Volvo 2004 Annual Report Download - page 92

Download and view the complete annual report

Please find page 92 of the 2004 Volvo annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

90 The Volvo Group

Notes to consolidated financial statements

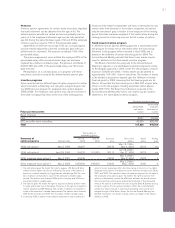

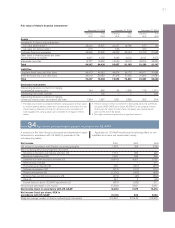

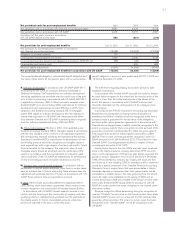

January 1, 2004 December 31, 2004

Carrying value 1Fair value 2Carrying value 1Fair value 2

Available for sale

Marketable securities 446 446 387 387

Shares and convertible debenture loan 22,963 20,648 677 183

Trading 19,083 19,072 25,400 25,400

1In accordance with Swedish GAAP.

2 For the purpose of these disclosures, fair values have been based upon quoted market prices for listed securities.

The carrying values and fair values for these securities were distributed as follows:

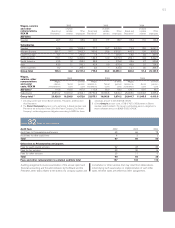

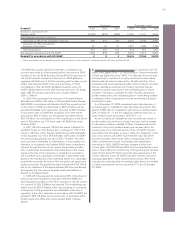

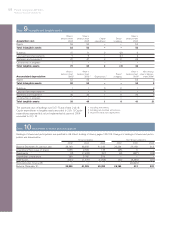

D. Restructuring costs. Up to and including 2000, restructuring

costs were in the Volvo Group’s year-end accounts reported in the

year that implementation of these measures was approved by each

company’s Board of Directors. In accordance with US GAAP, costs

were reported for restructuring measures only under the condition

that a sufficiently detailed plan for implementation of the measures is

prepared at the end of the accounting period. Effective in 2001,

Volvo adopted a new Swedish accounting standard, RR 16

Provisions, contingent liabilities and contingent assets, which was

substantially equivalent to US GAAP at that time. As from 2003,

when SFAS 146 “Accounting for Costs Associated with Exit or

Disposal Activities” became effective under US GAAP, there are

again differences compared to Swedish GAAP regarding the timing

of when restructuring costs should be recognized in the income

statement. However, no differences was identified in relation to busi-

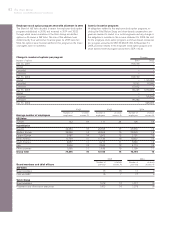

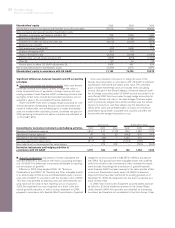

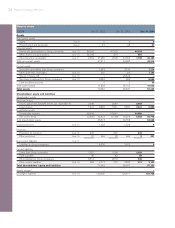

SFAS 115- SFAS 115-

Summary of debt and equity securities adjustment, Income adjustment,

available for sale and trading Carrying value 1Fair value 2gross taxes net

Trading, December 31, 2004 25,400 25,400 0 0 0

Trading, January 1, 2004 19,083 19,072 (11) 3 (8)

Change 2004 11 (3) 8

Available for sale

Marketable securities 387 387 – – –

Shares and convertible debenture loan 677 183 (494) 0 0

Available for sale

December 31, 2004 1,057 563 (494) 0 (494)

January 1, 2004 23,409 21,094 (2,315) (29) (2,344)

Change 200431,821 29 1,850

ness transactions during 2003. During 2004 the Renault Truck industrial

relocation in Spain will be treated differently under US-GAAP and

the restructuring charge will be accounted for during 2004–2006.

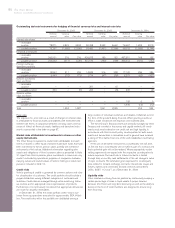

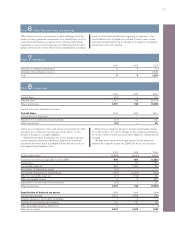

E. Provisions for post-employment benefits. Effective in 2003,

provisions for post-employment benefits in Volvo’s consolidated

financial statements are accounted for in accordance with RR 29

Employee benefits, which conforms in all significant respects with

IAS 19 Employee Benefits. See further in Note 1 and 21. In accord-

ance with US GAAP, post-employment benefits should be accounted

for in accordance with SFAS 87, “Employers Accounting for

Pensions” and SFAS 106, “Employers’ Accounting for Post-retire-

ment Benefits Other than Pensions”. The differences between Volvo’s

accounting principles and US GAAP pertain to different transition

dates, recognition of past service costs and minimum liability

adjustments.

1In accordance with Swedish GAAP.

2 For the purpose of these disclosures, fair values have been based upon

quoted market prices for listed securities.

3 Of the net SFAS 115 adjustment during 2004, 5,157 has been reported as

an increase of net income in accordance with US GAAP and (3,299) has

been reported in Other comprehensive income.