Volvo 2004 Annual Report Download - page 89

Download and view the complete annual report

Please find page 89 of the 2004 Volvo annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

87

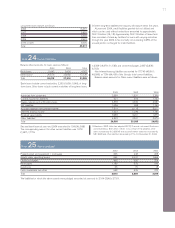

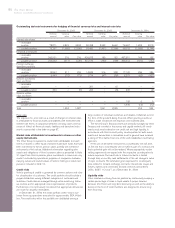

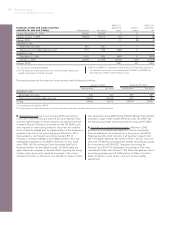

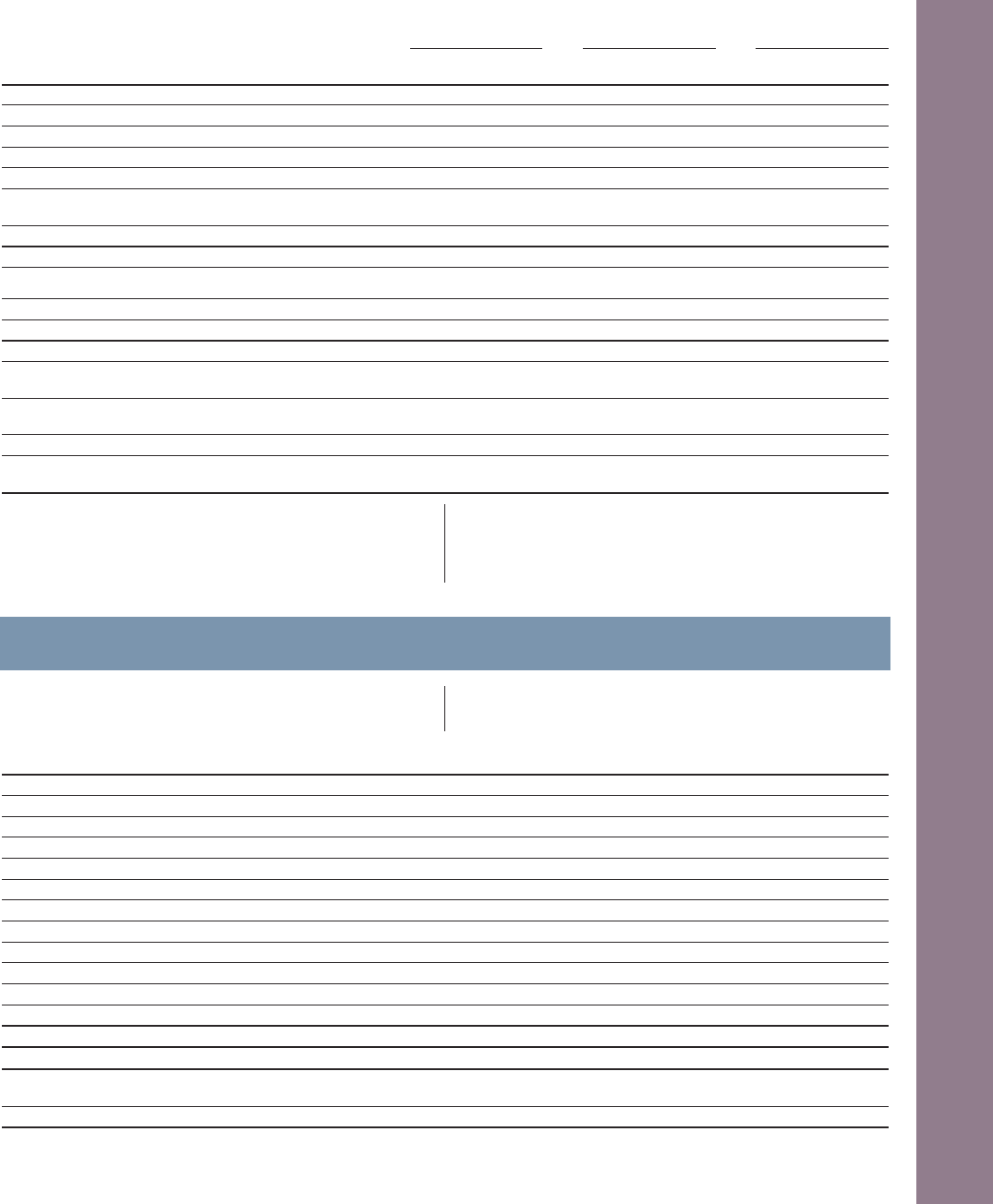

Fair value of Volvo’s financial instruments 1

December 31, 2002 December 31, 2003 December 31, 2004

Carrying Fair Carrying Fair Carrying Fair

value value value value value value

Assets

Investments in shares and participations

fair value determinable 225,220 15,537 21,217 18,798 670 169

fair value not determinable 3615 – 626 – 420 –

Customer-financing receivables 46,998 47,508 46,002 46,244 51,193 51,948

Other loans to external parties and other

interest-bearing receivables 4,807 4,735 6,483 6,623 3,047 3,075

Marketable securities 16,707 16,659 19,529 19,518 25,955 25,955

Total 94,347 84,439 93,857 91,183 81,285 81,147

Liabilities

Long-term bond loans and other loans 46,419 48,282 46,674 48,175 40,411 41,684

Short-term bank loans and other loans 26,018 26,083 27,418 27,655 21,396 21,584

Total 72,437 74,365 74,092 75,830 61,807 63,268

Derivative instruments

Outstanding derivative contracts for hedging

of commercial currency risks 144 855 53 1,335 176 1,371

Outstanding commodity contracts – 159 – 5 – (25)

Outstanding derivative contracts for hedging

of financial currency risks and interest rate risks 1,394 1,987 1,961 2,589 252 924

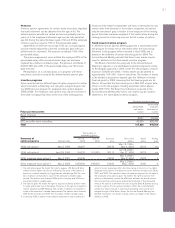

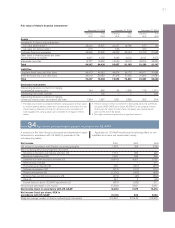

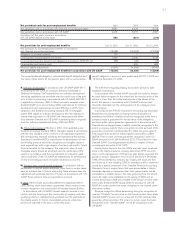

Note 34Net income and shareholders’ equity in accordance with US GAAP

A summary of the Volvo Group’s net income and shareholders’ equity

determined in accordance with US GAAP, is presented in the

accompanying tables.

Application of US GAAP would have the following effect on con-

solidated net income and shareholders’ equity:

Net income 2002 2003 2004

Net income in accordance with Swedish accounting principles 1,393 298 9,355

Items increasing (decreasing) reported net income

Derivative instruments and hedging activities (A) 1,772 882 228

Business combinations (B) 1,094 556 826

Investments in debt and equity securities (C) (9,616) 4,007 5,157

Restructuring costs (D) – – 311

Post-employment benefits (E) 669 (651) (273)

Software development (F) (212) (211) (119)

Product development (G) (1,236) (352) (828)

Entrance fees, aircraft engine programs (H) (219) (20) (392)

Other (I) 447 2 (60)

Income taxes on above US GAAP adjustments (J) (357) (532) 211

Net increase (decrease) in net income (7,658) 3,681 5,061

Net income (loss) in accordance with US GAAP (6,265) 3,979 14,416

Net income (loss) per share, SEK in

accordance with US GAAP (14.90) 9.50 34.44

Weighted average number of shares outstanding (in thousands) 419,445 419,445 418,529

1This table only includes a comparison between carrying values and fair values

for interest bearing balance sheet items and derivative instruments. For non

interest bearing financial instruments, such as accounts receivable and

trade payables, the carrying values are considered to be equal to the fair

values.

2Pertains mainly to Volvo’s investments in Scania AB, Deutz AG and Henlys

Group plc 2002–2003 and in Deutz AG 2004. For the purpose of these

disclosures, fair values of listed shares are based upon quoted market

prices at the end of the period.

3No single investment represents any significant amount.