Volvo 2004 Annual Report Download - page 94

Download and view the complete annual report

Please find page 94 of the 2004 Volvo annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

92 The Volvo Group

Notes to consolidated financial statements

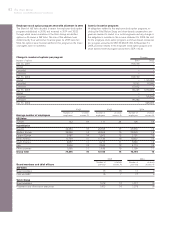

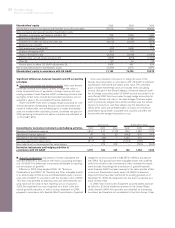

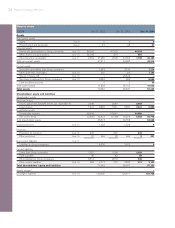

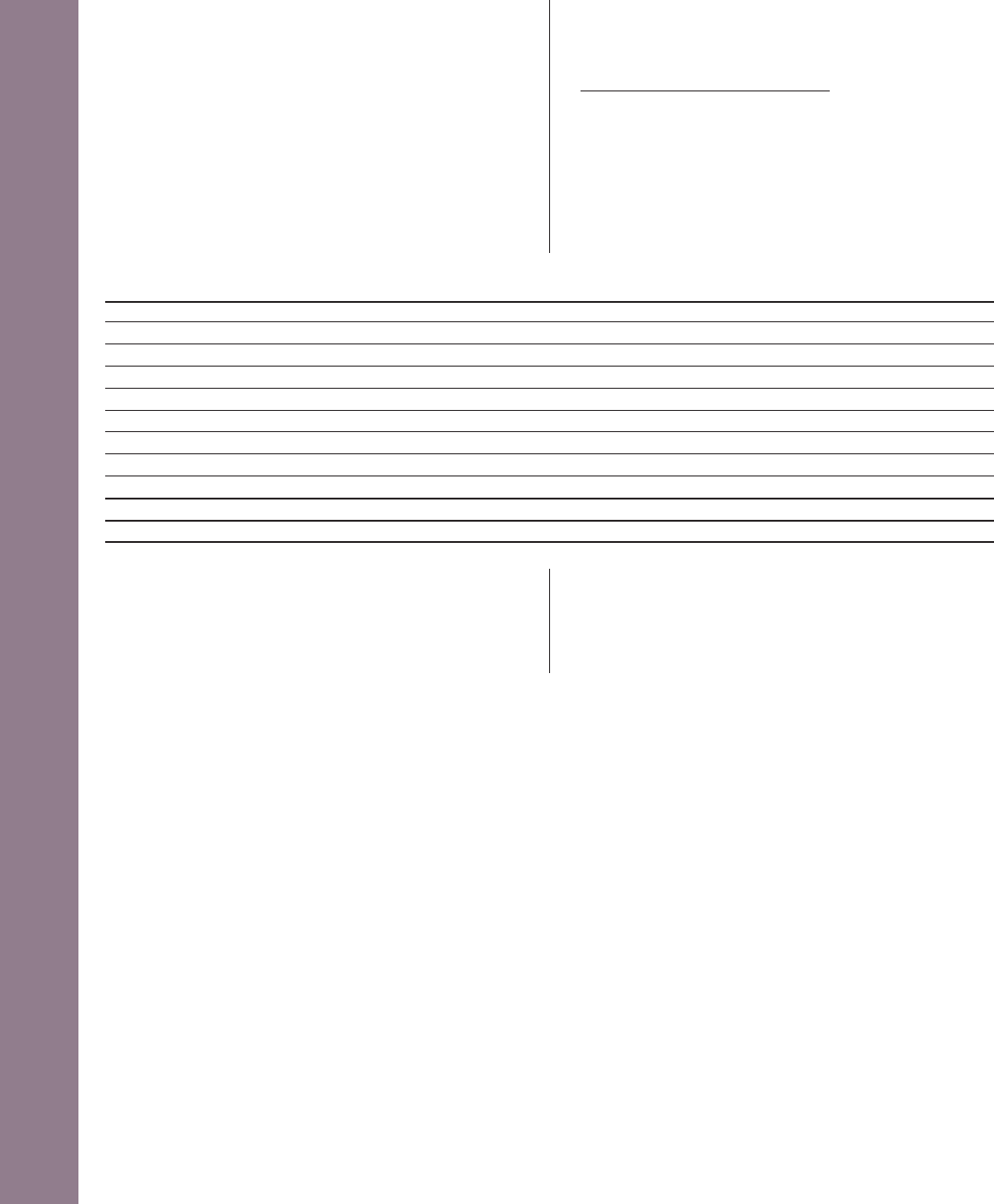

Comprehensive income (loss) 2002 2003 2004

Net income (loss) in accordance with US GAAP (6,265) 3,979 14,416

Other comprehensive income (loss), net of income taxes

Translation differences (2,222) (606) (172)

Unrealized gains and (losses) on securities (SFAS 115):

Unrealized gains (losses) arising during the year (2,425) 3,366 (14)

Less: Reclassification adjustment for (gains) and losses included in net income 7,558 62 (3,285)

Additional minimum liability for pension obligations (SFAS 87) (3,234) 186 (471)

Fair value of cash-flow hedges (SFAS 133) – (11) 13

Other (165) (12) (1)

Other comprehensive income (loss), subtotal (488) 2,985 (3,930)

Comprehensive income (loss) in accordance with US GAAP (6,753) 6,964 10,486

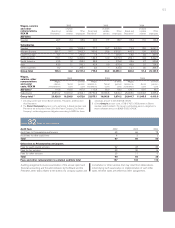

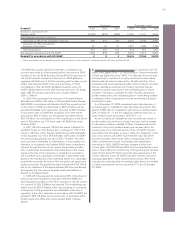

Supplementary US GAAP information

Classification. In accordance with SFAS 95, “cash and cash equiva-

lents” comprise only funds with a maturity of three months or less

from the date of purchase. Some of Volvo’s liquid funds (see Notes

19 and 20) do not meet this requirement. Consequently, in accord-

ance with SFAS 95, changes in this portion of liquid funds should be

reported as investing activities.

Income from investments in associated companies is reported

before income taxes in accordance with Swedish accounting prin-

ciples, and after income taxes in accordance with US GAAP. Income

taxes attributable to associated companies amounted 5 (30: 65).

Under Swedish GAAP all sales not qualifying for revenue recogni-

tion are treated in the same way as deferred income. Under US

GAAP sales that are made to companies who in turn lease out the

equipment under operating leases are accounted for as financing

transactions rather than as deferred income. The total impact of rev-

enue recognition is an additional 433 as assets under operating

leases, 270 reduced residual value liability and 783 as interest bear-

ing liablilities. The net income effect is negative 73.

Variable Interest Entities, In accordance with US GAAP FIN -46

certain entities should be consolidated where the Group is the

Primary Beneficiary of the Variable Interest Entity. Volvo adopted FIN

46 as per January 1, 2004. In Volvo this has had a limited impact

and a minor number of entities have been consolidated. The majority

of the consolidated entities have been so called Franchisees to Volvo

Rents. The balance sheet impact is 42 and the additional turnover

112.

J. Income taxes on U.S. GAAP adjustments. Deferred taxes are

generally reported for temporary differences arising from differences

between US GAAP and Swedish accounting principles. During 2002,

a new tax legislation was enacted in Sweden which removed the

possibility to offset capital losses on investments in shares held for

operating purposes against income from operations. As a result of

the new legislation, a tax expense of 2,123 was charged to Volvo’s

net income under US GAAP to reduce the carrying value of deferred

tax assets relating to investments in shares classified as “available-

for-sale”.