Volvo 2004 Annual Report Download - page 6

Download and view the complete annual report

Please find page 6 of the 2004 Volvo annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

4The Volvo share

THE VOLVO

SHARE

The Volvo share in 2004

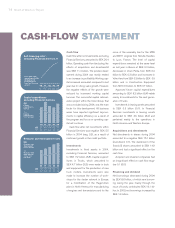

The year was characterized by a contin-

ued positive development for equity on

markets globally. On the Stockholm Stock

Exchange, the All-Share Index increased

by more than 17%. In the US, the Dow

Jones Industrial Average gained 3% and

the NASDAQ Composite closed up 9%.

The Volvo B share gained 23% in

2004, compared with an increase of 26%

for the MSCI Europe Machinery Index.

Market capitalization

At the end of 2004, the market capital-

ization of Volvo was SEK 106,754 M,

which corresponds to 4.0% of the total

market value of the companies listed on

the Stockholm Stock Exchange.

Trading

The majority of trading in Volvo shares

takes place via the Stockholm Stock

Exchange. In 2004, a total of 540 (436)

million shares were traded in Stockholm,

which equals an average of 2.1 (1.8) mil-

lion shares traded per day. The deregula-

tion of the international capital markets

and the increased foreign ownership of

shares listed on the Stockholm Stock

Exchange have led to secondary listings

becoming less important. Against this

background, Volvo delisted its share from

the London Stock Exchange and from the

German stock exchanges in 2004. The

NASDAQ listing in the United States is the

only remaining secondary listing for Volvo.

ADR program in the United States

Since 1985, a program for American

Depositary Receipts (ADRs) has existed

in the United States. Each ADR repre-

sents one Volvo B share and the Volvo

ADR is traded with the ticker VOLVY on

NASDAQ. In 2004, the average daily vol-

umes of ADRs traded were 94,695

(40,729) and the total number of out-

standing ADRs at year-end was about 20

million (10 million), which equalled approx-

imately 5% of the outstanding shares.

Dividend policy

The objective is that the effective return

to the shareholders, the dividend combined

with the change in the share price, should

exceed the average for the industry.

Distribution of Ainax

At the Annual General Meeting of AB

Volvo on April 16, 2004, the Board’s pro-

posal to transfer all A shares in Scania

AB to Ainax and then distribute Ainax to

Volvo’s shareholders was approved.

On June 8, 2004, AB Volvo distributed

the shares in Ainax to AB Volvo's share-

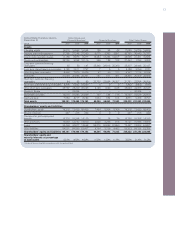

11.2 3.1 3.3 9.1

8.0 8.0 8.0 8.0

5.1Direct return* 4.5 5.6 10.5

(23)Effective return** 17.6 (14.8) 71.2

Net income* and cash dividend

per share

Net income*,

SEK per share

Dividend,

SEK per share

* Excluding

restructuring

costs and

revaluation of

shares.

00 01 02 03 04

00 01 02 03 04

Direct return* and

effective return**, %

* Dividend as

percentage

of share price

** Share price at

year-end, including

dividend proposed

during the year,

divided by share

price atthe begin-

ning of the year.

Sweden (48)

France (21)

US (13)

UK (9)

Luxemburg (2)

Others (7)

* of capital, re

g

istered share

s

* of capital, registered shares

Ownership categories*, %

Non-Swedish owners

(

52

)

Saving funds (10)

Pension funds and

insurance compa-

nies (13)

Private share-

holdings (11)

Others (14)

Ownership by country*, %

20.4

12.5

4.7

25.4

0