Volvo 2004 Annual Report Download - page 90

Download and view the complete annual report

Please find page 90 of the 2004 Volvo annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

88 The Volvo Group

Notes to consolidated financial statements

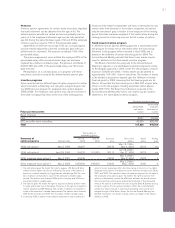

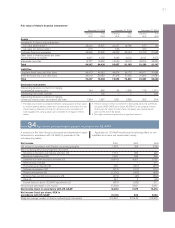

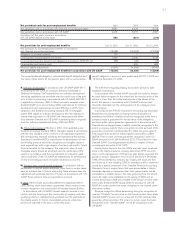

Shareholders’ equity 2002 2003 2004

Shareholders’ equity in accordance with Swedish accounting principles 78,278 72,420 69,409

Items increasing (decreasing) reported shareholders’ equity

Derivative instruments and hedging activities (A) 188 1,054 1,300

Business combinations (B) 5,219 5,788 6,597

Investments in debt and equity securities (C) (9,813) (2,326) (494)

Restructuring costs (D) – – 311

Post-employment benefits (E) (20) 1,658 778

Software development (F) 330 119 –

Product development (G) (3,263) (3,568) (4,368)

Entrance fees, aircraft engine programs (H) (855) (874) (1,320)

Other (I) 52 52 33

Income taxes on above US GAAP adjustments (J) 1,066 467 833

Net increase (decrease) in shareholders’ equity (7,096) 2,370 3,670

Shareholders’ equity in accordance with US GAAP 71,182 74,790 73,079

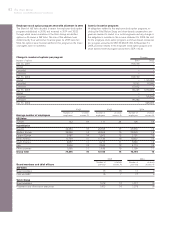

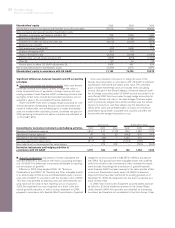

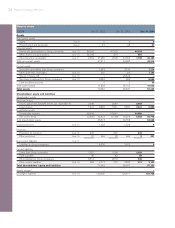

Net income Shareholders’ equity

Accounting for derivative instruments and hedging activities 2002 2003 2004 2002 2003 2004

Derivatives Commercial exposure 1,814 417 (117) 870 1,287 1,170

Derivatives Financial exposure 43 92 23 (642) 315 672

Derivatives in fair value hedges 426 (36) – 1,234 315 –

Fair value adjustment hedged items (511) 36 – (1,274) (138) –

Basis adjustment on derecognised fair value hedges – 373 322 – (725) (542)

Derivative instruments and hedging activities in

accordance with US GAAP 1,772 882 228 188 1,054 1,300

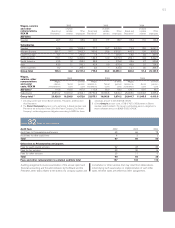

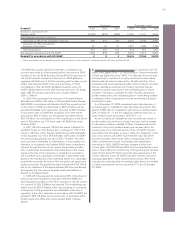

B. Business combinations. Acquisitions of certain subsidiaries are

reported differently in accordance with Volvo’s accounting principles

and US GAAP. The differences are primarily attributable to reporting

and amortization of goodwill.

Effective in 2002, Volvo adopted SFAS 141 “Business

Combinations” and SFAS 142 “Goodwill and Other Intangible Assets”

in its determination of Net income and Shareholders’ equity in accord-

ance with US GAAP. In accordance with the transition rules of SFAS

142, Volvo has identified its reporting units and determined the car-

rying value and fair value of each reporting unit as of January 1,

2002. No impairment loss was recognized as a result of the tran-

sitional goodwill evaluation. In Volvo’s income statement for 2004

prepared in accordance with Swedish GAAP, amortization of goodwill

charged to income amounted to 684 (873; 1,094). In accordance

with SFAS 142, goodwill and other intangible assets with indefinite

useful lives should not be amortized but rather evaluated for impair-

ment annually. Accordingly, the amortization of goodwill reported

under Swedish GAAP has been reversed in the determination of Net

income and Shareholders’ equity under US GAAP. Furthermore,

impairment tests have been performed for existing goodwill as of

December 31, 2004. No impairment loss has been recognized as a

result of these tests.

In 2003, Volvo Construction Equipment acquired assets associat-

ed with the L.B. Smith distribution business in the United States.

Under Swedish GAAP, this operation was classified as a temporary

investment and therefore not consolidated in the Volvo Group. Under

Significant differences between Swedish and US accounting

principles

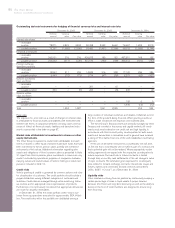

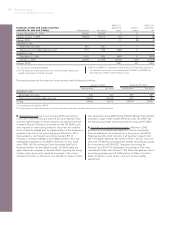

A. Derivative instruments and hedging activities. Volvo uses forward

exchange contracts and currency options to hedge the value of

future commercial flows of payments in foreign currency and com-

modity purchases. Under Swedish GAAP outstanding contracts that

are highly certain to be covered by forecasted transactions are not

assigned a value in the consolidated financial statements.

Under US GAAP Volvo does not apply hedge accounting for com-

mercial derivatives. Outstanding forward contracts and options are

valued at market rates, and unrealized gains or losses that thereby

arise are included when calculating income. Unrealized net gains for

2004 pertaining to forwards and options contracts are estimated at

1,170 (1,287; 870).

Volvo uses derivative instruments to hedge the value of the

Group’s financial position. In accordance with US GAAP, all outstand-

ing derivative instruments are valued at fair value. The unrealized

gains or losses that thereby arise are included when calculating

income. Only part of the Group’s hedges of financial exposure quali-

fies for hedge accounting under US GAAP and are accounted for as

such. During 2004 Volvo has ceased to apply hedge accounting for

hedging of interest rate risks in fair value hedges. The basis adjust-

ment on previously hedged items will be amortized over the remain-

ing time to maturity. In cash flow hedges only the derivatives are

valued at fair value and unrealised gains or losses are included in

shareholders equity (other comprehensive income), and affect net

income when the hedged transactions occur.