Volvo 2004 Annual Report Download - page 112

Download and view the complete annual report

Please find page 112 of the 2004 Volvo annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

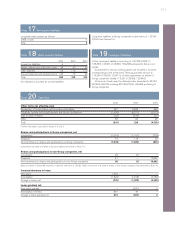

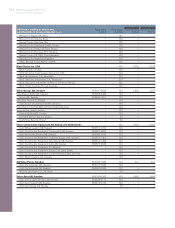

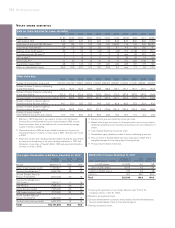

110 Expected impact of IFRS

Capitalization and amortization of development costs:

Effective on January 1, 2001, Volvo adopted the accounting standard

RR 15 “Intangible Assets” under Swedish GAAP. According to this

accounting standard, expenditures relating to development of new

and existing products and software should be capitalized and amor-

tized over their estimated useful life. According to the transition rules

of RR 15, no retroactive application was permitted. According to the

transition rules of IFRS, the accounting standard IAS 38, Intangible

Assets, which is similar to RR 15 regarding the accounting for devel-

opment costs, should be applied retroactively for development costs

incurred prior to 2001. The restatements and transition effects attrib-

utable to this accounting change therefore pertains to retroactive

capitalization and amortization of development costs incurred prior to

2001.

Minority interests:

In accordance with IFRS, minority interests are presented as a sepa-

rate component of Shareholders’ equity and is included in the net

income of the year in the income statement.

Non-amortization of intangible assets with indefinite useful lives:

According to Swedish GAAP, all intangible assets have been amor-

tized over their estimated useful lives. In accordance with IFRS,

intangible assets considered to have indefinite useful lives should not

be amortized. Such assets should rather be subject to an annual

impairment test. Volvo has chosen not to apply IFRS 3 “Business

Combinations” retrospectively according to the IFRS transition rules.

On the date of the IFRS adoption, Volvo has determined that intang-

ible assets with indefinite useful lives include only goodwill. The

restatements and transition effects attributable to this accounting

change therefore pertain to reversal of goodwill amortization charged

to the income statement under Swedish GAAP for 2004 and a corre-

sponding increase of the carrying value of goodwill at December 31,

2004, adjusted for currency translation differences.

Post Employee benefits:

Effective on January 1, 2003, Volvo adopted RR 29 “Employee bene-

fits” under Swedish GAAP. RR 29 is similar to the IFRS accounting

standard IAS 19. The only difference between Swedish GAAP and

IFRS relates to the date of transition. In accordance with the transi-

tion rules of RR 29, actuarial gains and losses arising prior to

January 1, 2003, were set to zero and charged to equity as of the

transition date. In accordance with the IFRS transition rules, actuarial

gains and losses arising prior to January 1, 2004, could be set to

zero and charged to equity as of the transition date. The transition

effects attributable to the accounting change therefore pertain to rec-

ognizing actuarial gains and losses that have arisen between January

1, 2003 and January 1, 2004.

Volvo has applied URA43 according to the statement from The

Association for the Development of Generally Accepted Accounting

Principles in Sweden when calculating the Swedish pension liabilities,

in addition to IAS 19.

Investments in companies:

In accordance with IAS 39, which is adopted by Volvo under IFRS on

January 1, 2005, all investments in companies, except if these invest-

ments are classified as associated companies, should be reported in

the balance sheet at fair value. Under Swedish GAAP such invest-

ments have been carried at their cost of acquisition unless there has

been a permanent decrease in value. Under IAS 39, unrealized gains

and losses attributable to the fair value of investments are reported

against a separate component of shareholders equity except when an

impairment is other than temporary. The transition effect on January

1, 2005, attributable to this accounting change is mainly related to

Volvo’s investment in Deutz AG.

Fair value of derivative instruments:

In accordance with IAS 39, which is adopted by Volvo under IFRS on

January 1, 2005, all derivative financial instruments should be report-

ed in the balance sheet at fair value. The difference between IAS 39

and accounting principles applied for derivative financial instruments

under Swedish GAAP is dependent on the use of the derivative

instruments:

– Derivative financial instruments used for hedging of forecasted

commercial cash-flows and forecasted electricity consumption:

Under Swedish GAAP Volvo has applied hedge accounting for the

main part of these derivatives and these instruments have conse-

quently not been reported in the balance sheet (“Off-balance sheet

instruments”). Gains and losses on these contracts have been

charged to the income statement at the time of maturity of the

specific contracts. Under IFRS, the fair value of outstanding deriva-

tive instruments is debited or credited to a separate component of

equity to the extent the requirements for cash-flow hedge account-

ing are fulfilled. To the extent that the requirements are not met, the

unrealised gain or loss will be charged to income statement.

– Derivative financial instruments used for hedging of interest rate

risks and currency rate risks on loans: Under Swedish GAAP Volvo

has applied hedge accounting for these derivatives and the carry-

ing value of such derivatives has therefore been corresponding to

currency rate and interest rate gains and losses accruable up to

the reporting date. Under the more complex rules in IAS 39 Volvo

will not attain hedge accounting for many interest rate contracts.

The difference between carrying values reported under Swedish

GAAP and fair values to be reported under IFRS pertains to unre-

alized interest rate gains and losses attributable to the period

between the reporting date and maturity dates of the derivatives.

The unrealized gains and losses will be charged to the financial net

in the income statement.

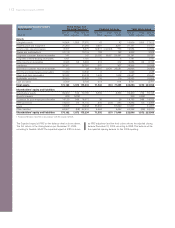

Derecognition of financial assets:

In accordance with IAS 39 which is adopted by Volvo under IFRS on

January 1, 2005, financial assets should be derecognized from the

balance sheet when substantially all risks and rewards have been

transferred to an external party. Under Swedish GAAP, financial

assets should be derecognized at settlement or if the ownership of