Rogers 2011 Annual Report Download - page 99

Download and view the complete annual report

Please find page 99 of the 2011 Rogers annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

In addition to the changes required to adjust for the accounting

policy differences described in the following notes, interest paid and

income taxes paid have been moved into the body of the

consolidated statements of cash flows as part of operating activities,

whereas they were previously disclosed as supplementary

information. There are no other material differences related to

presentation of the consolidated statements of cash flows.

(a) Principal exemptions elected on transition to IFRS:

IFRS 1 sets out the requirements that the Company must follow when

it adopts IFRS for the first time as the basis for preparing its

consolidated financial statements. The Company established its IFRS

accounting policies for the year ended December 31, 2011, and has

applied retrospectively these policies to the opening consolidated

statement of financial position at the date of transition of January 1,

2010, except for specific exemptions available to the Company

outlined as follows:

(i) Business combinations:

The Company has elected to apply IFRS 3, Business Combinations

(“IFRS 3”), retrospectively to all business combinations that took

place on or after the date of transition, January 1, 2010. Under

previous Canadian GAAP, the Company had elected to early

adopt The Canadian Institute of Chartered Accountants’

Handbook Section 1582, Business Combinations, effective

January 1, 2010, the requirements of which are converged with

IFRS. As a condition under IFRS 1 of applying this exemption,

goodwill relating to business combinations that occurred prior

to January 1, 2010 was tested for impairment even though no

impairment indicators were identified. No impairment existed at

the date of transition.

(ii) Leases:

The Company has elected to apply the transitional provisions in

International Financial Reporting Interpretations Committee

(“IFRIC”) 4, Determining Whether an Arrangement Contains a

Lease (“IFRIC 4”), thereby determining whether the Company

has any arrangements that exist at the date of transition to IFRS

that contain a lease on the basis of facts and circumstances

existing at January 1, 2010. No such arrangements were

identified.

(iii) Changes in existing decommissioning, restoration and

similar liabilities included in the cost of PP&E:

The Company has elected to apply the exemption to full

retrospective application of IFRIC 1, Changes in Existing

Decommissioning, Restoration and Similar Liabilities (“IFRIC 1”).

This election allows the Company to measure the impact of any

changes to its decommissioning and restoration liabilities using

estimates applicable at the date of transition to IFRS, and no

adjustment was required to the opening consolidated statement

of financial position as a result of applying this election and

IFRIC 1.

(iv) Borrowing costs:

The Company has elected to apply the transitional provisions of

IAS 23, Borrowing Costs (“IAS 23”), prospectively from the date

of transition.

(v) Transfers of assets from customers:

The Company has elected to apply the transitional provisions of

IFRIC 18, Transfers of Assets from Customers (“IFRIC 18”),

prospectively from the date of transition.

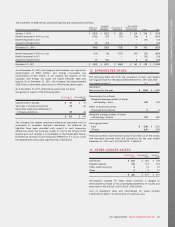

(b) Employee benefits:

(i) Upon adoption of IFRS, actuarial gains and losses, as

described in the significant accounting policies note are

recognized immediately in OCI, as permitted by IAS 19,

Employee Benefits (“IAS 19”). Under previous Canadian

GAAP, the Company used the corridor method to amortize

actuarial gains or losses over the average remaining service

life of the employees. At the date of transition, all

previously unrecognized cumulative actuarial gains and

losses, including the unamortized transitional obligation,

were recognized in retained earnings, resulting in a

reduction of retained earnings of $149 million. Actuarial

losses of $76 million were recognized in OCI for the year

ended December 31, 2010.

(ii) In compliance with IAS 19, past service costs are recognized

immediately if vested, or on a straight-line basis over the

average remaining vesting period if unvested. Under

Canadian GAAP, past service costs were recognized over the

expected average remaining service period of active

employees expected to receive benefits under the plan. At

the date of transition, all previously unrecognized past

service costs amounting to $9 million were fully vested and

as such were recognized in retained earnings.

(iii) Furthermore, IAS 19 requires that the defined benefit

obligation and plan assets be measured at the consolidated

statement of financial position date. Accordingly, the

defined benefit obligation and plan assets have been

measured at January 1, 2010 and December 31, 2010,

resulting in an $8 million reduction to retained earnings at

the Transition Date.

(iv) In addition, IAS 19 and IFRIC 14, The Limit on a Defined

Benefit Asset, Minimum Funding Requirement and their

Interaction, limit the amount that can be recognized as an

asset on the consolidated statement of financial position to

the present value of available contribution reductions or

refunds plus unrecognized actuarial losses and

unrecognized past service costs. This restriction has resulted

in a limit on the asset that can be recorded for one of the

Company’s defined benefit plans, which resulted in a

further reduction of $8 million that has been recognized in

retained earnings at the Transition Date. For the year

ended December 31, 2010, $4 million was recognized in

OCI.

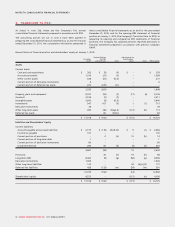

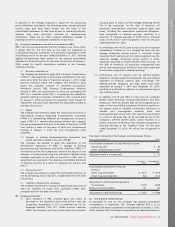

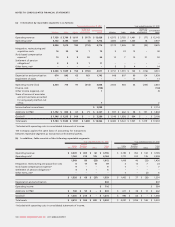

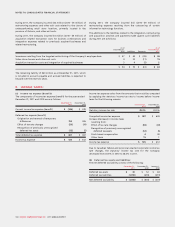

The impact arising from the changes is summarized as follows:

Year ended December 31, 2010

Consolidated statement of comprehensive income:

Operating costs $ (5)

Other comprehensive income 80

Adjustment before income taxes $ 75

January 1,

2010 December 31,

2010

Consolidated statements of financial

position:

Other long-term assets $ (121) $ (137)

Other long-term liabilities (53) (112)

Adjustment to retained earnings before

income taxes (174) (249)

Related income tax effect 44 64

Adjustment to retained earnings $ (130) $ (185)

(c) Stock-based compensation:

As described in note 22, the Company has granted stock-based

compensation to employees. The Company applied IFRS 2 to its

unsettled stock-based compensation arrangements at January 1, 2010,

which requires that stock-based compensation be measured based on

2011 ANNUAL REPORT ROGERS COMMUNICATIONS INC. 95