Volvo 2004 Annual Report Download - page 110

Download and view the complete annual report

Please find page 110 of the 2004 Volvo annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

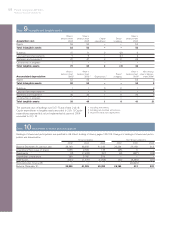

108 Expected impact of IFRS

Expected impact of IFRS

Reporting in accordance with IFRS

as from 2005

The Volvo Group’s financial reporting is

up to 2004 prepared in accordance with

generally accepted accounting principles

in Sweden (“Swedish GAAP”). Effective

from 2005, all listed companies within the

European Union (“the EU”) are required

to prepare their consolidated financial

reporting in accordance with International

Financial Reporting Standards (“IFRS”),

as endorsed by the EU. The EU carve

outs, rules not approved by EU, have no

impact for Volvo. The purpose of the pre-

sentations on the following pages is to

describe and explain the expected impact

on Volvo’s financial reporting as a conse-

quence of adopting IFRS. Volvo Group’s

accounting principles are described in

note 1. The below presentation is focused

on the areas where Volvo’s present

accounting principles will be effected by

the implementation of IFRS.

Restatements and transition effects

In accordance with the IFRS transition

rules (IFRS 1), Volvo will adopt IFRS on

January 1, 2005, with retroactive applica-

tion from the IFRS transition date at

January 1, 2004. The general rule is that

restatement of financial reporting for peri-

ods after the transition date should be

made as if IFRS has been applied histor-

ically. There are however certain excep-

tions from the general rule of which the

most significant are:

– IAS 39 “Financial instruments:

Recognition and measurement” is

adopted from January 1, 2005.

– Non-amortization of intangible assets

with indefinite useful lives (e.g. good-

will) in accordance with revised version

of IAS 38 should be applied retroac-

tively only from the transition date

January 1, 2004.

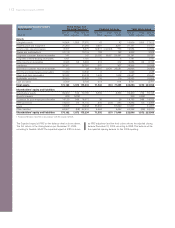

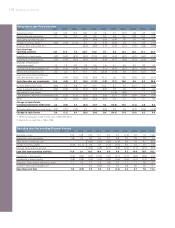

The enclosed income statements and

other specifications prepared in accor-

dance with IFRS therefore include

restatements and transition effects as fol-

lows:

Financial position January 1, 2004:

Affected by differences between Swedish

GAAP and IFRS for which retroactive

application prior to the transition date is

required.

Financial performance 2004 and

financial position December 31, 2004:

Affected by all differences between

Swedish GAAP and IFRS except IAS 39

and IFRS 5, “Non-Current Assets Held

for Sale and Discontinued Operations”.

Financial position January 1, 2005:

Affected by all differences between

Swedish GAAP and IFRS including IAS

39 and IFRS 5. Impact of adopting IAS

39 will be charged to Equity according to

IFRS 1.

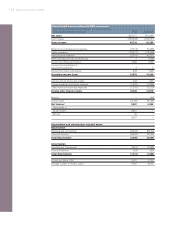

The defined transition effects and pre-

sented reconciliations are made accord-

ing to the present issued IFRS standards.

New standards or interpretations could

be issued during 2005. The transition

effects could be affected by such devel-

opment until the year-end release for

2005.

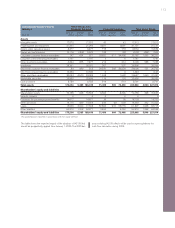

Significant differences between

Swedish GAAP and IFRS

The most significant differences between

Swedish GAAP and IFRS for Volvo are

further explained below in the Equity- and

net income reconciliation: