Volvo 2004 Annual Report Download - page 59

Download and view the complete annual report

Please find page 59 of the 2004 Volvo annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

57

the book value of foreign associated companies. This difference

affects restricted reserves directly.

When foreign subsidiaries, joint ventures and associated com-

panies are divested, the accumulated translation difference is report-

ed as a realized gain/loss and, accordingly, affects the capital gain.

Financial statements of subsidiaries operating in highly inflationary

economies are translated to Swedish kronor using the monetary

method. Monetary items in the balance sheet are translated at year-

end rates and nonmonetary balance sheet items and corresponding

income statement items are translated at rates in effect at the time

of acquisition (historical rates). Other income statement items are

translated at average rates. Translation differences are credited to, or

charged against, income in the year in which they arise.

In the individual Group companies as well as in the consolidated

accounts, receivables and liabilities in foreign currency are valued at

period-end exchange rates.

Gains and losses pertaining to hedges are reported at the same

time as gains and losses of the items hedged. Received premiums or

payments for currency options, which hedge currency flows in busi-

ness transactions, are reported as income/expense during the con-

tract period.

Gains/losses on outstanding currency futures at year-end, which

were entered into to hedge future commercial currency flows, are

reported at the same time as the commercial flow is realized. For

other currency futures that do not fullfil the criteria for hedge

accounting a full market valuation is made on a portfolio basis and

are credited to, or charged, against income.

In valuing financial assets and liabilities whose original currency

denomination has been changed as a result of currency swap con-

tracts, the loan amount is accounted for translated to Swedish kro-

nor at the period-end exchange rate. Unrealized exchange rate gains

relating to swap contracts are reported among short-term receiv-

ables and unrealized exchange rate losses relating to swap contracts

are reported among current liabilities.

Exchange rate differences on loans and other financial instru-

ments in foreign currency, which are used to hedge net assets in for-

eign subsidiaries and associated companies, are offset against trans-

lation differences in the shareholders’ equity of the respective com-

panies.

Exchange rate gains and losses on payments during the year and

on the valuation of assets and liabilities in foreign currencies at year-

end are credited to, or charged against, income in the year they arise.

The more important exchange rates employed are shown above.

Other financial instruments

Effective in 2003, Volvo has adopted RR 27 Financial Instruments:

Disclosure and Presentation, which conforms to a large extent with

IAS 32 issued by the IASC. The adoption of RR 27 has affected the

balance sheet presentation of certain derivative instruments that are

used to manage financial risks related to financial assets and liabil-

ities. In accordance with RR 27, derivative instruments with unreal-

ized gains are to be presented as assets and derivative instruments

with unrealized losses are to be presented as liabilities. In accord-

ance with Volvo’s earlier accounting principles, derivative instruments

used for management of financial assets were reported as assets

and derivative instruments used for management of financial liabil-

ities were reported as liabilities. As a consquence of adoption of the

presentation principles in RR 27, the Volvo Group’s assets at

December 31, 2003, increased by SEK 3.6 billion and the Group’s

liabilities increased by the corresponding amount. In accordance with

the transition rules of RR 27, no restatement has been made of fig-

ures for prior years.

Interest-rate contracts and forward exchange rate contracts are

used to change the underlying financial asset and debt structure and

are reported as hedges against such assets and debts.

Interest-rate contracts used as part of the management of the

Group’s short-term investments are valued together with these

investments in accordance with the portfolio method. Provisions are

made for unrealized losses in excess of the unrealized gains within

the portfolio.

Interest-rate contracts that do not fullfil the criteria of hedge

accounting are valued at the balance sheet date at which time provi-

sions for unrealized losses are made.

Net sales

The Group’s reported net sales pertain mainly to revenues from sales

of goods and services. Net sales are reduced by the value of dis-

counts granted and by returns.

Income from the sale of goods is recognized when significant

risks and rewards of ownership have been transferred to external

parties, normally when the goods are delivered to the customers. If,

however, the sale of goods is combined with a buy-back agreement

or a residual value guarantee, the sale is accounted for as an operat-

ing lease transaction if significant risks of the goods are retained in

Volvo. Income from the sale of workshop services is recognized

when the service is provided. Rental revenues and interest income in

conjunction with financial leasing or installment contracts are recog-

nized over the contract period.

Research and development expenses

Effective in 2001, Volvo adopted RR 15 Intangible Assets. In accord-

ance with the new accounting standard, expenditures for develop-

ment of new products, production systems and software shall be

reported as intangible assets if such expenditures with a high degree

of certainty will result in future financial benefits for the company.

The acquisition value for such intangible assets shall be amortized

over the estimated useful life of the assets. Volvo’s application of the

new rules means that high demands are established in order for

these development expenditures to be reported as assets. For ex-

ample, it must be possible to prove the technical functionality of a

new product or software prior to this development being reported as

an asset. In normal cases, this means that expenditures are capital-

ized only during the industrialization phase of a product development

project. Other research and development expenses are charged to

income as incurred. Expenditures for development of new products,

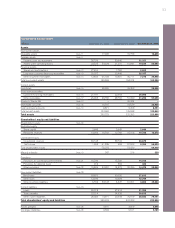

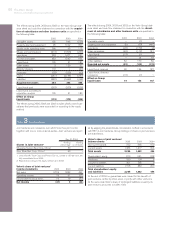

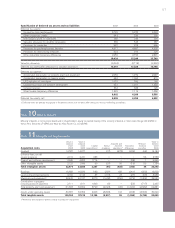

Exchange rates Average rate Year-end rate

Country Currency 2002 2003 2004 2002 2003 2004

Denmark DKK 1.2326 1.2281 1.2285 1.2386 1.2226 1.2126

Japan JPY 0.0779 0.0697 0.0680 0.0740 0.0681 0.0638

Norway NOK 1.2205 1.1418 1.0926 1.2605 1.0815 1.0890

Great Britain GBP 14.5816 13.2023 13.4515 14.1538 12.9188 12.7163

United States USD 9.7287 8.0778 7.3655 8.8263 7.2763 6.6138

Canada CAD 6.1965 5.7688 5.6495 5.6335 5.5610 5.4635

Euro EUR 9.1596 9.1258 9.1408 9.2018 9.1033 9.0163