Volvo 2004 Annual Report Download - page 62

Download and view the complete annual report

Please find page 62 of the 2004 Volvo annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

60 The Volvo Group

Notes to consolidated financial statements

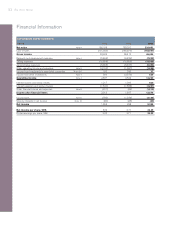

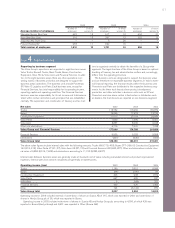

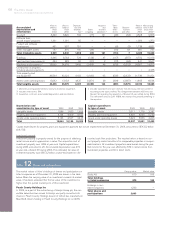

The effects during 2004, 2003 and 2002 on the Volvo Group’s bal-

ance sheet and cash flow statement in connection with the divest-

ment of subsidiaries and other business units are specified in

the following table:

2002 2003 2004

Intangible assets – (1) –

Property, plant and equipment (5) (23) (440)

Inventories (23) (170) (4)

Other receivables (43) (112) 181

Liquid funds (13) (1) –

Provisions – 24 94

Other liabilities 52 170 50

Divested net assets (32) (113) (119)

Liquid funds received 32 134 187

Liquid funds, divested

companies (13) (1) –

Effect on Group

liquid funds 19 133 187

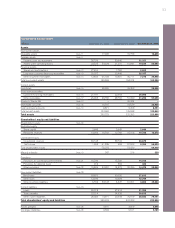

The effects during 2004, 2003 and 2002 on the Volvo Group’s bal-

ance sheet and cash flow statement in connection with the acquisi-

tion of subsidiaries and other business units are specified in

the following table:

2002 2003 2004

Intangible assets 135 948 (599)

Property, plant and equipment 95 1,102 300

Assets under operating lease 286 95 115

Shares and participations (214) (1,303) (260)

Inventories 234 1,477 630

Current receivables 382 1,562 958

Liquid funds 105 31 180

Other assets 3 129 62

Minority interests 119 – (20)

Provisions (33) (225) (63)

Loans (247) (2,144) (347)

Liabilities (582) (1,469) (448)

Acquired net assets 283 203 508

Liquid funds paid (283) (203) (508)

Liquid funds according to

acquisition analysis 105 31 180

Effect on Group

liquid funds (178) (172) (328)

The effects during 2004, 2003 and 2002 includes wholly owned sub-

sidiaries that previously were accounted for according to the equity

method.

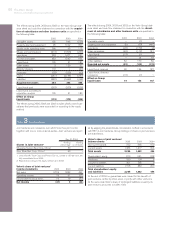

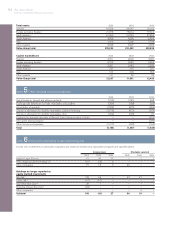

Note 3Joint ventures

Joint ventures are companies over which Volvo has joint control

together with one or more external parties. Joint ventures are report-

ed by applying the proportionate consolidation method, in accordance

with RR 14 Joint ventures. Group holdings of shares in joint ventures

are listed below.

Dec 31, 2004

Holding Holding

Shares in Joint ventures1percentage no of shares

Shanghai Sunwin Bus Corp., China250 –

Xian Silver Bus Corp., China250 –

1Jinan Hua Wo Truck Corp. and Prevóst Car Inc., owned to 100 per cent, are

fully consolidated from 2004.

2Reported according to the equity method up to 2002.

Volvo’s share of joint ventures’

income statements 2002 2003 2004

Net sales 2,724 1,832 492

Operating income 74 51 (27)

Income after financial items 10 19 (32)

Net income (21) 3 (34)

Volvo’s share of joint ventures’

balance sheets 2002 2003 2004

Non-current assets 782 665 100

Current assets 1,484 1,217 394

Total assets 2,266 1,882 494

Shareholders’ equity 570 581 228

Provisions 180 124 6

Long-term liablities 361 295 0

Current liabilities 1,155 882 260

Total shareholders’ equity

and liabilities 2,266 1,882 494

At the end of 2004 no guarantees were issued for the benefit of

joint ventures, neither by Volvo alone or jointly with other venturers.

At the same date Volvo’s share of contingent liabilities issued by its

joint ventures amounted to 6 (96; 109).