Rogers 2011 Annual Report Download - page 27

Download and view the complete annual report

Please find page 27 of the 2011 Rogers annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

MANAGEMENT’S DISCUSSION AND ANALYSIS

Operating Highlights and Significant Developments in 2011

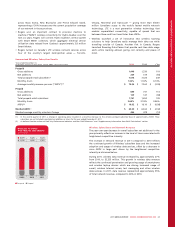

• Generated revenue growth of 2% at Wireless, 4% at Cable

Operations and 10% at Media, with consolidated annual revenue

growth of 2%. Adjusted operating profit grew 2% to $4,716

million with adjusted operating profit margins of 37.9%.

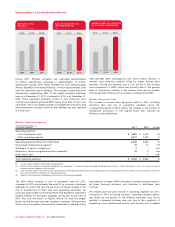

• In February 2011, we renewed our normal course issuer bid

(“NCIB”) to repurchase up to the lesser of $1.5 billion or

39.8 million Class B Non-Voting shares during the twelve-month

period ending February 21, 2012, under which we purchased for

cancellation 31 million Class B Non-Voting shares during 2011 for

$1.1 billion.

• In February 2011, we increased the annualized dividend from $1.28

to $1.42 per Class A Voting and Class B Non-Voting share, paying

out $758 million in dividends to shareholders during the year.

• We closed $1.85 billion aggregate principal amount of investment

grade debt offerings during the year, consisting of $400 million of

6.56% Senior Notes due 2041 and $1,450 million of 5.34% Senior

Notes due 2021. Among other things, proceeds of the offerings

were used to repay bank debt and redeem both of our public debt

issues maturing in 2012, including US$470 million of 7.25% Senior

Notes and US$350 million of 7.875% Senior Notes. In total, we

reduced our weighted average cost of borrowing to 6.22% at

December 31, 2011 from 6.68% at December 31, 2010.

• We closed the acquisition of Atria Networks, one of Ontario’s

largest fibre-optic networks, which augments Rogers Business

Solutions’ enterprise offerings by further enhancing its ability to

deliver on-net data centric services within and adjacent to Cable’s

footprint.

• Rogers announced that it, along with Bell Canada, is jointly

acquiring a net 75 percent equity interest in Maple Leaf Sports and

Entertainment (“MLSE”) being sold by the Ontario Teachers’

Pension Plan. The investment advances Rogers’ strategy to deliver

highly sought-after content anywhere, anytime, on any platform

across our advanced broadband and wireless networks and our

media assets, while continuing to strengthen and enhance the

value of our Sportsnet media brands. Rogers’ net cash

commitment, following a planned leveraged recapitalization of

MLSE, will total approximately $533 million, representing a 37.5

percent equity interest in MLSE, and will be funded with currently

available liquidity.

• Free cash flow, defined as adjusted operating profit less property,

plant, and equipment (“PP&E”) expenditures, interest on long-term

debt (net of capitalization) and cash income taxes, decreased by

7% from 2010 levels to $1.9 billion due to higher PP&E

expenditures.

• At December 31, 2011, we had only $250 million of advances

borrowed under our $2.4 billion committed bank credit facility that

matures in July 2013. This strong liquidity position is further

enhanced by the fact that our earliest scheduled debt maturity is in

June 2013, together providing us with substantial liquidity and

flexibility.

• Subsequent to the end of 2011, in February 2012, we announced

that our Board of Directors had approved an 11% increase in the

annualized dividend to $1.58 per share effective immediately, and

that it has approved the renewal of our NCIB share buyback

program authorizing the repurchase of up to $1.0 billion of Rogers

shares on the open market during the next twelve months.

Year Ended December 31, 2011 Compared to Year Ended

December 31, 2010

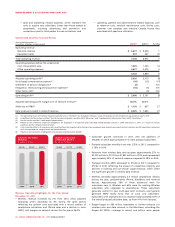

For the year ended December 31, 2011, Wireless, Cable and Media

represented 57%, 30% and 13% of our consolidated revenue,

respectively (2010 – 57%, 31% and 12%). On the basis of consolidated

adjusted operating profit, Wireless, Cable and Media also represented

63%, 33% and 4%, respectively (2010 – 67%, 30%, and 3%).

(%)

2011 CONSOLIDATED REVENUE BY SEGMENT

WIRELESS 57%

MEDIA 13%

CABLE 30%

(%)

2011 CONSOLIDATED ADJUSTED OPERATING PROFIT BY SEGMENT

WIRELESS 63%

MEDIA 4%

CABLE 33%

($)

ADJUSTED EPS

$2.51$2.91$3.22

2009 20102011

For detailed discussions of Wireless, Cable and Media, refer to the

respective segment discussions below.

2011 ANNUAL REPORT ROGERS COMMUNICATIONS INC. 23