Volvo 2004 Annual Report Download - page 87

Download and view the complete annual report

Please find page 87 of the 2004 Volvo annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

85

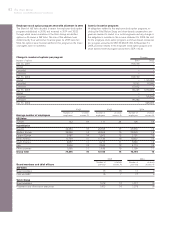

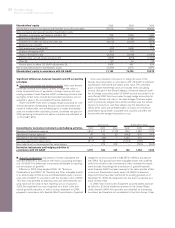

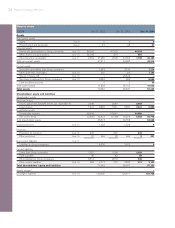

Financial currency risks

Loans and deposits in the Group companies are mainly made through

Volvo Treasury in local currencies and financial currency exposure in

the individual entities are thereby being minimized. Volvo Treasury uses

various derivative instruments in order to provide deposits and lend-

ing in different currencies without increasing the company’s own risk.

The Volvo Group’s net financial position is being affected by changes

in currency rates because financial assets and liabilities are allocated

between Group companies operating in different currencies. Carrying

amounts, fair values and additional specifications of derivative instru-

ments used to manage currency and interest rate risks related to

financial assets and liabilities are shown in the table on page 86.

Equity currency risks

The Group value of assets and liabilities in foreign subsidiaries is

affected by currency exchange rates in connection with the trans-

lation to SEK. Equity currency risks are being minimized by ongoing

optimization of the amount of equity in foreign subsidiaries with con-

sideration of commercial and legal prerequisites. Equity hedging

could be made if the equity level of a foreign subsidiary is consid-

ered as too high. At year-end 2004, net assets in subsidiaries and in

associated companies outside Sweden amounted to SEK 24.6 bil-

lion. Of this amount, SEK 0.7 billion was hedged by loans in foreign

currencies. Hedging of investments in associated companies and

other companies will be executed on a case-by-case basis.

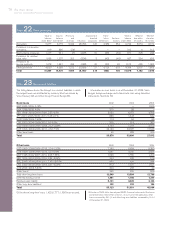

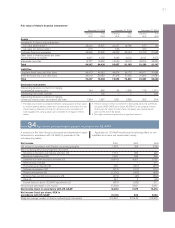

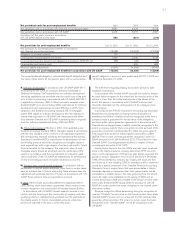

Interest rate risks

Interest rate risks include the risks that changes in interest rates

affects the Group’s income and cash-flow (cash-flow risks) or the

fair value of financial assets and liabilities (price risks). By matching

fixed interest periods of financial assets and liabilities the exposure

for interest rate risks is reduced. Interest rate swaps are used to

change the fixed interest rate periods of the Group’s financial assets

and liabilities. Exchange rate swaps make it possible to borrow in

foreign currencies in different markets without incurring currency

risks. Volvo also holds standardized futures and forward rate agree-

ments. The majority of these contracts are used to secure interest

levels for short-term borrowing or deposits. Carrying amounts, fair

values and additional specifications of derivative instruments used to

manage currency and interest rate risks related to financial assets

and liabilities are shown in the adjoining table.

Cash-flow risks

The exposure for cash-flow risks related to changes in interest rates

pertains mainly to the Group’s customer financing operations and

interest net. According to the Group policy, matching of interest rate

terms between lending and funding should exceed 80% in the cus-

tomer financing operations. At the end of 2004, this matching was

100%. Volvo’s interest-bearing assets, apart from the customer

financing portfolio, consisted at the end of 2004 mainly of liquid

funds that were invested in interest bearing securities with short-

term maturities. By use of derivative instruments, the target is to

achieve a fixed interest period of six months for the Group’s liquid

funds. At December 31, 2004, the average interest rate on liquid

funds was 2.3%. Volvo’s interest bearing liabilities, apart from loans

designated to funding of the customer financing portfolio, consisted

on the same date mainly of provisions for post-employment benefits

and loans. For the outstanding loans, the interest rate terms with

consideration of derivative instruments were corresponding to a fixed

interest period of six months. The average interest rate at year-end

was 3.7%.

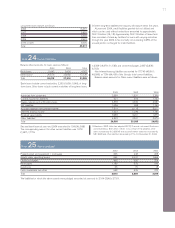

If assuming an instantaneous one percentage (100 basis points)

increase in interest rates of all currencies from their levels at

December 31, 2004, with all other variables held constant, Volvo’s

income after financial items over a 12-month period would increase

by 246. If assuming a corresponding one percentage (100 basis

points) decrease in interest rates, Volvo’s income after financial items

would decrease by the same amount. It should be noted that the

assumptions on which this sensitivity analysis is based upon rarely

occur in reality. Actual interest rates rarely move instantaneously.

Also, the sensitivity analysis assumes a parallel shift of the yield

curve and that both assets and liabilities react correspondingly to

changes in market interest rates. The impact from actual interest

rate movements may thus differ from the above analysis.

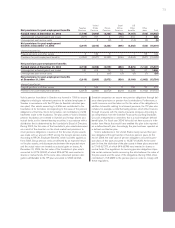

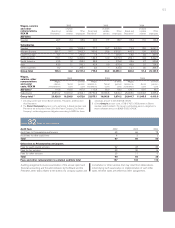

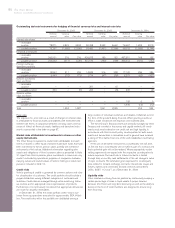

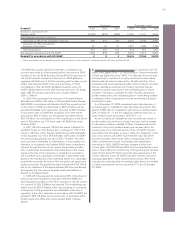

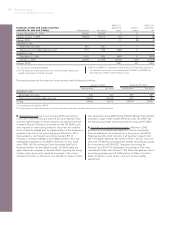

Outstanding forward contracts and option contracts for hedging of commercial currency risks

December 31, 2002 December 31, 2003 December 31, 2004

Notional Carrying Notional Carrying Notional Carrying

amount 1value Fair value amount 1value Fair value amount 1value Fair value

Foreign exchange

forward contracts

– receivable

position 25,857 149 1,017 19,823 53 1,449 26,203 264 1,775

– payable position 10,210 (5) (202) 6,104 – (208) 9,982 (88) (511)

Options – purchased

– receivable

position 4,484 – 94 8,012 – 148 2,831 – 112

– payable position 117 – (1) 110 – – – – –

Options – written

– receivable

position ––––––233–0

– payable position 3,458 – (53) 7,082 – (54) 2,729 – (5)

Subtotal 144 855 53 1,335 176 1,371

Commodity forward contracts

– receivable

position 223 – 272 148 – 19 (10) – 7

– payable position 88 – (113) 119 – (14) 243 – (32)

Total 144 1,014 53 1,340 176 1,346

1 The notional amount of the derivative contracts represents the gross contract amount outstanding. To determine the estimated fair value, the major part of the

outstanding contracts have been marked to market. Discounted cash flows have been used in some cases.