,

the following criteria must be met: the position being hedged is iden-

tified and exposed to exchange-rate or interest-rate movements, the

purpose of the loan/instrument is to serve as a hedge and the hedg-

ing effectively protects the underlying position against changes in

the market rates. Financial instruments used for the purpose of

hedging future currency flows are accounted for as hedges if the

currency flows are considered probable to occur.

Foreign currencies

In preparing the consolidated financial statements, all items in the

income statements of foreign subsidiaries and joint ventures (except

subsidiaries in highly inflationary economies) are translated to

Swedish kronor at the average exchange rates during the year (aver-

age rate). All balance sheet items except net income are translated

at exchange rates at the respective year-ends (year-end rate). The

differences in consolidated shareholders’ equity arising as a result of

variations between year-end exchange rates are charged or credited

directly to shareholders’ equity and classified as restricted or unre-

stricted reserves. The difference arising in the consolidated balance

sheet as a result of the translation of net income, in the income

statements, in foreign subsidiaries’ to Swedish kronor at average

rates, and in the balance sheets at year-end rate, is charged or cred-

ited to unrestricted reserves. Movements in exchange rates change

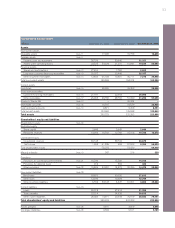

General information

Amounts in SEK M unless otherwise specified. The amounts within parentheses refer to the two preceding years; the first figure is for 2003

and the second for 2002.

Note 1Accounting principles

The consolidated financial statements for AB Volvo (the Parent

Company) and its subsidiaries have been prepared in accordance

with generally accepted accounting principles in Sweden (Swedish

GAAP). Accounting standards and interpretations issued by the

Swedish Financial Accounting Standards Council have thereby been

applied. Swedish GAAP differs in significant respects from US

GAAP, see further in Note 34.

In the preparation of these financial statements, the company

management has made certain estimates and assumptions that

affect the value of assets and liabilities as well as contingent liabil-

ities at the balance sheet date. Reported amounts for income and

expenses in the reporting period are also affected. The actual future

outcome of certain transactions may differ from the estimated out-

come when these financial statements were issued. Any such differ-

ences will affect the financial statements for future fiscal periods.

Changes of accounting principles

Effective in 2005 Volvo will adopt International Financial Reporting

Standards (IFRS) in its financial reporting. The transition from

Swedish GAAP to IFRS is being made according to a regulation

applicable to all listed companies within the European Union as of

2005. A more detailed overview of the transition to IFRS is presented

on pages 108–115.

No changes of accounting principles have been made during

2004.

As of 2003, Volvo has adopted RR 29 Employee Benefits in its

financial reporting. RR 29 Employee Benefits conforms in all signifi-

cant respects with IAS 19 Employee Benefits issued earlier by the

International Accounting Standards Committee (IASC). Effective in

2003, Volvo has adopted RR 27 Financial Instruments: Disclosure

and Presentation, which conforms to a large extent with IAS 32

issued by the IASC. The adoption of RR 27 has affected the balance

sheet presentation of certain derivative instruments that are used to

manage financial risks related to financial assets and liabilities.

As of 2003, Volvo has also adopted RR 22 Presentation of

Financial Statements, RR 24 Investment Property, RR 25 Segment

Reporting – Sectors and Geographical Areas, RR 26 Events after

the Balance Sheet Date and RR 28 Government Grants. Certain

changes have been made in the structure and content of the finan-

cial information as from 2003, as a result of these new standards.

However, the standards listed above have not resulted in any

changes of the measurement of the Group’s financial performance

or position.

Consolidated financial statements

The consolidated financial statements comprise the Parent Company,

subsidiaries, joint ventures and associated companies. Subsidiaries

are defined as companies in which Volvo holds more than 50% of

the voting rights or in which Volvo otherwise has a controlling influ-

ence. However, subsidiaries in which Volvo’s holding is temporary are

not consolidated. Joint ventures are companies over which Volvo has

joint control together with one or more external parties. Associated

companies are companies in which Volvo has a significant influence,

which is normally when Volvo’s holding equals to at least 20% but

less than 50% of the voting rights.