Rogers 2011 Annual Report Download - page 121

Download and view the complete annual report

Please find page 121 of the 2011 Rogers annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

The Company did not have any non-derivative held-to-maturity

financial assets during years ended December 31, 2011 and 2010.

(ii) Guarantees:

The Company has the following guarantees at December 31,

2011 and 2010 in the normal course of business:

(a) Business sale and business combination agreements:

As part of transactions involving business dispositions, sales of

assets or other business combinations, the Company may be

required to pay counterparties for costs and losses incurred as a

result of breaches of representations and warranties, intellectual

property right infringement, loss or damages to property,

environmental liabilities, changes in laws and regulations

(including tax legislation), litigation against the counterparties,

contingent liabilities of a disposed business or reassessments of

previous tax filings of the corporation that carries on the

business.

(b) Sales of services:

As part of transactions involving sales of services, the Company

may be required to pay counterparties for costs and losses

incurred as a result of breaches of representations and

warranties, changes in laws and regulations (including tax

legislation) or litigation against the counterparties.

(c) Purchases and development of assets:

As part of transactions involving purchases and development of

assets, the Company may be required to pay counterparties for

costs and losses incurred as a result of breaches of

representations and warranties, loss or damages to property,

changes in laws and regulations (including tax legislation) or

litigation against the counterparties.

(d) Indemnifications:

The Company indemnifies its directors, officers and employees

against claims reasonably incurred and resulting from the

performance of their services to the Company, and maintains

liability insurance for its directors and officers as well as those of

its subsidiaries.

The Company is unable to make a reasonable estimate of the

maximum potential amount it would be required to pay

counterparties. The amount also depends on the outcome of

future events and conditions, which cannot be predicted. No

amount has been accrued in the consolidated statements of

financial position relating to these types of indemnifications or

guarantees at December 31, 2011 or 2010 or January 1, 2010.

Historically, the Company has not made any significant payments

under these indemnifications or guarantees.

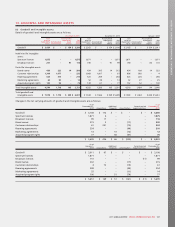

(iii) Fair values:

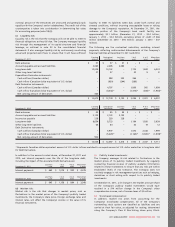

The tables above present the level in the fair value hierarchy into

which the fair values of financial instruments that are carried at

fair value on the consolidated statements of financial position

are categorized. There were no financial instruments

categorized in Level 3 (valuation technique using

non-observable market inputs) as at December 31, 2011 and

2010 and January 1, 2010.

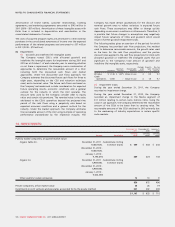

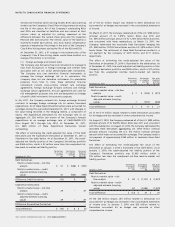

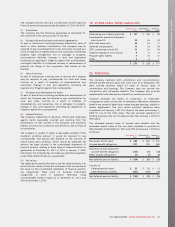

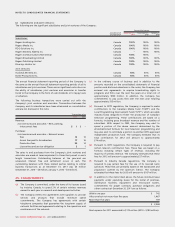

19. OTHER LONG-TERM LIABILITIES:

December 31,

2011 December 31,

2010 January 1,

2010

Deferred pension liability (note 20) $ 167 $ 106 $ 49

Supplemental executive retirement

plan (note 20) 39 36 33

Restricted share units 24 16 11

Deferred compensation 15 16 18

CRTC commitments (note 25) 12 31 45

Liabilities related to stock options 989

Program rights liability 510 11

Other 561

$ 276 $ 229 $ 177

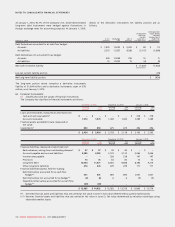

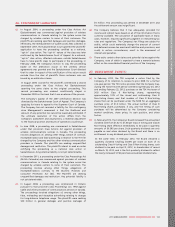

20. PENSIONS:

The Company maintains both contributory and non-contributory

defined benefit pension plans that cover most of its employees. The

plans provide pensions based on years of service, years of

contributions and earnings. The Company does not provide any

non-pension post retirement benefits. The Company also provides

supplemental unfunded pension benefits to certain executives.

Actuarial estimates are based on projections of employees’

compensation levels at the time of retirement. Maximum retirement

benefits are primarily based upon career average earnings, subject to

certain adjustments. The most recent actuarial valuations were

completed as at January 1, 2011 for three of the plans and January 1,

2009 for one of the other plans. The next actuarial valuation for

funding purposes must be of a date no later than January 1, 2012 for

these plans.

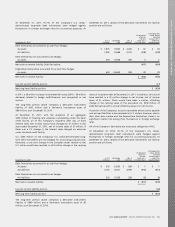

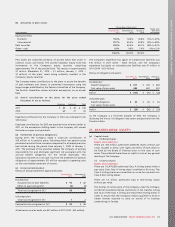

The estimated present value of accrued plan benefits and the

estimated market value of the net assets available to provide for

these benefits at December 31, 2011 and 2010 and January 1, 2010 are

as follows:

December 31,

2011 December 31,

2010 January 1,

2010

Plan assets, at fair value $684$ 652 $ 541

Accrued benefit obligations 817 728 569

Deficiency of plan assets over

accrued benefit obligations (133) (76) (28)

Effect of asset ceiling limit (1) (4) (8)

Net deferred pension liability $ (134) $ (80) $ (36)

Consists of:

Deferred pension asset $33 $26$13

Deferred pension liability (167) (106) (49)

Net deferred pension liability $ (134) $ (80) $ (36)

2011 ANNUAL REPORT ROGERS COMMUNICATIONS INC. 117