Volvo 2004 Annual Report Download - page 120

Download and view the complete annual report

Please find page 120 of the 2004 Volvo annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

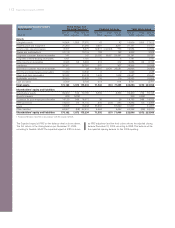

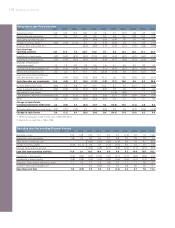

118 Eleven-year summary

Operating cash flow excluding Financial Services

SEKbn 1994 1995 1996 1997 1998 1999 2000 2001 2002 2003 2004

Operating income 12.9 12.8 12.4 11.1 6.4 5.2 (1.0) 2.3 1.6 12.8

Depreciation and amortization 4.8 4.4 5.0 6.4 3.1 3.8 7.0 7.8 7.2 7.4

Other items not affecting cash (4.0) (5.5) (0.5) (1.6) 0.0 1.0 4.1 (0.4)

Change in working capital (6.3) (11.1) 3.4 0.7 (1.7) (3.0) 6.0 0.4 0.7 (1.5)

Financial items and income taxes (0.5) (2.3) (1.7) (0.8) (2.3) (1.1) (0.7) (0.2)

Cash flow from operating activities 11.4 6.1 16.3 10.4 5.6 3.6 9.7 10.4 12.9 18.1

Investments in fixed assets (6.4) (8.0) (9.5) (10.2) (4.7) (5.1) (7.7) (6.3) (5.8) (7.2)

Investments in leasing assets (0.8) (0.8) (0.5) (0.9) (0.5) (0.6) (0.5) (0.1) (0.1) (0.3)

Disposals of fixed assets and leasing assets 1.2 1.8 1.0 1.5 0.8 0.7 1.1 1.1 0.6 0.7

Customer-financing receivables, net – – 0.3 (0.3) 0.1 0.0 0.8 0.0 0.0 0.1

Operating cash flow 5.4 (0.9) 7.6 0.5 1.3 (1.4) 3.4 5.1 7.6 11.4

11999, excluding gain on sale of Volvo Cars of SEK 26.7 billion.

2Reported on a single line in 1994–1996.

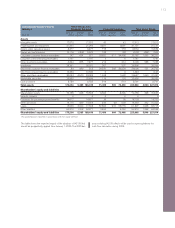

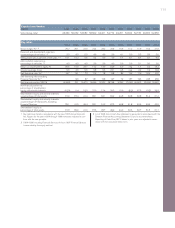

Consolidated cash-flow statements

SEKbn 1994 1995 1996 1997 1998 1999 2000 2001 2002 2003 2004

Operating income 116.9 13.3 13.2 12.8 11.8 7.5 6.7 (0.7) 2.8 2.5 14.2

Depreciation and amortization 5.1 5.6 5.4 6.8 9.6 5.2 6.3 10.0 10.8 10.2 10.3

Other items not affecting cash 2(3.5) (4.9) (0.3) (0.4) 0.5 2.0 4.9 0.2

Change in working capital 2(8.9) (7.3) (11.2) 4.7 1.5 (1.0) (3.3) 6.4 1.0 0.4 (1.5)

Financial items and income tax 2(0.4) (2.0) (1.7) (1.3) (2.1) (1.3) (0.9) (0.5)

Cash flow from

operating activities 13.1 11.6 7.4 20.4 16.0 9.7 8.0 14.1 15.3 17.1 22.7

Investments in fixed assets (4.3) (6.5) (8.2) (9.9) (10.5) (4.9) (5.4) (8.1) (6.7) (6.0) (7.4)

Investments in leasing assets (2.5) (2.6) (3.9) (9.8) (12.7) (5.6) (5.7) (5.8) (5.2) (5.3) (4.4)

Disposals of fixed assets

and leasing assets 1.4 1.3 2.0 1.8 2.6 1.6 2.1 2.6 3.2 2.9 2.4

Customer financing receivables, net (1.5) (1.6) (4.8) (15.5) (12.8) (7.1) (4.5) (3.7) (5.7) (4.3) (7.4)

Shares and participations, net 8.2 2.0 14.1 10.7 5.5 (25.9) (1.6) 3.9 (0.1) (0.1) 15.1

Acquired and divested subsidiaries

and other business units, net – (4.4) (0.9) (1.3) (5.6) 31.0 0.0 13.0 (0.2) 0.0 (0,1)

Cash flow after net investments 14.4 (0.2) 5.7 (3.6) (17.5) (1.2) (7.1) 16.0 0.6 4.3 20.9

Increase (decrease) in loans (8.3) 1.5 6.8 5.6 19.5 16.3 8.1 6.2 (0.1) 1.9 (8.8)

Loans to external parties, net (0.9) (0.9) (1.9) (0.4) (0.3) (3.2) 0.3 0.2 1.7 0.9 0.0

Repurchase of own shares ––––––(11.8) (8.3) – – (2.5)

Cash dividend to AB Volvo’s shareholders (0.6) (1.5) (1.9) (2.0) (2.2) (2.6) (3.1) (3.4) (3.4) (3.4) (3.4)

Other (1.3) 0.7 (5.0) (5.9) (0.2) (0.1) 0.0 0.1 0.1 0.1 0.0

Change in liquid funds,

excluding translation differences 3.3 (0.4) 3.7 (6.3) (0.7) 9.2 (13.6) 10.8 (1.1) 3.8 6.2

Translation differences on liquid funds (0.3) (0.7) (0.3) 0.3 0.3 (0.2) 0.3 0.6 (0.7) (0.6) (0.2)

Change in liquid funds 3.0 (1.1) 3.4 (6.0) (0.4) 9.0 (13.3) 11.4 (1.8) 3.2 6.0