Volvo 2004 Annual Report Download - page 16

Download and view the complete annual report

Please find page 16 of the 2004 Volvo annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

14 Board of Directors’ Report

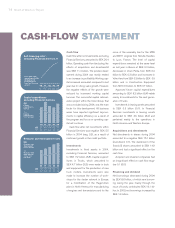

CASH-FLOW STATEMENT

Cash flow

Cash flow after net investments, excluding

Financial Services, amounted to SEK 26.4

billion. Operating cash flow (excluding the

effects of acquisitions and divestments)

was SEK 11.4 billion. The positive devel-

opment during 2004 was mostly related

to an increase in profitability. Working cap-

ital increased somewhat compared to last

year due to strong sales growth. However,

the negative effects of the growth were

reduced by increased working capital

turnover. The successful capital rationali-

zation project within the Volvo Group, that

was concluded during 2004, was the main

factor for this development. All business

areas have reported significant improve-

ments in capital efficiency as a result of

the program and focus on operating cap-

ital will continue.

Cash flow after net investments within

Financial Services was negative SEK 5.5

billion in 2004 (neg. 3.2), as a result of

continued growth in the credit portfolio.

Investments

Investments in fixed assets in 2004,

excluding Financial Services, amounted

to SEK 7.2 billion (5.8). Capital expend-

itures in Trucks, which amounted to

SEK4.7 billion (3.9), were made in tools

and equipment for the production of new

truck models. Investments were also

made to increase the number of work-

shops for the dealer network in Europe,

for a modification of the Hagerstown

plant in North America for manufacturing

of engines and transmissions and for the

move of the assembly line for the MD9

and MD11 engines from Skövde, Sweden,

to Lyon, France. The level of capital

expenditures remained at the same level

as last year in Buses at SEK 0.2 billion,

decreased in Volvo Penta from SEK 0.4

billion to SEK 0.3 billion and increased in

Volvo Aero from SEK 0.3 billion to SEK 0.5

billion and in Construction Equipment

from SEK 0.5 billion to SEK 0.7 billion.

Approved future capital expenditures

amounting to SEK 8.2 billion (6.4) relate

mainly to investments for the next gener-

ation of trucks.

Investments in leasing assets amounted

to SEK 0.3 billion (0.1). In Financial

Services investments in leasing assets

amounted to SEK 4.6 billion (5.2) and

pertained mainly to the operations in

North America and Western Europe.

Acquisitions and divestments

Net divestments in shares during 2004

amounted to a negative SEK 15.1 billion

(investment: 0.1). The divestment of the

Scania B shares amounted to SEK 14.9

billion and had a significant effect on the

cash flow.

Acquired and divested companies had

an insignificant effect on cash flow nega-

tive 0.1 (0.0).

Financing and dividend

Net borrowings decreased during 2004

by SEK 8.8 billion, of which new borrow-

ing during the year, mainly through the

issue of bonds, contributed SEK 19.1 bil-

lion. In 2003, net borrowings increased by

SEK 1.9 billion.

00 01 03 0402

Self-financing ratio*,

excluding Financial Services, %

72 137 196 243 266

00 01 03 04

6.3 8.4 6.8

02

6.2

Capital expenditures

excluding Financial Services

Capital

expenditures,

SEK bn

Capital

expenditures,

% of net sales

5.3 4.6 3.8 3.6

00 01 03 04

4.9 5.4 5.9

02

6.8

Research and development costs

3.7 2.8 3.2 3.7

Research and

development

costs, SEK bn

Research and

development

costs, % of

net sales

7.2

3.6

7.7

3.8

* Cash flow from

operating activities

divided by net

investments in

fixed and leasing

assets.