Volvo 2004 Annual Report Download - page 14

Download and view the complete annual report

Please find page 14 of the 2004 Volvo annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

12 Board of Directors’ Report

Balance sheet

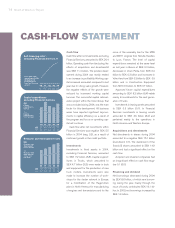

The Volvo Group’s total assets at

December 31, 2004 amounted to

SEK 222.9 billion, corresponding to a

decline of SEK 8.4 billion compared to

year-end 2003. Total assets were

reduced since year-end, mainly as a

result of divestment and distribution of

Scania shares as well as changes in cur-

rency rates. This effect was partially off-

set by growth in the credit portfolio of

Financial Services and higher inventories

and receivables as a consequence of the

significant sales increase. In addition, liquid

funds increased by SEK 6.0 billion, main-

ly due to the proceeds received on the

divestment of Scania B shares and a pos-

itive operating cashflow.

Shareholders’ equity and minority

interests amounted to SEK 69.6 billion,

corresponding to an equity ratio of

40.0%, excluding Financial Services.

Changes in shareholders’ equity during

the period are specified on page 54.

The Group’s net financial assets on

December 31, 2004, amounted to

SEK 18.7 billion, which corresponded to

26.8% of Shareholders’ equity and minor-

ity interests. Changes in net financial

position are specified in the adjoining

table.

Minority interests

Minority interests in the Volvo Group were

mainly attributable to Volvo Aero Norge

AS (22%), Volvo Aero Services LP (5%)

and Wuxi da Hao Power Co, Ltd (30%).

Net income

Net income amounted to SEK 9,355 M

(298) corresponding to an income per

share of SEK 22.35 (0.71). The return on

shareholders’ equity was 13.2% (0.4).

Preparations for adoption

of International Financial

Reporting Standards

For a description of Volvo’s preparations

for adoption of International Financial

Reporting Standards (IFRS) in 2005,

see further in Note 1 on page 56 and

pages 108–115.

Impact of exchange rates

on operating income

Compared with preceding year, SEK bn

Net sales1(5.7)

Cost of sales 3,7

Research and development expenses 0.1

Selling and administrative expenses 0.5

Other operating income and expenses (0.4)

Income from investments in shares 0.0

Total effect of changes in exchange

rates on operating income (1.8)

1 Group sales are reported at average spot rates and

the effects of currency hedges are reported among

“Other operating income and expenses.”

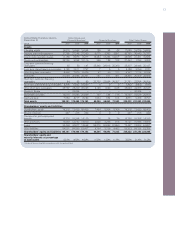

Operating net flow per currency

SEKM 2002 2003 2004

USD 7,100 7,500 13,100

EUR5,100 7,300 6,700

GBP 5,400 3,400 4,200

CAD 1,600 1,600 2,800

Other currencies 5,000 5,200 9,300

Total 24,200 25,000 36,100

Change in net financial position

SEK bn

December 31, 2003 2.4

Cash flow from operating activities 18.1

Investments in fixed assets

and leasing assets, net (6.8)

Customer financie receivables, net 0.1

Investments in shares, net 15.1

Acquired and divested operations (0.1)

Cash flow after net investments,

excluding Financial Services 26.4

Contribution to US pension plans 1.1

Write-down of convertible

debenture loan to Henlys (1.2)

Debt in acquired and divested operations (0.7)

Repurchase of own shares (2.5)

Dividend paid to AB Volvo's shareholders (3.4)

Currency effect 0.8

Other 0.6

Total change 21.1

December 31, 2004 18.7

FINANCIAL POSITION