Volvo 2004 Annual Report Download - page 28

Download and view the complete annual report

Please find page 28 of the 2004 Volvo annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

26 Board of Directors’ Report

Total market

The total world market for heavy and

compact construction equipment, within

Volvo CE’s product range, increased by

20% during 2004. In North America the

market increased by 27%, Western

Europe was up 12%, while other markets

were up 20%, primarily driven by strong

development in Eastern Europe, up 46%.

South America rose 54% and East Asia

was up 55%.

The increase in the total market was

driven by both heavy and compact con-

struction equipment. The North American

market for heavy equipment was up

41% and the market in Europe was up

12%. Other markets rose by 14%.

The world market for compact equip-

ment increased in 2004, up 20% com-

pared with the preceding year. The mar-

ket in North America was up 21%, and

markets in Europe were up 12%. Other

markets rose by 27%.

Business environment

No major structural changes in the indus-

try were reported during 2004. The con-

solidation among small and medium com-

petitors continued. Overall business envir-

onment remained positive in most mar-

kets, with the exception of a significant

slow down in China during the second

half of the year, due to governmental

measures taken to slow the economy.

Volvo CE’s products, spare parts and

services are offered worldwide in more

than 125 markets. Customers are using

the products in a number of different

applications including general construc-

tion, road construction and maintenance,

forestry, demolition, waste handling,

material handling and extraction.

Volvo CE has launched more than 50

new products onto the market over the

last three years. The comprehensive

product portfolio includes a range of

wheeled and crawler excavators, articu-

lated haulers, wheel loaders, motor

graders and a range of compact equip-

ment such as compact wheel loaders,

compact excavators, backhoe loaders and

skid steer loaders.

The customer offering also includes

services such as financing, leasing and

used equipment sales. The rental initia-

tive, launched in 2001, continues to

develop favorably and on December 31,

2004, Volvo CE Rents had 77 stores

established in North America and Europe.

In the course of 2004, almost 90% of

the US distribution network, acquired

from L.B Smith Inc in 2003, was divested.

The different distribution areas have been

sold to strong, well capitalized and ex-

perienced independent dealers.

In Europe, the construction equipment

dealerships arising from the Bilia acquisi-

tion have been fully integrated with Volvo

CE’s organization.

CONSTRUCTION

EQUIPMENT

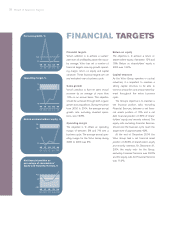

00 01 03 04

20.0 21.1 21.0

00 01 03

00 01 02 04

02

23.2

02

03 0

Net sales, SEK bn

04

Operating income*, SEK bn

* excluding

restructuring

costs

* excluding

restructuring

costs

1.6 0.9 0.4 0.9

8.0 4.2 1.9 3.9

Operating margin*, %

Net sales as percentage of

Volvo Group sales, %

28.7

1.6

5.5

14%